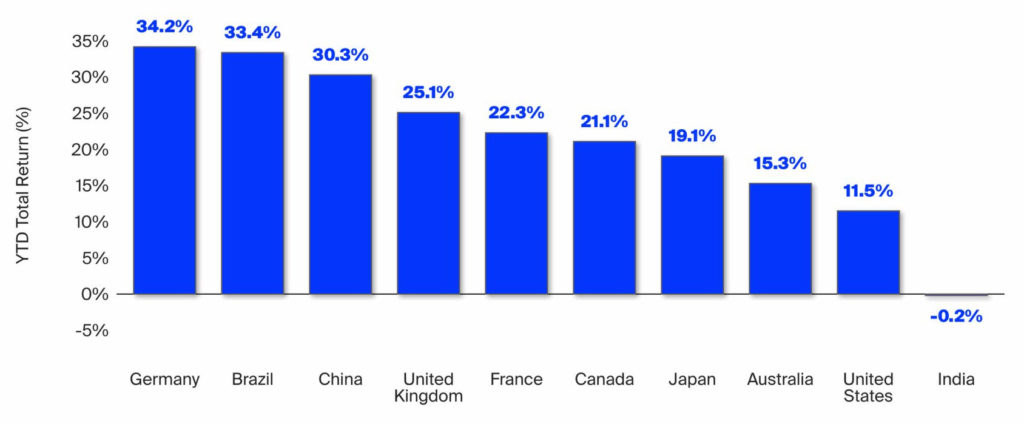

After unpredictable trade policies and multiple wars, who would have thought global stock markets would be this strong through the end of August? Emerging market stocks are having their best start since 2017 — despite U.S. tariff announcements — and a weaker U.S. dollar has aided global equities.

In the past, a softer U.S. dollar has signaled reduced global risk aversion, moving investment dollars into other countries. While U.S. markets are having a great year, international equity returns are in some instances two to three times the S&P 500 returns.

This raises the question: Should I invest only in the S&P 500?

The answer is no. Chasing the best-performing asset class year after year is nearly impossible, and one year’s winners often are the next year’s losers.

While international stocks have trailed the U.S. for many years, the chart below demonstrates exactly why we maintain international equity exposure. History tells us that outperformance rotates between U.S. and international markets over time, not favoring either one exclusively. A globally diversified portfolio can help spread risk and positions the portfolio to benefit from shifts in market leadership.

Major Country Equity Performance in 2025

Year-to-date equity total returns

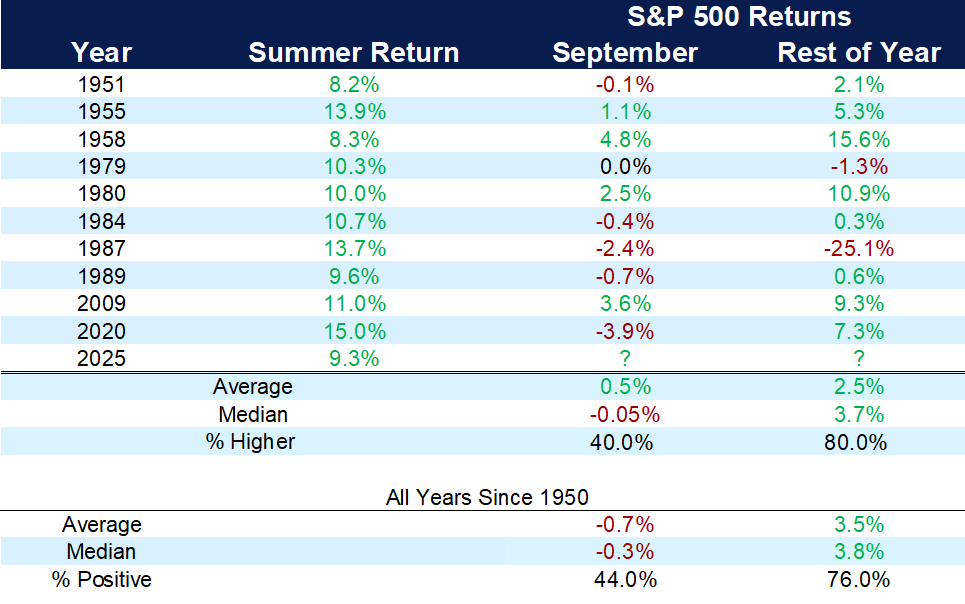

Here in the U.S., the S&P 500 ended August higher, its fourth consecutive monthly gain, and has rallied about 30% from April lows. This year was the first time since 1950 that August saw higher equity returns during a president’s second term.

This summer will be remembered for a strong rally, with the index up 9.3% from June through August. Historically, the rest of the year has seen positive returns when this has happened (excluding the market crash of 1987), with an average return of 5.6% for the remainder of the year.

A Big Summer Rally Usually Is Bullish

Top 10 S&P 500 returns, June-August (1950-present)

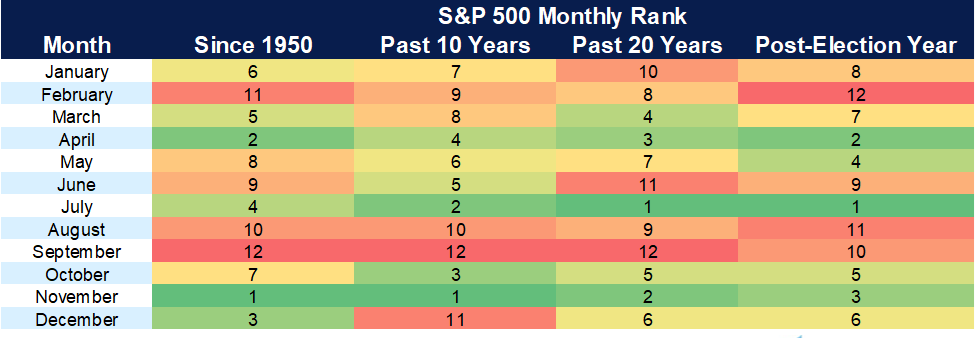

For decades, September has been the weakest month for the S&P 500 — but the so-called September Effect is a pattern, not a guaranteed outcome. Since 1950, the index has averaged a -0.68% return and has been positive only 44.9% of the time in September, the lowest of any month.

There are several theories that seek to explain the weakness in September. The first is investor psychology: This historical trend can become a self-fulfilling prophecy, as a sense of weariness can lead to selling. Also, as the third quarter ends in September, institutional investors often rebalance and relocate, which may lead to downward selling pressure. Market uncertainty also could arise as Congress comes back into session this month and the fiscal year-end deadline arrives Sept. 30.

Meanwhile, the Fed continues to face an inflation problem but is still planning on cutting interest rates, and markets are expecting six rate cuts by the end of 2026. The number of rate cuts has grown while recession odds have fallen, and inflation remains sticky. If the Fed were to reduce rates as much as is currently priced in, that would be bullish for stocks.

September Is the Worst Month of the Year

S&P 500 monthly rank (1950-2024)

For long-term investors, the September Effect is not a reliable indicator. We are not making short-term decisions based on how one month has performed historically. It is useful to be aware of the historical trend, but it is not a reason to deviate from the long-term strategy; reacting to it can cause investors to miss potential gains.

The key is to focus on broader macroeconomic factors, such as interest rate changes, earnings and health of the economy. For those with excess cash, September may provide an opportunity to put it to work into the market through dollar-cost averaging.

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Sources: Bloomberg, Carson, CNBC, A Wealth of Common Sense, JP Morgan