With the presidential and congressional elections less than three weeks away, many investors are wondering if a new administration and a new Congress might pass tax reforms that alter the current tax landscape. After the Nov. 3 elections, we will get a better sense of the potential for tax reform, but in the interim, we continue to look for opportunities to bolster tax savings for our clients, regardless of who takes office in 2021.

Strategy No. 1: Tax Loss Harvesting

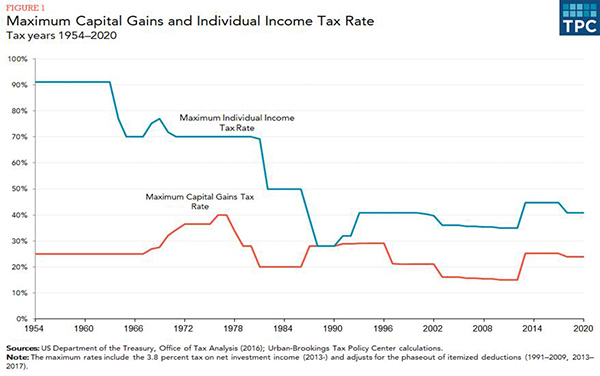

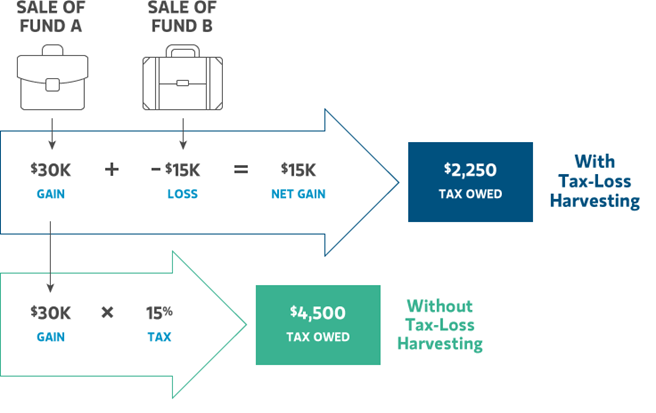

Under current tax law, it’s possible to offset current capital gains with capital losses you’ve incurred during the year or carried over from a prior tax return. Capital gains are the profits you realize when you sell an investment for more than you paid for it, while capital losses are the losses you realize when you sell an investment for less than you paid for it. Short-term capital gains are taxed as ordinary income rates, whereas long-term capital gains are taxed at a lower capital gains rate. The chart above displays the historical gap between maximum individual tax rate and maximum capital gains tax rate, including the 3.8% tax on net investment income.

As seen in the chart, the current spread between the two tax rates is not that wide. However, the ability to reduce the tax on both short-term and long-term capital gains by harvesting losses can help offset the gains one incurs from taking profits. Harvesting the loss has no effect on the portfolio value, as one can use the proceeds from the sale to buy a similar investment. This allows the investor to maintain similar asset allocation and reduce federal income taxes, as seen in the example below. Throughout the year, we continue to look for opportunities to harvest losses and take profits, all while maintaining the current risk tolerance.

Tax-loss harvesting and portfolio rebalancing can provide nice synergies as they play different roles in portfolio management. When we rebalance a portfolio, we are managing risk in the portfolio by selling holdings that have outsized their target holdings and adding those gains to positions that may have losses or not grown as much. Often in rebalancing, the portfolio will experience sizeable capital gains. That’s where tax-loss harvesting helps reduce the gains and brings the risk of the portfolio back to its target allocation.

Strategy No. 2: Converting to a Roth IRA

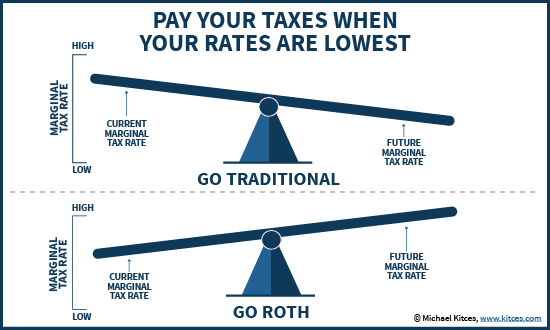

A traditional IRA/401K is funded with pre-tax contributions. Future withdrawals from your IRA/401K are then taxed at ordinary income rates. A Roth IRA/401K is funded with after-tax dollars and the withdrawals are tax-free, if the qualifications are satisfied. Individuals who have a majority of their retirement assets in traditional IRA/401K might consider converting a portion of those assets to a Roth retirement account for “tax diversification.” With tax rates currently at historically favorable levels, now might be an opportune time to do a Roth conversion as the IRS treats Roth IRA conversions as taxable income.

Strategy No. 3: Increasing charitable contributions

The Tax Cuts and Jobs Act passed in 2017 increased the deduction limit for cash contributions made to public charities to 60% of Adjusted Gross Income from 50%. The CARES Act, passed earlier this year due to the global pandemic, provided additional tax relief to those individuals donating to charity in 2020. For this tax year, taxpayers can elect on their 2020 income tax return to deduct up to 100% of adjusted gross income for cash gifts made to public charities.

Also, under the CARES Act, taxpayers can gift long-term appreciated securities to public charities (including donor advised funds) up to 30% of their adjusted gross income while also making cash gifts to public charities totaling up to 70% of adjusted gross income. For those who are charitably inclined, 2020 offers an opportunity to donate more to your favorite charities and potentially reduce your taxable income.

What does this mean for you?

We will continue to monitor the financial plan and the portfolios to look for opportunities to tax-loss harvest, discuss Roth IRA conversions and potentially donate appreciated stock to your favorite charities. We remain hypervigilant going into the election and will make tweaks to the portfolios when necessary.

_____

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

S&P 500 Index is an unmanaged group of securities considered to be representative of the stock market in general. You cannot directly invest in the index.The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. Kestra IS and Kestra AS are not affiliated with CD Wealth Management.

Click here for additional investor disclosures.