Market uncertainty has become the new normal. As we wrote last week, the stock market has been extremely volatile. During the first three days of last week alone, the S&P 500 experienced nine intraday moves of 1% or more. The stock market is reacting to every policy announcement — positive or negative — from the White House.

These aren’t policy changes, but clarifications about what policies may be or their potential implications.

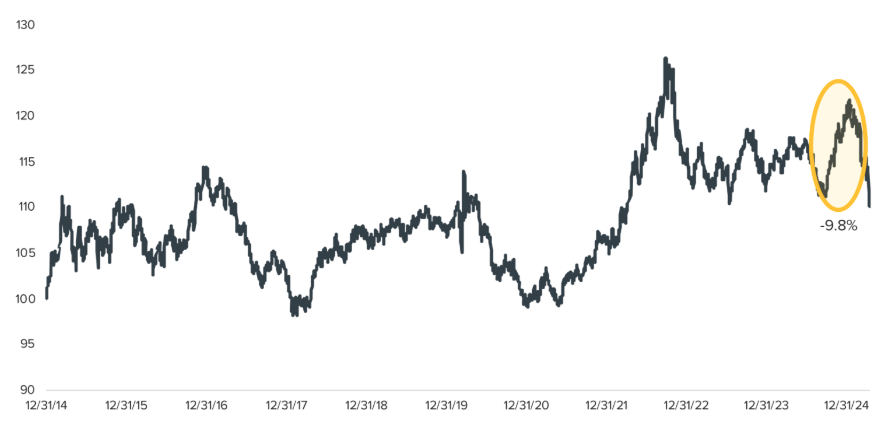

Stocks aren’t the only asset class experiencing higher volatility and downward pressure. The U.S. dollar has been hit hard, falling almost 5% in April and 7.3% from its peak in mid-January. This marks the worst start for the U.S. dollar index since 1990.

Large drawdowns are common for the U.S. dollar, but the speed of the decline is unusual. We saw a similar moves during the first year of President Trump’s first term and during the pandemic, but those drawdowns occurred over a much longer period.

The ICE U.S. Dollar Index

Why has the dollar been losing value?

Wall Street originally anticipated that tariffs would boost the dollar. Traditionally, the dollar strengthens as tariffs sink demand for foreign products. Currency values rise and fall often in response to inflation concerns and central bank moves.

Over the last few decades, the dollar’s strength has helped keep borrowing costs down and has bolstered the U.S.’s position as the world’s leading economy and a major power player. With much of the world’s goods exchanged in dollars, demand for the currency has stayed strong, even as the deficit has ballooned.

This year, however, the dollar has weakened. The drop has raised concerns because it coincided with a spike in interest rates, which is an unusual event. Typically, when bond yields are higher than those in other countries, the dollar rises. During times of volatility, Treasury yields tend to fall, as U.S. Treasuries have been perceived as the “safe haven” investment amid market uncertainty.

However, this pattern did not occur in April. Investors instead have exited dollar-based assets, reacting to widespread tariffs and the belief that they could slow U.S. growth and potentially lead to a recession. As risk aversion rose globally, the U.S. appeared to be the source of risk, and investors sold dollar-denominated assets, further weakening the dollar.

A weaker dollar could limit how much U.S. interest rates fall. Foreign investors may not be as willing to buy U.S. Treasuries as they have been in the past, limiting the decline in yields.

We do not see the dollar losing its status as the world’s reserve currency. U.S. Treasury bonds are still among the safest assets in the world, and rising yields could boost their appeal.

While a weaker dollar threatens to increase the cost of tariffs for U.S. consumers and businesses, it also can stimulate the economy by making U.S. goods and services less expensive for the rest of the world. If the economic outlook stabilizes, one could expect the dollar to gain value and offset some of the tariff-related price increases.

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Sources: Bloomberg, Carson, CNBC, Horizon, Investopedia, Schwab