The current bull market turned 3 years old on Oct. 12. In October 2022, the S&P 500 was down more than 25% from its peak. Tech stocks had been cut in half, and soaring interest rates dragged down both stocks and bonds by double digits.

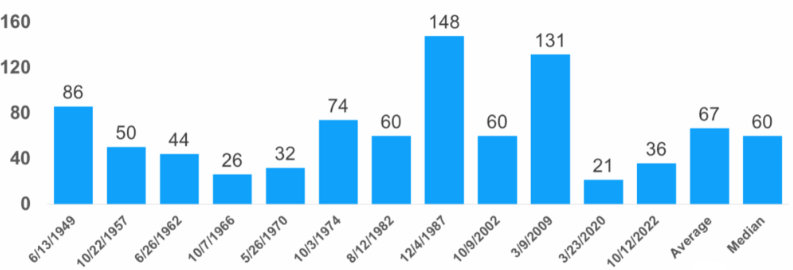

History shows that bull markets tend to last. Since World War II, there have been 11 of them, with an average lifespan of just over five years. We’re only three years into the current one, and it’s already up about 90%. That may sound like a lot, and it’s fair to ask how long it can continue. Statistically, though, the average bull market since WWII has gained more than 190%. By that measure, this one could keep on trucking.

Bull Markets Last Longer Than You Think

Length of bull markets in months and when they started

Pundits often repeat, “Buy low, sell high,” and skeptics warn that what goes up must come down. But history tells a different story. All-time highs typically have been followed by significant selloffs. In fact, markets have often delivered better-than-average returns after reaching new highs.

Stocks typically make new highs when the economy and corporate earnings are strong, and those conditions don’t vanish overnight. Since 1950, the S&P 500 has returned an average of 12.7% in the year following an all-time high.

To be clear: History suggests that reaching new heights isn’t a signal to worry. It’s often a sign of continued strength.

So why not sell your stocks and sit on the sidelines?

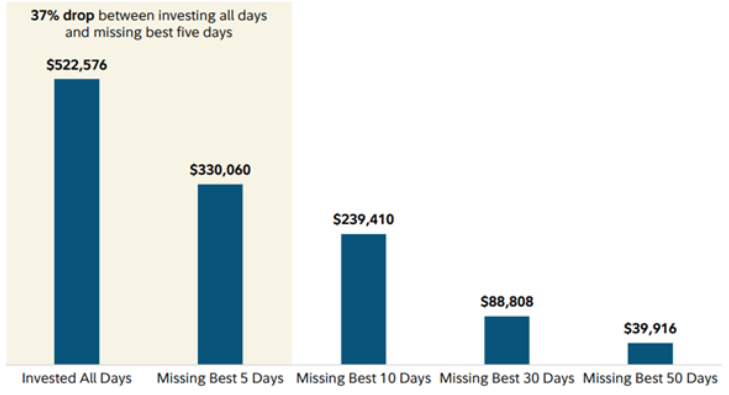

1. Timing the Market Is a Mirage: The idea that investors can move to cash and re-enter at lower levels sounds rational, but it rarely is successful. The market’s biggest gains tend to cluster in just a few unpredictable days. Missing even a few of those days can sharply reduce long-term returns.

Hypothetical Growth of $10,000 in the S&P 500 Index

Jan. 1, 1988-Dec. 31, 2024

2. Recent Evidence — 2025 in Real Time: We just saw this unfold recently. Stocks pulled back from early February through early April, then rebounded quickly. Many investors who “played it safe” by stepping aside missed the sharp recovery. Those who stayed invested captured the full rebound and are now benefiting from new highs.

3. Highs Are Normal, Not Worrisome: The market spends most of its life near record levels because earnings, innovation and productivity grow over time. A new high doesn’t mean we’ve hit a peak; it often signals continuing resilience and progress.

4. The Real Risk Is Emotional, Not Economic: Acting on headlines or fears of a bubble often leads to short-term decisions that undermine long-term fundamentals. The discipline to stay invested through cycles is what separates strategy from speculation.

5. Perspective for Clients: Instead of asking, “Should I wait for the market to drop?” the better question is, “Is my portfolio aligned with my goals and time horizon?” If the answer is yes, then the winning move is staying invested. History shows that trying to “wait for the drop” almost always backfires.

Markets are always forward-looking, and while past performance never guarantees future results, history still offers perspective. Even amid uncertainty — including the current government shutdown, now the longest full shutdown in U.S. history — several strong tailwinds continue to support market strength:

1. The Fed and Interest Rates: The market is predicting five rate cuts before the end of 2026. This has historically provided a boost for profits and stock gains.

2. Momentum: The market has had several months of strong returns, and earnings expectations for the fourth quarter remain positive.

3. Spending: Investment in artificial intelligence, along with consumer demand and corporate balance sheets, remains strong.

Every market cycle includes new highs, temporary declines and renewed growth. Long-term investors don’t need to predict the next dip — they just need to participate and stay invested for the long run.

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Sources: Carson, Fidelity, CNBC