Government shutdowns are typically more of a political standoff than an economic crisis. As lawmakers approach the Sept. 30 fiscal year deadline, negotiations often devolve into a blame game and a test of endurance. With no stopgap measure in place this year, a shutdown began Oct. 1, forcing federal agencies to halt operations and leaving both parties pointing fingers. It’s worth noting that shutdowns have occurred under both Republican and Democratic leadership.

The immediate concern is that the monthly jobs report and inflation readings could be delayed, complicating the Federal Reserve’s outlook on interest rates. Beyond that, a shutdown affects “nonessential” government functions, leading to furloughed workers and paused services, which may cause short-term economic ripples.

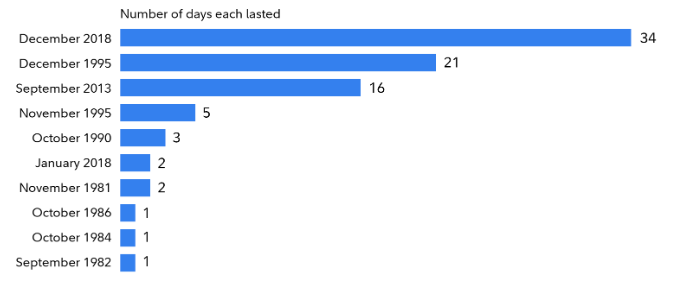

Since the first shutdown in 1981, the government has closed 10 times, most recently in 2018. In recent years, Congress has often relied on last-minute, short-term measures to keep the government open, usually with little lasting impact on markets or the broader economy.

Government Shutdowns

There have been 10 government shutdowns since 1980. Other funding gaps have occurred, but the gaps were either too short or occurred over a weekend, so affected agencies did not begin to shut down before Congress restored funding.

How could a shutdown affect bonds and credit rating?

A shutdown does not affect the government’s ability to pay its debt to bondholders, nor does it have an impact on its borrowing costs or creditworthiness. Treasury interest payments and Social Security would continue to be paid, and the Treasury would conduct its regularly scheduled bond auctions.

A prolonged shutdown could potentially affect prices of some bonds issued by corporations that rely on contracts with the government for a significant portion of their revenue, but that would be temporary.

Rating agencies such as Moody’s already downgraded the debt earlier this year, and while further downgrades are possible, they are not likely. If it does happen, a downgrade could raise borrowing costs for the government in the future and push up interest rates.

How could a shutdown affect stocks?

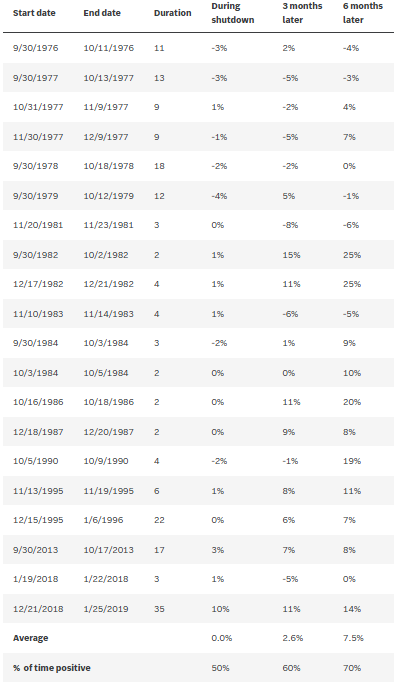

Over the last 45 years, the government shutdowns we’ve seen have had little impact on investors, consumers or financial markets. History shows us that the market understands that while these short-lived political dramas make headlines, they don’t have a meaningful impact on corporate earnings. And earnings are the primary driver of stock prices.

That is not to say we couldn’t see an uptick in volatility, especially after a period of strong returns since mid-April. During previous government closures, stocks have been positive half the time, and six months later, they have been higher 70 percent of the time.

S&P 500 Returns Around Government Shutdowns

How could a shutdown affect the economy?

Furloughed workers are guaranteed to receive back pay once funding resumes. President Trump’s threat to fire federal workers complicates matters, but many view it as a strategic pressure tactic aimed at pushing Democrats to advance the stopgap bill already passed by the House.

From an economic perspective, we expect a short-term slowdown in growth but a quick recovery once operations resume. Government spending doesn’t disappear; it’s simply delayed or displaced. Because the federal government plays a significant role in purchasing goods, providing services and driving economic activity, a prolonged shutdown could dampen overall output. Still, while the impact grows with the length of the disruption, the broader economic damage will probably be minimal.

The bottom line: Stay the course.

Concerns about a shutdown may trigger some market volatility. History has shown that the impact is short-lived, and we do not expect a shutdown to alter the outlook for the economy or federal markets.

Rather than worry about the impact of a shutdown, investors should focus on avoiding the temptation to overreact or make decisions based on fear and uncertainty. As always, the key is to stick with the plan that is already in place and not make changes in response to headlines.

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Sources: Capital Group, Fidelity, Edward Jones, U.S. House of Representatives