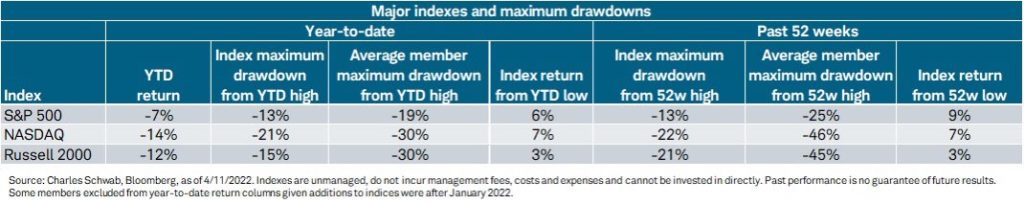

As we enter the second quarter of 2022, we want to pause and look back at the difficult start to the year. The “Santa Claus rally” at the end of 2021 seems like a long time ago. Stock prices began to sink right from the first trading day of the year, and the S&P 500 recorded its worst January since 2009. At the low point of the first quarter, the S&P 500 index closed almost 14% below its all-time high. The NASDAQ was down more than 20% during the first quarter, an official bear market. Looking below the surface, the average stock in the S&P 500, NASDAQ and Russell 2000 is down significantly more than the overall index.

At the same time, the bond market in the first quarter saw U.S. Treasury indexes decline more than 10%, and the Bloomberg US Aggregate Index fell almost 6%. Volatility in the bond market portfolio’s so-called risk-free assets came amid worsening inflation, central bank tightening and the impact of the war in Europe.

We are in the process of reallocating and rebalancing our client portfolios to account for the current economic cycle, as more and more leading economic indicators are pointing toward a recession overseas and possibly in the U.S. in the next six to 24 months.

We are making the following changes:

1. In 2020, we increased the technology position in the portfolio to take advantage of the boom brought about by the global pandemic. In 2021, we took some profits in tech stocks and slightly reduced the exposure to a market weight level. From a long-term perspective, we continue to believe strongly in technology stocks. As we move from mid cycle to late cycle, we want to continue to trim technology stocks to slightly underweight and add back mid-cap stocks for additional diversification, both in market capitalization and also across economic sectors.

2. While international equities remain less expensive than their U.S. counterparts, the war in Europe and the pandemic’s continuing effects in China continue to weigh heavier on international stocks. We are reducing our international exposure slightly and in turn increasing our allocation to higher-dividend-yielding companies that have a broad exposure to the overall economy in sectors like energy, financials and industrials. At the same time, we are reducing exposure to small-cap stocks. Smaller stocks tend to benefit coming out of a recession rather than heading into a slowdown.

3. From a fixed-income perspective, we reduced our duration of the portfolio in December as we anticipated higher interest rates in 2022. At the same time, we increased our exposure to strategic fixed income to provide for additional income in bonds. We are not making any additional changes to fixed income now, as we believe a lot of the selling in fixed income that occurred in the first quarter is pricing in a worst-case scenario for bonds.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought-out, looking at where we see the economy is heading. We are not guessing or market timing; we are anticipating and shifting to areas of strength in the economy and the stock market. We strategically have new cash on the sidelines, and we buy in for clients on down days or dips in the market, as one does with a 401(k). We continually speak with our clients about staying the course and not listening to the noise.

In the short term, the outlook for the global economy continues to deteriorate, and sentiment remains negative. Many economists feel that the Federal Reserve is behind the curve in regard to raising rates to stem the inflation tide while working on soft landing the economy to avoid a recession.

So, what can we learn from all this? Remember, a recession is a regular finale to a business cycle. Every expansion ultimately ends in a recession. We never encourage clients to time large-scale portfolio adjustments with recessions.

From a portfolio perspective, we continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been. As we say each week, it is important to stay the course and focus on the long-term goal, not on one specific data point or indicator. In markets and moments like these, it is essential to stick to the financial plan. Remember, first and foremost, that panic is not an investing strategy. Neither are “get in” or “get out” — those are just gambling on moments in time. Investing is about following a disciplined process over time.

At the end of the day, investors will be well-served to remove emotion from their investment decisions, and remember that over a longer time horizons, markets tend to rise. Market corrections are normal, as nothing goes up in a straight line. Making market decisions based on what might happen may be detrimental to long-term performance. The key is to stay invested and stick with the financial plan. Markets go up and down over time, and downturns present opportunities to purchase stocks at a lower value.

It all starts with a solid financial plan for the long run that understands the level of risk that is acceptable for each client. Regarding investments, we believe in diversification and having different asset classes that allow you to stay invested. The best option is to stick with a broadly diversified portfolio that can help you to achieve your own specific financial goals — regardless of market volatility. Long-term fundamentals are what matter.

Sources: Schwab, Bloomberg

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS. Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.