The ongoing strength in large cap technology stocks has many investors wondering if there is another bubble in the making. The Nasdaq 100, as measured by the ETF, QQQ, is up 27.85 percent year to date, while the S&P 500 is up 4.75 percent for the year.

The top 10 holdings of QQQ, which comprise almost 60 percent of the index, are all part of the so-called FAANG (Facebook, Amazon, Apple, Netflix and Google) stocks. At the same time, the top five holdings of the S&P 500, Apple, Microsoft, Amazon, Facebook and Google, make up more than 22 percent of the current index, and a big reason that the stock market returns are now positive year to date.

Investors have been willing to pay an increasingly higher price for these FAANG stocks as they continue to show massive innovation, whether through 5G, the ever-growing cloud business, or taking advantage of the stay-at-home economy caused by the pandemic.

These stocks have provided shelter from lockdown-sensitive stocks like restaurants, hotels and airlines. Cloud spending and internet streaming are proving to be mostly recession-resistant, and the at-home environment has accelerated these growth trends.

Analysts valuate these companies by looking at a myriad of financial ratios: P/E (price-to-earnings), P/B (price-to-book), P/S (Price to Sales) and PEG (price/earnings to growth), to name a few. Back in the late 1990s and early 2000s, many of the newly public growth technology companies were unprofitable and had zero revenues and earnings. These companies were far from becoming innovators and game-changers.

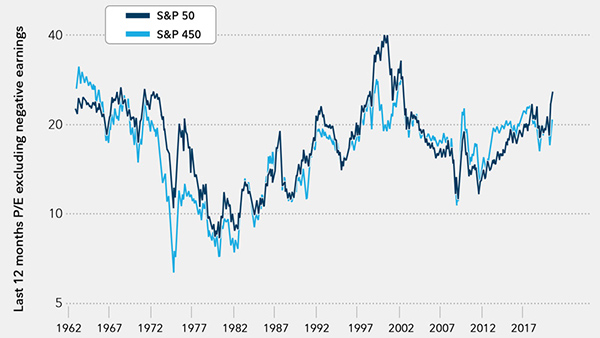

As seen in the chart below, at the peak of the dot-com bubble, the top 50 companies in the S&P 500 produced a P/E ratio of 40.2x, while the bottom 450 stocks had a P/E ratio of 19x. Today, the top 50 companies are trading at a P/E of 25.7x, while the bottom 450 are trading at a multiple of 20.8x.

Fast-forward to today, the leading companies in the Nasdaq 100 are large revenue and profit generators, with a few exceptions. The price gains we have seen over the last six months in the stock market have been justified by solid earnings growth, and as a result, we have seen valuation spreads widen between these technology companies and the rest of the market.

It is important to keep in mind that stocks trade based on future earnings and are forward-looking in nature. The earnings expectations for the top large cap companies are high, and we should expect these companies to face volatility in the near future with growing regulatory pressure, ad-spending boycotts, the upcoming election and potential corporate tax changes.

So, what can we learn from all this? The best option is to stick with a broadly diversified portfolio that can help you to achieve your own specific financial goals and not place all your eggs in one sector basket.

_____

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Investing involves risk, including the possible loss of principal. Past performance does not guarantee future results. Asset allocation alone cannot eliminate the risk of fluctuating prices and uncertain returns. There is no guarantee that a diversified portfolio will outperform a non-diversified portfolio in any given market environment. No investment strategy, such as asset allocation, can guarantee a profit or protect against a loss. Actual client results will vary based on investment selection, timing, and market conditions. It is not possibly to invest directly in an index.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. Kestra IS and Kestra AS are not affiliated with CD Wealth Management.