We are more than halfway through 2022, and the midterm elections are right around the corner. Midterm elections for the U.S. Senate and House of Representatives have the potential to shift control of Congress, and they can also have a significant impact on taxes, laws, and foreign policy. If Republicans gain control of either the Senate or the House, we can expect to see a legislative gridlock. If Republicans gain control of both bodies of Congress, President Biden’s agenda will face strong headwinds. If Democrats were to retain control of both the House and Senate, we would likely see significant changes to spending and taxation.

What does this mean for the market? While we can’t predict future results, we can examine how previous midterm cycles have affected it. Let’s take a look at past performance during midterm cycles:

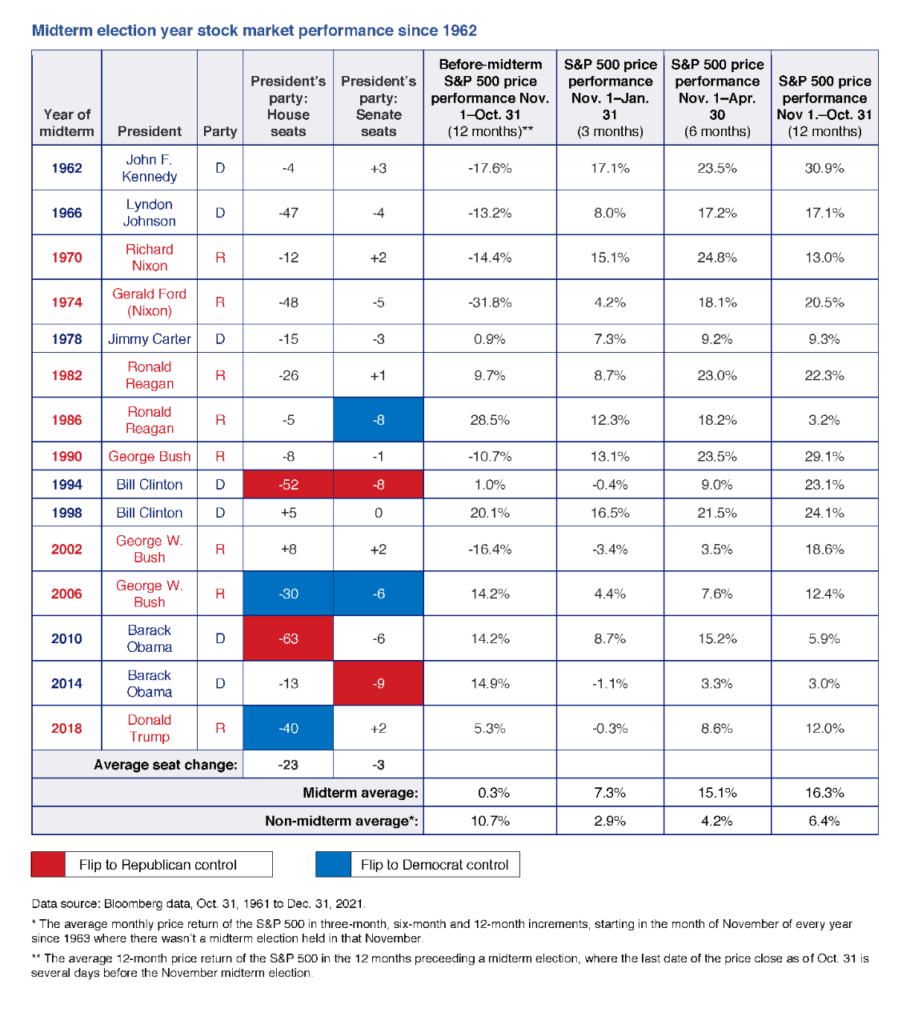

The S&P 500 has historically underperformed in the 12 months leading up to the midterm elections. Since 1962, in the 12 months prior to a midterm election, the average annual return of the S&P 500 is 0.3%, well below the historical average of 8.1% . 1

The post-midterm election period is very different. The S&P 500 has historically outperformed the market in the 12-month period after the election, with an average return of 16.3%. This is also true for the one-month and three-month periods following midterm elections. Since 1962, there has not been one instance in which the S&P 500 has experienced a negative return either six months or 12 months following the midterm elections, as shown in the chart below.

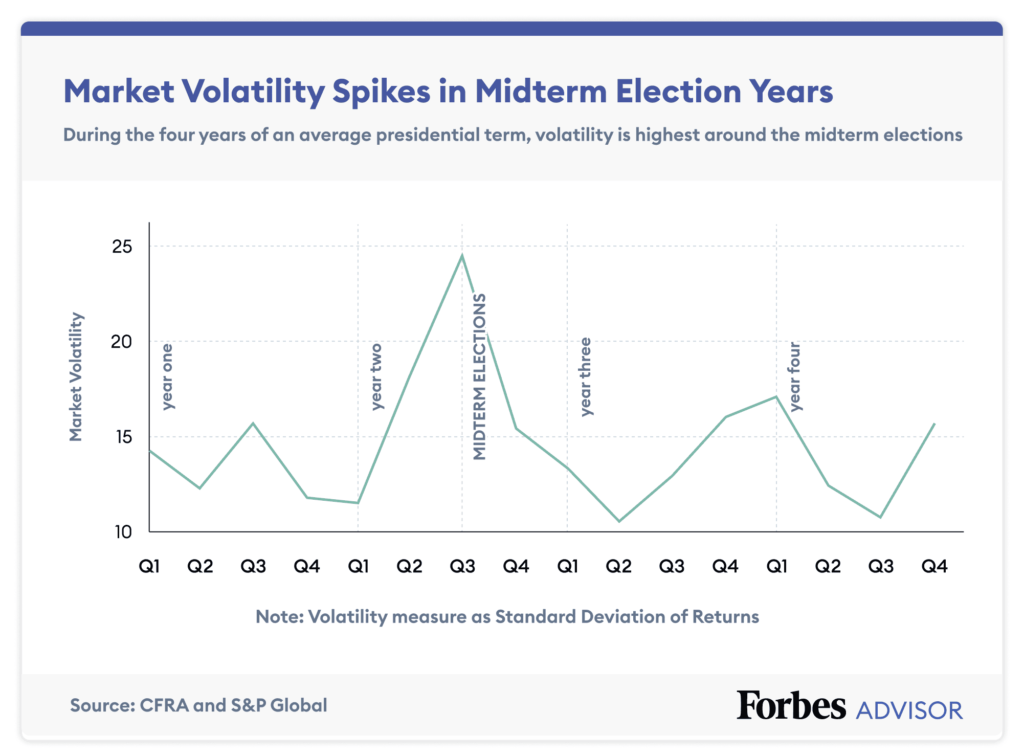

Midterm election years are historically more volatile than the rest of the presidential cycle. As seen in the chart below, the second and third quarters have historically been the most volatile. The average S&P 500 intra-year decline in midterm election years is 19%. In the other three years of the presidential cycle, the average decline is just 13%.

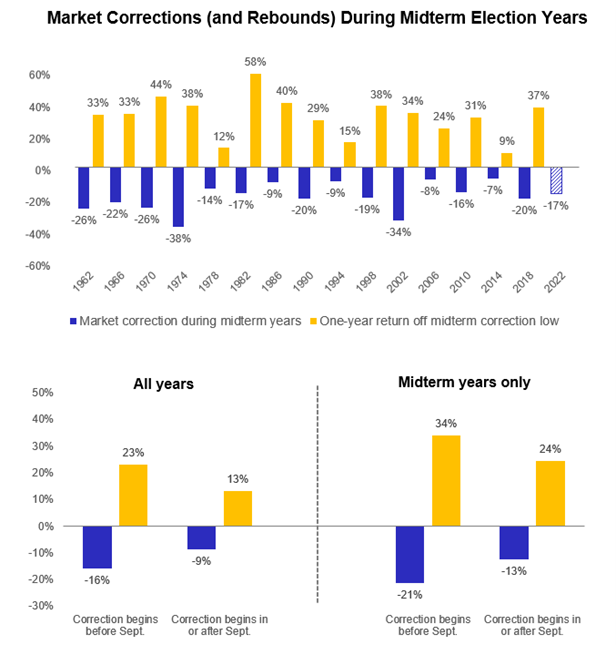

The past three midterm election corrections (2002, 2010 and 2018) were definitely painful, and this year is proving no different. The timing of this year’s decline has been faster than usual, largely due to the issues that we continue to discuss: heightened inflation, geopolitical risk from the Ukraine war, and China’s restrictions due to the ongoing global pandemic. Additionally, the market has been trending very similar to 1982, a year in which we were also dealing with high inflation, Russia and a midterm election all at the same time.

The chart below also shows how the market has pulled back in each of the midterm election years dating back to 1962 — and rebounded the one year following the correction low. In each instance, the S&P 500 had a strong bounce back. The second chart below shows that, the earlier the decline in the midterm election year, the stronger the recovery. For example, corrections that began before September had a negative return of 21% on average, while their subsequent rebound was 34% on average for the following one year. While past performance is no guarantee of future results, analyzing historical data does offer insight into how midterm elections might affect the market in the coming year and beyond.

Depending on which party controls Congress, U.S. fiscal policy may change after the election. However, economic fundamentals — and not election results — play the greatest role in stock market performance. How the Fed steers the economy amid ongoing inflation concerns will continue to be the dominant market driver. The last time the S&P 500 produced negative returns during the 12 months after a midterm election was 1939 – a time of terrible uncertainty. The U.S. was still battling the Great Depression, and World War II was beginning in Europe.

So, what can we learn from all this? Past results do not guarantee future returns. However, if the past gives us any insight, the 12 months following the midterm elections may see a strong market rebound. That said, it is important to be mindful that every individual year is different, and it follows its own path. U.S. midterm elections, and politics as a whole, come with a lot of noise and uncertainty. Investors should not let that be a distraction from the fact that long-term equity returns are generated by solid investment fundamentals over time. It is imperative to look past the short-term volatility that elections may bring and maintain a long-term focus.

We will continue to harp on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip to take advantage of potential market upturns. We adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been. It is important to focus on the long-term goal, not on one specific data point or indicator. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

At the end of the day, investors will be well-served to remove emotion from their investment decisions and remember that over time, markets tend to rise. During volatile markets, it is important to remember that the fear of losing money is stronger than the joy of making money. Investor emotions can have a big impact on retirement outcomes. Market corrections and bear markets are normal; nothing goes up in a straight line. Making market decisions based on what might happen may be detrimental to long-term performance. The key is to stay invested and stick with the financial plan. Markets go up and down over time, and downturns present opportunities to purchase stocks at a lower value.

It all starts with a solid financial plan for the long run that understands the level of risk that is acceptable for each client. Regarding investments, we believe in diversification and having different asset classes that allow you to stay invested. The best option is to stick with a broadly diversified portfolio that can help you to achieve your own specific financial goals — regardless of market volatility. Long-term fundamentals are what matter.

Sources: Baird, Bloomberg, Forbes Advisor, U.S. Bank

1. Looking at 12-month periods when the price return is closing price on Oct 31.

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS. Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.