The April 15 deadline to file federal tax returns is approaching quickly, but the practice of tax planning shouldn’t be limited to once a year. Whether you are preparing your own returns or working with a CPA, staying informed about policy changes and regularly assessing your financial situation can help you build strategies that align with your goals.

What tax documents might you need?

• W-2: If you work for an employer, this form tells you how much you earned and how much was deducted for taxes and other withholdings.

• 1099-NEC (MISC): If you are a contract employee, this form tells you how much you earned.

• 1099-INT and 1099-DIV: If you earned interest from savings or investments, you may receive this form. The 1099-DIV reports dividends and distributions from investments.

• Consolidated 1099: This brokerage tax form will show income from dividends, both qualified and non-qualified, as well as any capital gains and losses that occurred during the year.

• 1099-R: If you take a distribution from your retirement account, this form shows the amount of distribution and amount of taxes withheld.

• 5498: This form reports your total annual contributions to an IRA account and identifies the type of retirement account you have.

• 1098: If you own a home and pay mortgage interest, you will receive this form, which shows how much interest you paid and can deduct.

• 1098-T: If you have a dependent in college, you will receive this form, which reports how much qualified tuition and expense was paid during the year.

• K-1: If you have any limited partner investments, you will receive this form, which shows each partner’s share of the earnings, losses, deductions and credits.

Do you know your tax bracket?

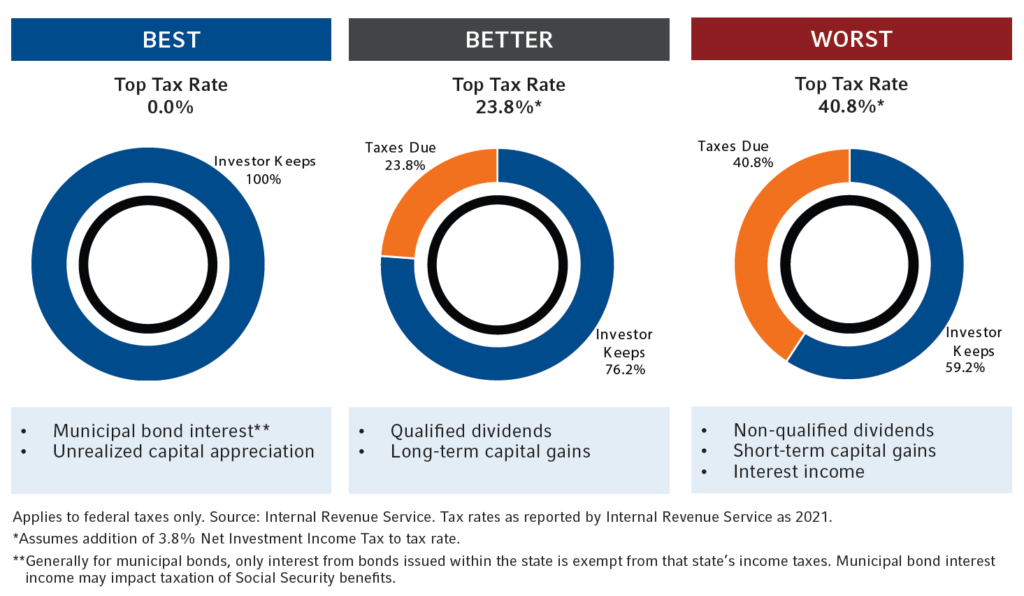

No one wants to pay more taxes than they must. Although the tax code has been simplified over the years, it remains incredibly complex. The number of tax brackets has been reduced significantly; knowing your bracket can help you determine the most tax-efficient investments to make. As shown in the chart below, investors in a high tax bracket may choose to own municipal bonds to reduce taxable income. If you are in a low tax bracket, you may be able to take advantage of lower capital gains rates and pay less on investments sold for a gain. As always, we recommend speaking with your CPA or accountant to review your options.

Did you know that not all investments are taxed the same?

TIP: Where your returns come from matters

If you are in a higher tax bracket, the following strategies may make sense:

• If over age 70, using IRA monies to make charitable distributions to help reduce taxable income

• Delaying taking Social Security income to age 70

• Lumping charitable contributions together in one year to take advantage of itemizing on taxes

If you are in a lower tax bracket, the following strategies may make sense:

• Increasing withdrawals from IRAs up to the level of the current tax bracket

• Converting an IRA to a Roth IRA in a year of lower income taxes

• Deferring income and sale of capital gain property to postpone taxable income

• Bunching medical expenses in the current year to meet the percentage of your adjusted gross income to claim those deductions

How can you maximize your savings?

Regardless of your tax bracket, tax loss harvesting is a strategy worth understanding. With current market volatility, certain investments may have unrealized losses. Tax loss harvesting is the strategy of selling securities at a loss to offset a capital gain tax liability. You do not have to wait until year-end to deploy this strategy, and harvesting losses now allows you to offset taxable gains when the market rebounds.

Another common strategy is to maximize IRA contributions before April 15. If you currently contribute pre-tax money to a 401K and are not maximizing, consider increasing your contribution to reduce taxable income and help you long term for retirement planning.

You also may contribute to an IRA for your spouse if he or she is not working. The contributions may not be tax-deductible if you are both working — but this could be a good long-term strategy nonetheless. If you do not have a 401K, contributing to an IRA, Roth IRA or SEP IRA may help reduce taxable income. You may be able to deduct annual contributions of up to $6,000 to your traditional IRA and $6,000 to your spouse’s IRA ($7,000 if over age 50).

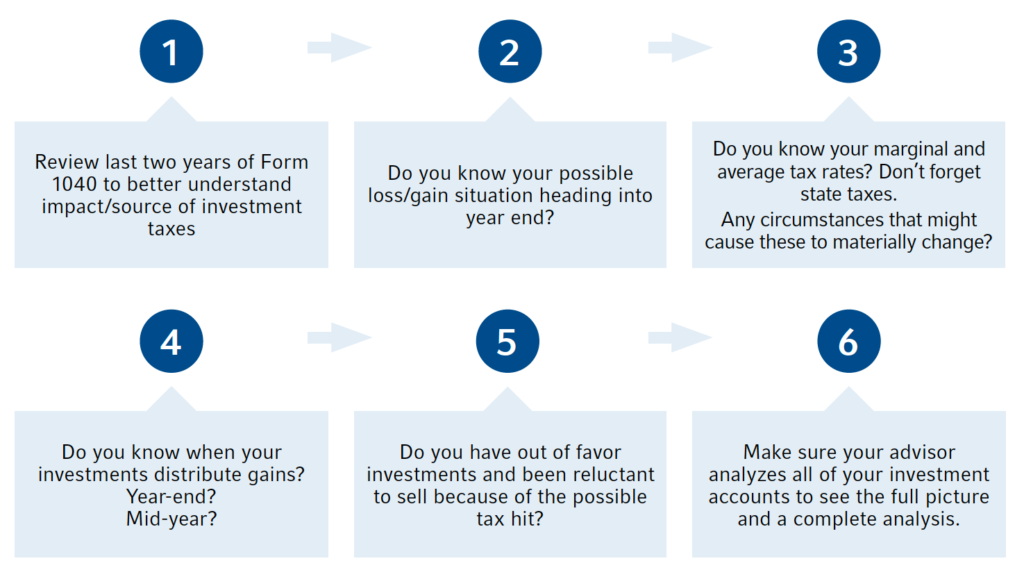

Here are some steps you and your advisor can consider before the end of the year:

Tax planning is not just a once-a-year event. The chart above is a good illustration of how we are constantly evaluating current circumstances to help guide our clients with potential tax saving strategies as part of the wealth planning process. We want to ensure you that along with your CPA, we are evaluating the landscape for tax changes and strategies that may help save future dollars and keep money in your pocket.

So, what can we learn from all this? As you prepare to file your taxes before April 15, it is a perfect time to review your financial and wealth planning needs. This includes reviewing the investment portfolio, assessing ongoing tax-planning opportunities, reviewing retirement goals and managing your wealth transfer and legacy plans. The information above represents just some of the items that may apply to you and your family. We are happy to meet to discuss any of the above to ensure that you remain on track with your financial profile.

From a portfolio perspective, we continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been. As we say each week, it is important to stay the course and focus on the long-term goal, not on one specific data point or indicator.

In markets and moments like these, it is essential to stick to the financial plan.

Panic is not an investing strategy. Neither are “get in” or “get out” — those sentiments are just gambling on moments. Investing is a disciplined process, done over time. At the end of the day, investors will be well served to remove emotion from their investment decisions and to remember that over the long term, markets tend to rise. Market corrections are normal, as nothing goes up in a straight line.

The key is to stay invested and stick with the financial plan. Markets go up and down over time, and downturns present opportunities to purchase stocks at a lower value.

It all starts with a solid financial plan for the long run that understands the level of risk that is acceptable for each client. Regarding investments, we believe in diversification and having different asset classes that allow you to stay invested. The best option is to stick with a broadly diversified portfolio that can help you to achieve your own specific financial goals — regardless of market volatility. Long-term fundamentals are what matter.

Sources: IRS, Russell Investments, U.S. News

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS. Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.