Last week was another tough week for the stock market. Major U.S. market indexes have now traded down 10 out of the last 11 weeks. Stock market losses occur for various reasons: Sometimes they are driven by excessive market valuations, like the tech bubble of 2000, and sometimes they are driven by external market events, such as a war or a global pandemic.

If the year were to end today, 2022 would be the sixth worst year in stock market history, as the S&P 500 is currently down 22.3% year to date. During times like these it is important to maintain perspective and know that even the worst market years will come to an end. Here are some points to keep in mind:

•The S&P 500 had 25 negative years between 1928 to 2021, meaning that 27% of the time, the market experienced a down year, while 73% of the time the market had positive returns.

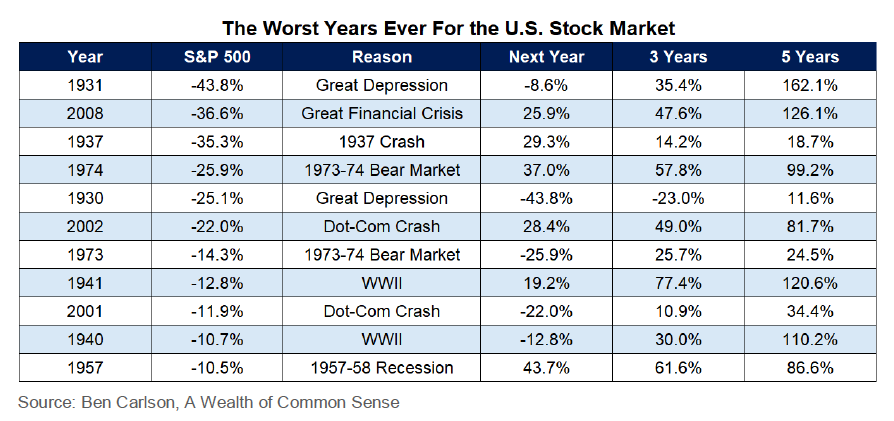

•Of the 25 negative years, 11 of those were double-digit losses as seen in the chart below.

• The market has experienced two consecutive years of negative returns eight times since 1928. It has experienced three consecutive years of negative returns three times in this same period, however, this has only happened once since the Great Depression.

• The longer-term returns following the worst performing stock markets have been strong. The average three-year return is +35% while the average five-year return is +80%.

• The results for the year that follows a worst performing year are mixed, however, there has only been one three-year period with negative returns, which was during the Great Depression.

• Every five-year period following one of the worst years in the stock market saw positive returns.

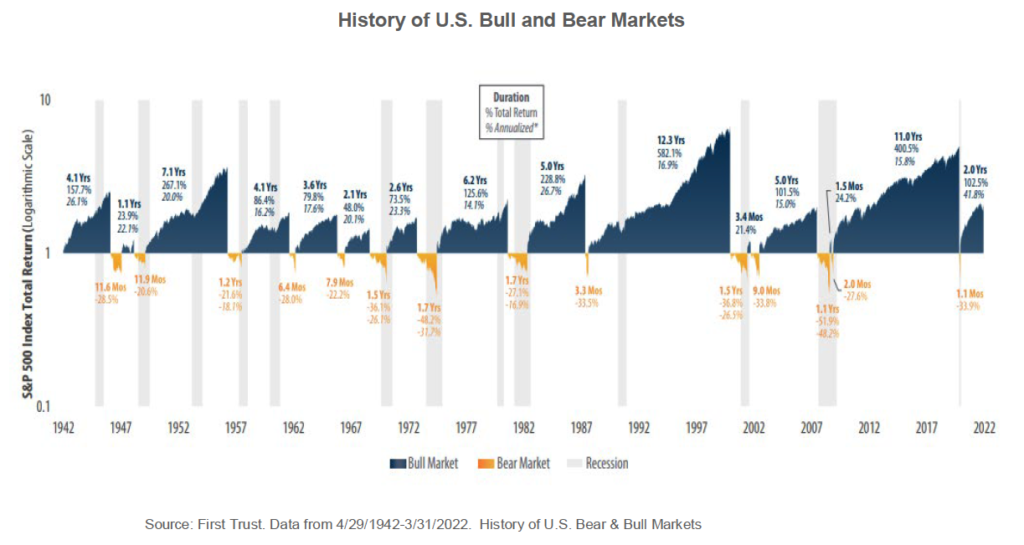

• Since 1929, there have been 26 bear markets, 15 of which were tied to recessions. The average length of a bear market in the S&P 500 index has been 9 ½ months. For bear markets that have been tied to a recession, the average decline is 35%, while those without a recession have experienced an average loss of 25%.

• The chart below is a history of bull and bear markets since 1942. During that time, the average cumulative return of a bull market has been 155%, while the average bear market has a loss of 32%. It is important to note the length of time of a bull market compared to a bear market: The bull market has lasted, on average, 4.4 years, while the bear market has only lasted 11 months on average.

Even after the worst years in the stock market, the markets have always bounced back. Those who remain disciplined in a down market, like we are in today, have the potential to enjoy better times ahead. Historically, the longer you stay invested, the greater the possibility you will have to reach your long-term goals.

So, what can we learn from all this? Today’s markets are certainly a challenging environment; however, when focused on long-term investing, there is no reason to panic. Since 1929, markets have experienced numerous challenges including multiple wars, asset bubbles, recessions, and a global pandemic. In each of these challenging times, companies and people have adapted and responded to get back on track. Investing will always be uncertain but sticking to the financial plan is critical to avoid short-sighted decisions. As Warren Buffet famously said, “The market is the most efficient mechanism anywhere in the world for transferring wealth from impatient people to patient people.”

What really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been. It is important to focus on the long-term goal, not on one specific data point or indicator. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

The market is the most efficient mechanism anywhere in the world for transferring wealth from impatient people to patient people. — Warren Buffet

At the end of the day, investors will be well-served to remove emotion from their investment decisions and remember that over time, markets tend to rise. During volatile markets, it is important to remember that the fear of losing money is stronger than the joy of making money. Investor emotions can have a big impact on retirement outcomes. Market corrections and bear markets are normal; nothing goes up in a straight line. Making market decisions based on what might happen may be detrimental to long-term performance. The key is to stay invested and stick with the financial plan. Markets go up and down over time, and downturns present opportunities to purchase stocks at a lower value.

It all starts with a solid financial plan for the long run that understands the level of risk that is acceptable for each client. Regarding investments, we believe in diversification and having different asset classes that allow you to stay invested. The best option is to stick with a broadly diversified portfolio that can help you to achieve your own specific financial goals — regardless of market volatility. Long-term fundamentals are what matter.

Sources: Assetmark, Ben Carlson, Fact-Set, First Trust, PGIM