On July 4, President Trump signed the “One Big Beautiful Bill” into law, which cements most of the tax cuts embedded in the 2017 Tax Cuts and Jobs Act (TCJA), along with some significant additional tax changes.

However, the primary question remains: What will be the long-term impact of this bill on the deficit? Let’s uncover what is inside this new tax law.

Permanent Changes

The following provisions will become a permanent part of the tax code, initially introduced in the original Tax Cuts and Job Act.

• The seven tax brackets with a top rate of 37% and a bottom rate of 10% will remain the same.

• The mortgage interest deduction will remain at its current limit of $750,000 in mortgage debt for joint filers ($375,000 for single filers).

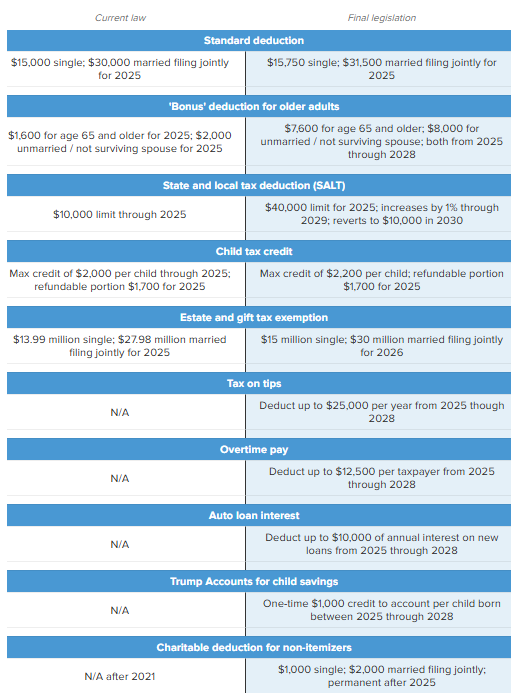

• The State and Local Tax (SALT) deduction had been capped at $10,000. This will increase to $40,000 and then revert to $10,000 in 2030. The higher SALT cap will phase out for incomes over $500,000.

• The standard deduction will be made permanent and increase to $15,750 for single filers and $31,500 for joint filers. These amounts will be indexed for inflation after 2025.

• The lifetime gift and estate tax exclusions will increase to $15 million for single filers and $30 million for those who are married and filing jointly. The exclusions will be indexed for inflation going forward.

• The Child Tax Credit will be permanent and will increase to $2,200 per child starting in 2025.

• Those who do not itemize deductions can claim a deduction for charitable contributions of up to $1,000 ($2,000 for couples) starting in 2026.

Temporary Provisions (4 Years)

The legislation includes numerous temporary deductions and credits that are valid for tax years 2025 to 2028 only.

• Workers can deduct up to $25,000 in qualifying tip income and $12,500 in overtime pay ($25,000 for joint filers). These deductions phase out with income over $150,000 ($300,000 for joint filers).

• People who are 65 or older will get an additional $6,000 deduction that begins to phase out at an income of $75,000 for single filers and $150,000 for joint filers. This is in addition to the $2,000 deduction for single filers and $3,200 for joint filers.

• The new law allows for a deduction of up to $10,000 of loan interest for purchased vehicles whose final assembly took place in the U.S. The deduction would apply for single taxpayers with adjusted gross income of $100,000 or less ($200,000 for people filing jointly).

What Else Is New?

Other additions include a savings account for children and expanded usage for health savings accounts and 529 plans.

• Parents and relatives can now contribute up to $5,000 a year to a new savings account, called Trump accounts. Initially acting like a non-deductible IRA, contributions can be made until the beneficiary reaches the age of 18. Then, the account would effectively convert to a traditional IRA. Additionally, parents of newborns born between Jan. 1, 2025, and Dec. 31, 2028, would qualify for $1,000 in federal money to start the account.

• The legislation expands the use of 529 funds to include miscellaneous expenses such as testing fees, tutoring outside the home, and educational therapies, as well as tax-free withdrawals for recognized postsecondary credential programs.

• The legislation also broadens HSA eligibility by including more health plan types and participant categories.

The legislation does not eliminate taxes on Social Security benefits, which remain taxable up to 85% for individuals with income greater than $34,000, or $44,000 for a couple. However, the $6,000 deduction for those 65 and older may help offset taxes on Social Security benefits for some over the next four years.

Key Individual Tax Changes

As you review the new tax legislation, it may be the perfect time to review your financial planning needs as well. This includes revisiting your investment portfolio, assessing tax planning opportunities, reevaluating retirement goals and managing your wealth transfer and legacy plans.

This summary of the new legislation contains merely a portion of the items that may apply to your family. We are always happy to meet and discuss any of the above to ensure that you remain on track with your financial profile and your goals.

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Sources: CNBC, Fidelity, Schwab