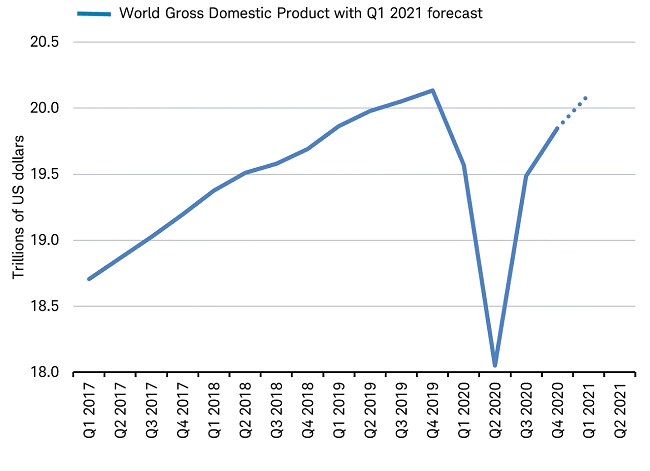

We have now experienced the sharpest “V-shaped” economic recovery in history — a deep global recession and rapid recovery within five quarters. A combination of vaccine rollouts and worldwide fiscal stimulus led to global growth forecast of 6% for 2021, and the U.S. GDP forecast is anywhere between 6% and 8%, which would be the fastest pace of growth since 1983.

We continue to see reacceleration in the job market, as nonfarm payrolls for the month of March grew by 916,000 jobs, and they are being added in nearly every sector, which is a strong positive for the overall economy. The downside is that we are still nearly 8.5 million jobs behind pre-pandemic levels of employment.

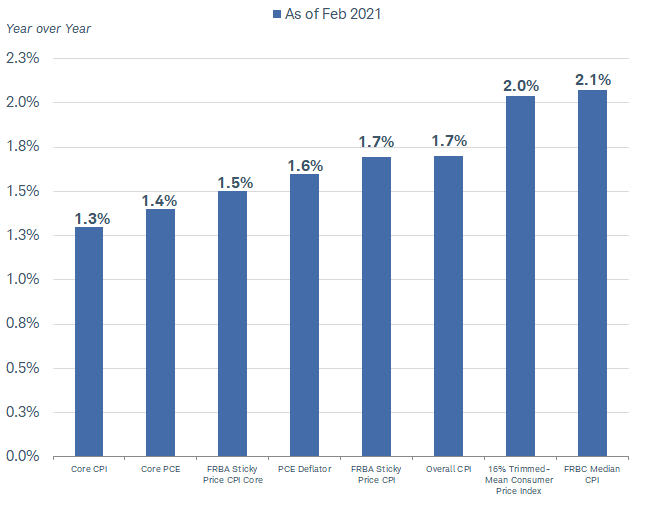

Inflation remains the talk of the town (and all the news channels). The consumer price index (CPI) has surged, but given that it is measured year-over-year, we are now comparing the current strong gains to depressed prices and demand from this time last year.

Inflation is rising around the world, lifted by transitory factors and supply-chain bottlenecks. With delays in ports and limited access to supply, prices are bound to rise near term. However, as shortages begin to disappear and supply delivery times shorten, inflation is expected to ease and land within a comfortable zone for world economies.

We are now in earnings season on Wall Street. Last year, we saw a surge in stock prices while earnings plunged as large pockets of the economy were shuttered. The effect of this is a growing Price-to-Earnings multiple (P/E) of the S&P 500. At the end of last year, the P/E multiple hit 27, a valuation in line with the late 1990s. With the growth in earnings in the current and previous quarters, the P/E multiple for the S&P 500 is roughly 23, which remains above average. Regardless of whether the P/E is above or below average — cheap or expensive — it is important to know that valuation based on P/E multiples is not an effective market timing tool. Markets can become expensive and stay expensive for some time without a negative impact on stock prices, especially if momentum and positive investor sentiment, like we are seeing today, are the dominant drivers.

So, what can we learn from all this? The global economy is on a roll. With strong earnings growth, increasing labor force and vaccine rollouts, all signs point toward tremendous GDP growth. Nonetheless, risks remain in the global market. Having a diversified portfolio and a mix of equities provides discipline around risk mitigation. Markets go up and down over time. The key is to stay invested and stick with the financial plan. Market downturns present opportunities to purchase stocks that were previously viewed as overvalued. In a down market, you are “buying low,” one of the fundamental tenets of investing.

Given the difficulty of timing the market, the most realistic strategy for a majority of investors is to invest and stay invested over time. Procrastination, or not investing, is worse than bad timing. We continue to view more risk being out of the market than in the market. Riding out future market volatility, in addition to having a diversified portfolio, means staying the course. From an investment perspective, we use trends to help with the strategic and tactical asset allocation and where we see the portfolio heading over the next 5-7 years with short-term adjustments along the way.

It all starts with a solid financial plan for the long run that understands the level of risk that is acceptable for each client. With regards to investments, we believe in diversification and having different asset classes that allow you to stay invested. The best option is to stick with a broadly diversified portfolio that can help you to achieve your own specific financial goals — regardless of market volatility. Long-term fundamentals are what matter.

Sources: Bloomberg, Federal Reserve Bank of St. Louis, Schwab

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. Kestra IS and Kestra AS are not affiliated with CD Wealth Management. Investor Disclosures: https://bit.ly/KF-Disclosures