Stocks have had an impressive rally to start the year. The S&P 500 finished the first quarter with a five-month winning streak — shrugging off higher interest rates, hotter than expected inflation data and a reduction in the number of potential rate cuts from the Federal Reserve.

Large-cap stocks, especially those related to artificial intelligence, continue to lead the way, but this year’s rally has been much broader than what we saw in 2023. Apple and Tesla, two of the Magnificent Seven stocks, have had very weak starts to the year.

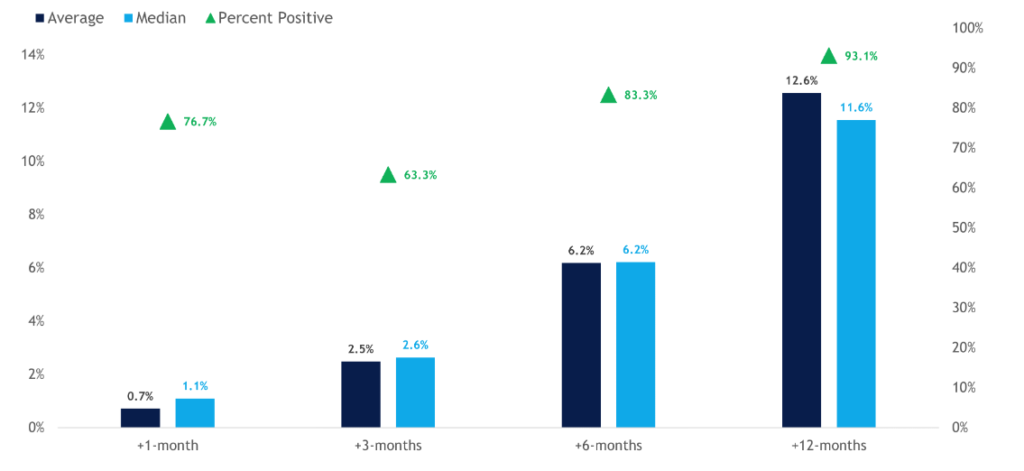

Since 1950, there have been only 30 occurrences in which the market rose for at least five consecutive months. In those occasions, the average return has been 12.6% in the following 12 months, and it has been positive 93.1% of the time.

S&P 500 Peformance Following a Five-Month Win Streak (1950-YTD)

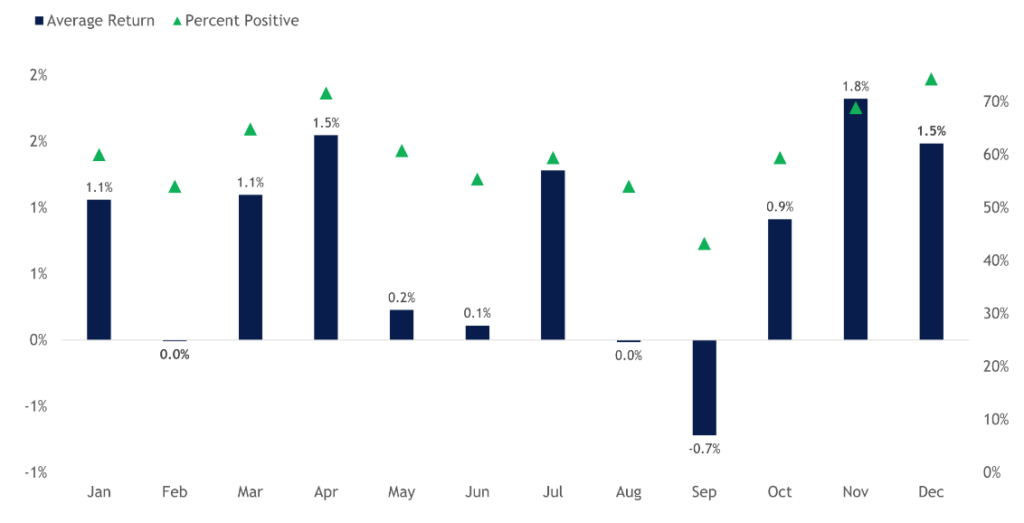

For stocks, April has historically been a good month for growth. Going back to 1950, the S&P 500 has averaged 1.5% in April and finished higher 72% of the time. During an election year, the index has posted an average return of 1.3% in April.

This April, the market started on a choppy note — which is not surprising, considering the start to the year and the Fed’s mixed messages on interest rates. A few weeks ago, Fed Chairman Jerome Powell said three rate cuts were still on the table for 2024, but over the last week, policymakers have indicated that there may be only one rate cut this year. The market is trying to digest what that may mean for stocks and, more importantly, for company valuations.

S&P 500 Monthly Seasonality (1950-YTD)

If you are invested, it’s great that stocks are hitting new all-time highs. But if you are looking to put cash to work or considering adding to the portfolio, what does it mean? It’s kind of like climbing a mountain: If you reach the top, isn’t down the only other option?

This kind of thinking is often short-sighted. Not investing — or worse, pulling money out of the market after stocks reach new highs — is calling a market top. Timing the market, which is the strategy of buying in when the market is at the lowest and selling at its peak, requires near-perfect insight to succeed.

Since 2020, the S&P 500 has experienced more than 120 all-time highs. Each of those moments was a market top. Selling on any of those days would have prevented you from participating in the next all-time high.

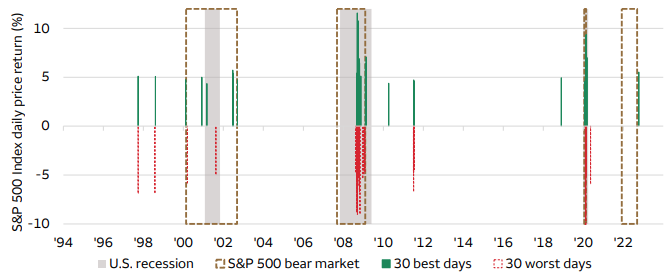

For market timing to work, you must be right twice: once on the way out and then again when to get back in. Investing in the S&P 500 at all-time highs has been a good strategy over the last several decades. As the chart below shows, the 30 best days (as well as the 30 worst days) tend to be clustered together. They also tend to occur during bear markets, when volatility is high.

The Market’s Best and Worst Days Have Often Been Close Together

There’s an old saying that bull markets don’t die of old age. Staying invested, maintaining a diversified portfolio and rebalancing the portfolio periodically can mitigate the risks that come with trying to time the market.

Momentum begets momentum. Rather than thinking of an all-time high as the top of the mountain, think of it as another step in establishing a new baseline to climb even higher over the long run.

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Sources: Baird, LPL Financial, Schwab, Wells Fargo

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS. Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.

Fidelity Investments and Fidelity Institutional® (together “Fidelity”) is an independent company, unaffiliated with Kestra Financial or CD Wealth Management. Fidelity is a service provider to both. There is no form of legal partnership, agency affiliation, or similar relationship between your financial advisor and Fidelity, nor is such a relationship created or implied by the information herein. Fidelity has not been involved with the preparation of the content supplied by CD Wealth Management and does not guarantee, or assume any responsibility for, its content. Fidelity Investments is a registered service mark of FMR LLC. Fidelity Institutional provides clearing, custody, or other brokerage services through National Financial Services LLC or Fidelity Brokerage Services LLC, Members NYSE, SIPC.