Although the stock market has experienced a steady climb this year, the TRIP is always an interesting ride — and rarely a steady one. Along the journey, the market typically faces many hurdles; currently, those speed bumps are Taxes, Rates, Inflation and Prices (valuation).

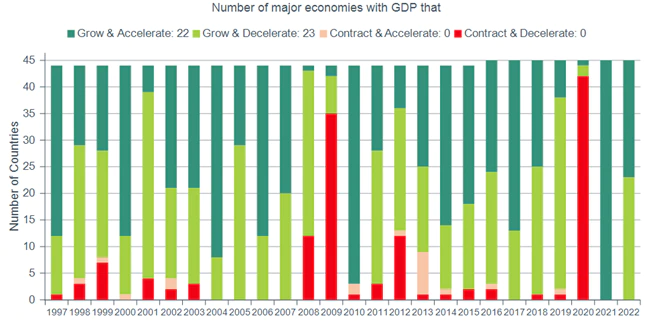

Global stocks will always have a myriad of worries, despite favorable longer-term economic forecasts and bright spots. The Organization for Economic Cooperation and Development forecasts that every one of the 45 major economies in the world should be growing next year, with about half experiencing slower growth than last year. Global economic growth is expected to be 6% for this year and 4.9% for 2022, according to the International Monetary Fund. For context, growth above 4% is understood to be an economic boom, whereas growth below 2% is considered a global recession.

The fundamental strength of the economy remains intact, powered by vaccines and the U.S. consumer. The global growth slowdown is expected following the strong reopening trade in the wake of the global pandemic. Price remains a major speed bump for the economy, both in the labor markets and in the supply chain. Firms need workers; there are more jobs available than there are workers right now. Therefore, companies are paying more for employees, which will disrupt profits.

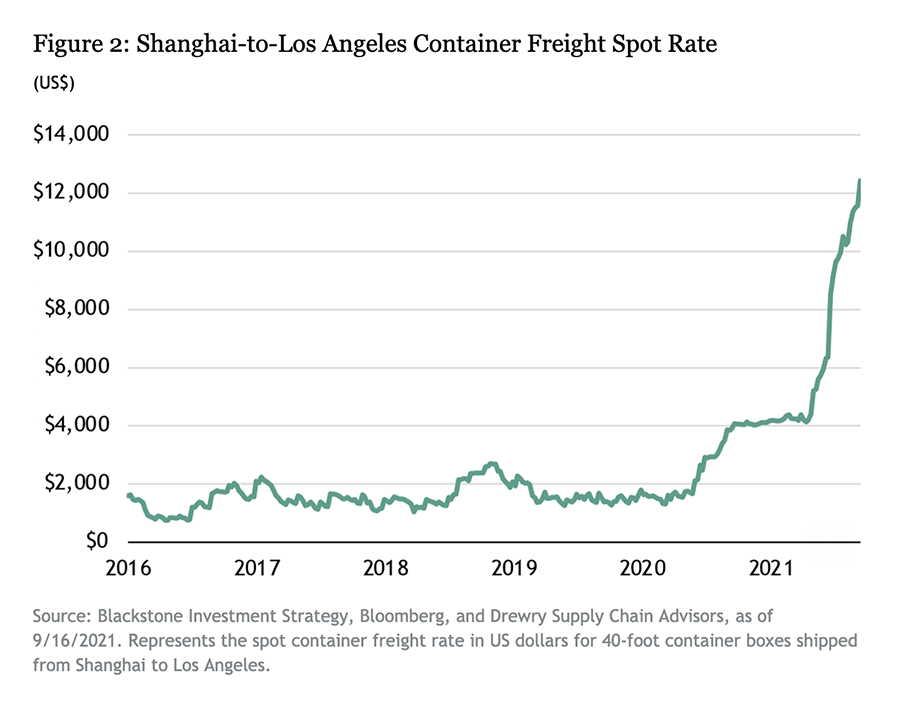

Shipping capacity remains too limited to satisfy the rebound in consumer demand, and cargo prices are through the roof (as seen below). Eventually, supply and demand will equalize, which will reduce costs, but until that time, shipping and other supply chain costs will soften corporate profits.

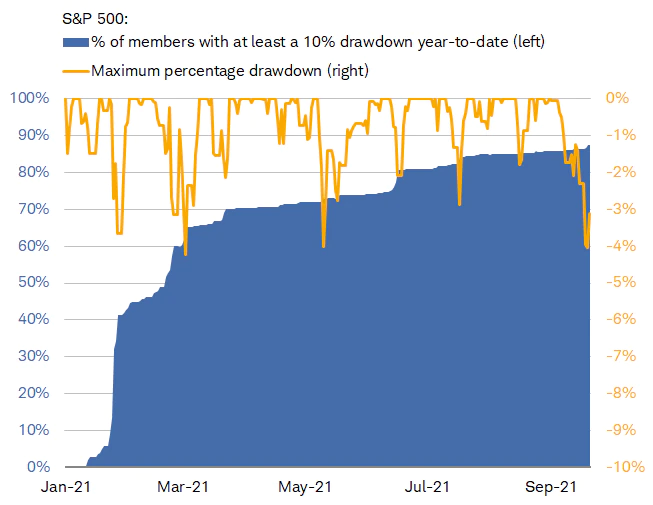

Throughout the year, we continue to see underlying movement between different sectors in the S&P 500. For example, Treasury rates rise, leading to investors selling technology stocks and buying financials and oil stocks — or instead, the 10-year Treasury falls, and the big-cap technology sector comes roaring back. Under the surface of the rally, many stocks in the S&P 500 already have reached correction territory this year, as seen in the chart below. Nearly 90% of the stocks in the S&P 500 have had at least a 10% correction at some point in 2021. The fact that so many stocks have had close to a 10% drawdown reflects what we have discussed recently: that there are some fundamental challenges in the economy, and now we have disagreements in Washington over the debt ceiling and potential government shutdown.

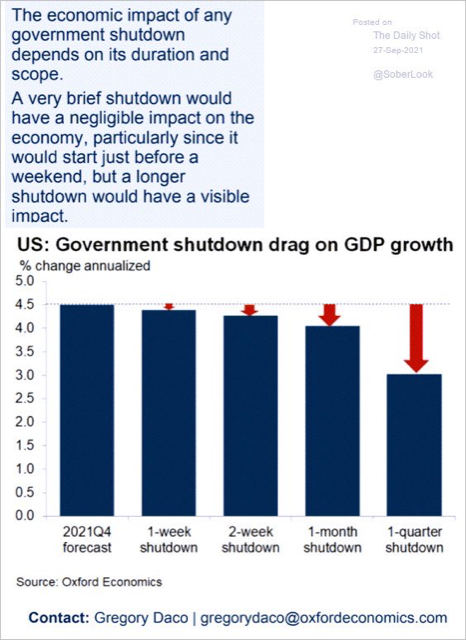

As we reach the end of September, Congress is faced with a pileup of legislative issues that have stock market implications. The most immediate deadline facing Congress is a potential government shutdown on Oct. 1. A tentative deal is in the works to temporarily fund through early December, but it is not a done deal. The chart below projects the economic impact of any government shutdown. The longer a shutdown occurs, the larger the impact on the U.S. economy. Markets also are watching the standoff over raising the debt ceiling. To date, Congress has never failed to raise the debt ceiling before the country would technically go into default.

So, what can we learn from all this? The current TRIP of the economy may not be the smoothest road. Please remember: While we may hit some speed bumps along our TRIP, we have been down this road before. Whether it’s tax increases, inflation, interest rates, equity valuations or government shutdowns, history has always shown that markets tend to move past these bumps. It is important to focus on the long-term goal and not on one specific data point or indicator.

From a portfolio perspective, we continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been. Making market decisions based on what might happen may be detrimental to long-term performance. The key is to stay invested and stick with the financial plan. Markets go up and down over time and downturns present opportunities to purchase stocks at a lower value.

It all starts with a solid financial plan for the long run that understands the level of risk that is acceptable for each client. Regarding investments, we believe in diversification and having different asset classes that allow you to stay invested. The best option is to stick with a broadly diversified portfolio that can help you to achieve your own specific financial goals — regardless of market volatility. Long-term fundamentals are what matter.

Sources: Blackstone, The Daily Shot, Schwab

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. Kestra IS and Kestra AS are not affiliated with CD Wealth Management. Investor Disclosures: https://bit.ly/KF-Disclosures