Only a month ago, stocks were in correction mode and fear was everywhere. Economists and emotional investors worried aloud about a new bear market and a recession on the horizon.

How quickly the narrative changes.

November saw a complete reversal, with stocks having their best month of the year. The S&P 500 finished November up 8.9%, one of its best monthly returns ever!

What led to this rally? Investor sentiment had become very pessimistic, as often is the case when stocks are in a correction mode. All it took for the market to rally was a little spark, and that spark came in the form of encouraging inflation data.

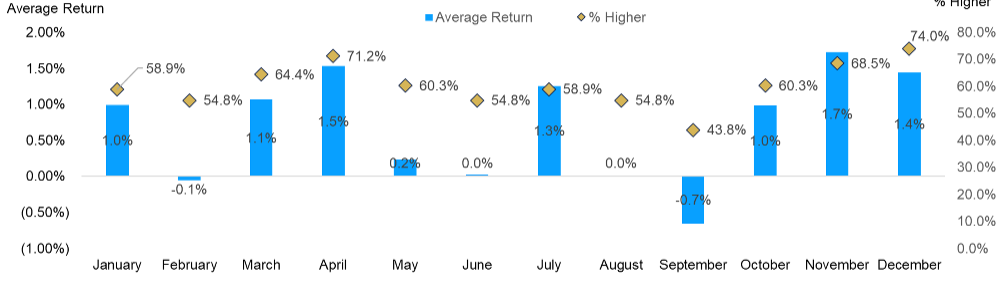

The market now believes that the Fed is probably through raising rates, and the likelihood of interest rate cuts next year has increased. There may be more good news on the horizon as well: History shows us that no month has been stronger than December. The chart below shows us that since 1950, the market in December has been positive 74% of the time with an average gain of 1.4%.

December Is Higher More Often Than Any Other Month

S&P 500 average monthly performance and how often each month is higher (1950-present)

Santa’s financial gifts are not always in the form of market returns. The IRS recently released its inflation adjustments for 2024 related to personal income tax, retirement contributions, estate taxes and Social Security benefits. While these changes won’t affect your tax return that’s due in April, they will be helpful in planning for 2024.

Personal Income Tax

The standard deductions are increasing in 2024, which potentially means a bigger tax break for you. The new standard deductions for 2024 are:

• Married filing jointly: $29,000 (an increase of $1,500)

• Single taxpayers and married individuals filing separately: $14,600 (an increase of $750)

• Heads of households: $21,900 (an increase of $1,100)

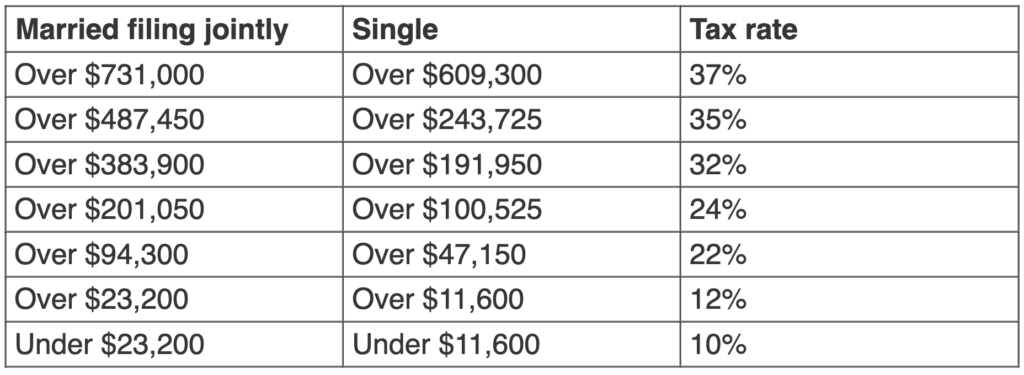

For the 2024 tax year, the top tax rate remains 37% for those with income greater than $731,000 for married filing jointly ($609,300 for single taxpayers). Here are all of the brackets:

In addition, retired married couples over 65 who file jointly will receive an additional standard deduction of $3,100 ($1,550 each)! This may make it more difficult to itemize deductions in 2024. We will want to keep this in mind when planning charitable giving and considering a bunching strategy.

Retirement Savings Contributions

The contribution limit for a 401(k) is increasing by $500 to $23,000, and maximum contribution for certain profit-sharing plans is increasing to $69,000. For the second year in a row, limits for contributions to traditional and Roth IRAs are increasing. For those under the age of 50, the cap will be $7,000 in 2024, up from $6,500.

Married couples with income below $230,000 will be able to make a full Roth contribution in 2024 ($146,000 for those who are single). However, phaseout ranges are unchanged, so couples with income over $240,000 will not be eligible to contribute to a Roth IRA.

The back-door Roth IRA option remains a viable option. The first step is to contribute to a traditional IRA; this will be a non-deductible contribution. After the traditional IRA contribution is completed, you can convert those funds to a Roth IRA (if the original contribution to a traditional IRA was not deductible, then the conversion of that amount is non-taxable).

However, any growth on that amount between the contribution and the conversion dates would be taxable. Completing the back-door Roth transaction can be a tricky process; you will want to consult your financial advisor and CPA.

Please make sure you adjust your 401(k) plan to account for the increased contribution limit.

Social Security

Social Security benefits will increase 3.2% in 2024, an average of almost $60 more per month. This represents the third-largest increase since 2011 but remains well below the 8.7% increase last year.

Estate Taxes and Gifting

The gift tax annual exclusion is increasing from $17,000 to $18,000 for 2024. This is the third consecutive increase to the gifting limit. You can gift up to this amount to any number of individuals in 2024 without incurring gift tax or using any of the taxpayer’s lifetime exemption. Married couples can use this exemption, allowing them to gift up to $36,000 annually to each recipient in 2024.

In addition, the lifetime exemption amount increased about $700,000 per person, to $13.61 million per individual. This increase means that a married couple can shield a total of $27.22 million from federal estate or gift tax. This exemption is set to sunset by about 50% at the beginning of 2026. Remember, however, that certain kinds of planning strategies can take months or even years to implement.

The end of the year is a perfect time to review your financial planning needs. This includes reviewing the investment portfolio, assessing year-end tax planning opportunities, reviewing retirement goals, and managing your legacy plans. The above changes for 2024 may apply to you and your family. We are happy to meet to discuss any of the above to ensure that you remain on track with your financial goals.

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Sources: Baird, Carson

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS. Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.

Fidelity Investments and Fidelity Institutional® (together “Fidelity”) is an independent company, unaffiliated with Kestra Financial or CD Wealth Management. Fidelity is a service provider to both. There is no form of legal partnership, agency affiliation, or similar relationship between your financial advisor and Fidelity, nor is such a relationship created or implied by the information herein. Fidelity has not been involved with the preparation of the content supplied by CD Wealth Management and does not guarantee, or assume any responsibility for, its content. Fidelity Investments is a registered service mark of FMR LLC. Fidelity Institutional provides clearing, custody, or other brokerage services through National Financial Services LLC or Fidelity Brokerage Services LLC, Members NYSE, SIPC.