Many of you ask us on a regular basis, “How can the market rebound so fast when the economy is still partially shut down and millions of Americans are unemployed?” There is a normal level of disconnect between the stock market and the economy, as the stock market is a leading indicator. The market will normally sell off before the economy turns south and will recover before the economy picks back up. This is never more clear than today.

As you peel back the onion on this stock market rally, look at what is driving the market higher from the March lows. You will notice that most of the sectors in the S&P 500 are still negative year-to-date, as is the overall stock market, and those that are negative, are mainly down double digits. While it should not surprise us that most sectors are in the same camp as the market, what is surprising is which sectors are in the red and which are in the black.

It is abnormal because the sectors that usually lead the stock market out of a recession-induced downturn are not doing so now. Instead, leadership has come largely from big tech stocks and pharmaceuticals, rather than financials and cyclical sectors that closely track the ups and downs of the economy, such as industrials and consumer discretionary stocks. This time, it is very different as we have the first ever global pandemic.

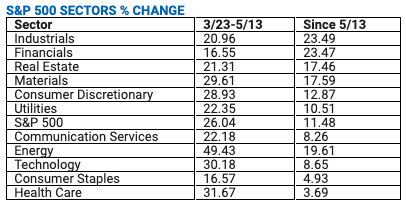

In March and May, we continued to tweak our portfolios and increase our exposure to technology and health care stocks. Throughout the entire downturn, Technology and Health Care, along with Biotech stocks, are leading the way. In the last few weeks, the cyclical sectors are starting to catch up, as you can see from the table below. It is healthy for the market to have sector rotation and not just two or three sectors leading the way, while the rest of the market struggles.

Markets continue to move higher off a rotation-driven rally as investors move into those economically sensitive value stocks. At the same time, we still have a global pandemic with many businesses shutdown, employees working from home, nationwide protests and an election coming up in November.

We believe that technology and health care continue to be very strong sectors to own. We will continue to closely track the markets, the sector rotation and continue to tweak the portfolios as necessary.

Full Transparency

Our Process

Our planning process has the rigor and comprehensiveness you would expect when trusting a firm with your financial well-being.

Our Fees

Full transparency regarding the costs tailored to your salary, gender, and lifespan (aka your real life). We’ve got your back!

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

S&P 500 Index is an unmanaged group of securities considered to be representative of the stock market in general. You cannot directly invest in the index.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. Kestra IS and Kestra AS are not affiliated with CD Wealth Management.