It seems like the stock market can’t get away from the never-ending drama that emanates from our nation’s capital. Congress has always raised the debt ceiling when needed, but concerns are building as the sides remain far apart and political divisiveness is as bad as ever.

The standoff has heightened uncertainty about the economy, as default would risk sending bond yields higher — and stocks and the U.S. dollar lower. Volatility is likely to increase in the financial markets. This is the scenario that played out in the 2011 debt-ceiling fight, and it is likely that we will see it happen if history repeats itself.

If no deal is reached, the Treasury has a couple of options:

1. Technical default. This is defined as an extended period of non-payment of interest and principal on the debt. In the U.S., assuming an agreement was eventually reached, investors would receive interest and principal payments, likely with accrued interest.

2. Creative possibilities. The Treasury could issue premium bonds that would generate a price above par, giving the Treasury additional cash. Another option could be that the Treasury could invoke Section 4 of the 14th Amendment, which some argue could give the president authority to order the nation’s debts be paid, regardless of the debt ceiling.

The other big debate revolves around whether the Fed will continue to raise rates to combat inflation. One of the benefits of higher rates from the Fed has been the return of attractive cash and short-term fixed-income returns. The chart below shows the massive inflows into money market funds since the pandemic.

There is now more than $5.2 trillion invested in the money market. With money market rates close to 5%, it is understandable that investors have moved monies from their regional or national bank to take advantage of the higher savings rates. Yields for very short-term Treasuries are elevated compared to those even a few months farther out, as investors shy away from the risk that interest on Treasury bills could be deferred.

ICI Money Market Fund Assets (USD Trillions)

A big question facing investors is just how long short-term bond yields may remain at historically high levels. If inflation remains sticky, we may be in for higher rates than the market has priced in. This would give investors the ability to earn more on cash and short-term CDs and Treasuries for a longer time — which may cause some investors to time their reentry into the market since they are earning near 5% on cash and cash equivalents.

You always want to have emergency cash sitting in something, and right now that’s giving you a nice return. When the Fed decides to cut interest rates, whether later this year or next year, money market, short-term Treasury and CD rates will fall as well. When rates fall, bond prices will rise, which is what we saw often before the Fed raised rates in March 2022. If this were to happen, as many believe it will, bond returns will be additive to total return.

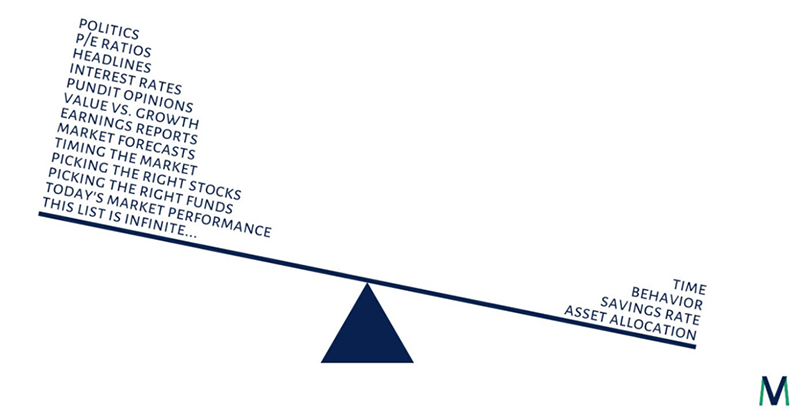

The picture below is important to remember during times like these. What drives investment returns is the right side of the seesaw: time in the market, investment behavior (not making rash decisions), saving more than spending and diversification in the portfolio. The items on the left side of the seesaw — politics, media, news, headlines, opinions from talking heads — are just noise.

Noise does not drive long-term investment returns. To participate in the upside of the bull market, you must survive and stay invested through a potential recession or debt-ceiling crisis. If there is not an agreement and we see volatility pick up — or a market sell-off — think back to the picture below and remember the four things that matter for long-term investment performance.

What Drives Investment Returns

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Sources: Baird, Bloomberg

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS. Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.

Fidelity Investments and Fidelity Institutional® (together “Fidelity”) is an independent company, unaffiliated with Kestra Financial or CD Wealth Management. Fidelity is a service provider to both. There is no form of legal partnership, agency affiliation, or similar relationship between your financial advisor and Fidelity, nor is such a relationship created or implied by the information herein. Fidelity has not been involved with the preparation of the content supplied by CD Wealth Management and does not guarantee, or assume any responsibility for, its content. Fidelity Investments is a registered service mark of FMR LLC. Fidelity Institutional provides clearing, custody, or other brokerage services through National Financial Services LLC or Fidelity Brokerage Services LLC, Members NYSE, SIPC.