Graduation season is here again, and with it comes all the emotions. Getting ready to send your loved one off to college can feel overwhelming, especially when you start thinking about the costs and everything that comes with the transition.

For the 2024–2025 academic year, the average total cost of attending college — including tuition, fees, room and board, books and supplies — was nearly $30,000 at an in-state public college. That cost rose to around $50,000 for an out-of-state public college and approximately $63,000 for a private college.

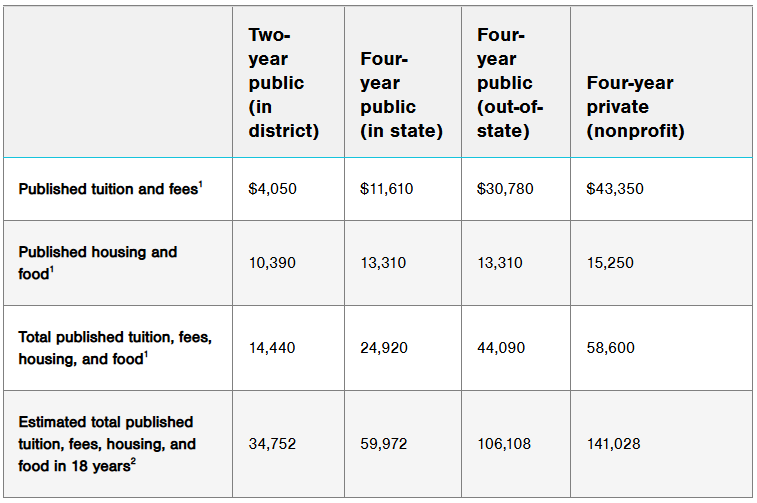

When looking at tuition alone, the average was $11,610 for an in-state public college, $31,000 for an out-of-state public college and $43,500 for a private college. The average cost of room and board was $13,310 at public colleges and slightly higher at private institutions. Additional expenses such as transportation, a computer, personal spending, and fraternity or sorority fees can further increase the overall cost.

Average Cost for One Year of College (2024-2025)

Costs vary greatly, depending on the type of college

2-Estimated future costs for one year, based on 5% annual inflation.

Not every family can begin saving for college in the first years after their child is born, but creating a savings strategy can help you plan from today until they graduate from college. The first step is figuring out what percentage of your child’s education you want to cover and what you think you can afford to save.

Knowing what you plan to save can also help you determine what you expect your children to cover – either through savings, work, financial aid or student loans — not to mention contributions from grandparents or other family members.

The most common and popular way to save for college is through a 529 plan, a tax-advantaged way to save for educational expenses that is offered in almost every state. Money saved in a 529 plan has the potential to grow-tax free, and it can be withdrawn federal income-tax free if it is used to pay for qualified educational expenses. Depending on the state you live in, you also may receive an income-tax break if you make contributions to a 529 plan.

Another benefit of 529 plans is their flexibility: They have no income restrictions and can be used for college, graduate school, trade school and even kindergarten through 12th grade. You also can change the beneficiary to be another family member at any time.

What expenses are covered?

A question our clients often ask is, “What expenses qualify for tax-free payment?” The following expenses always qualify:

• Tuition and mandatory school fees

• Room and board, up to the school’s cost of attendance for room and board

• Textbooks, supplies and other materials required for enrollment

• Computers, software and internet access for classes

However, the rules around qualified expenses in a 529 plan aren’t always straightforward. Some expenses can be paid for with tax-free dollars on the federal level, while some states impose taxes on withdrawals for K-12 private school tuition, gap year programs, off-campus housing and groceries.

Some expenses are never eligible for tax-free 529 payments, such as furniture for a student’s living space, fraternity and sorority dues, SAT and ACT prep fees, college application fees, parking, transportation and travel fees and health insurance.

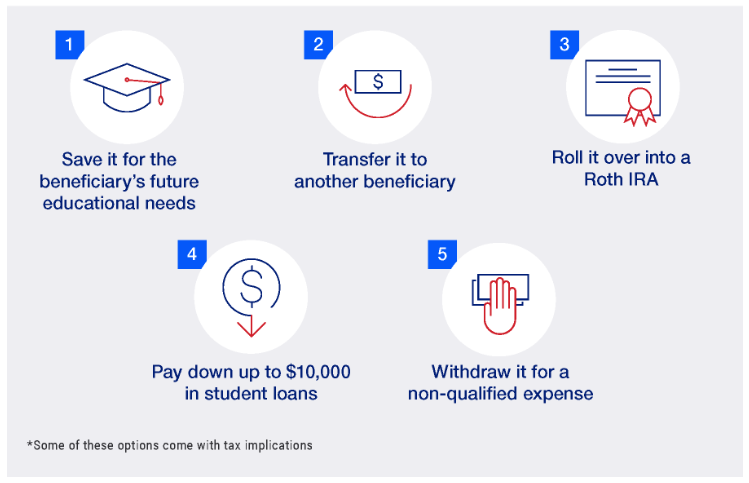

What if there is money left over?

More and more, clients are asking what happens if there is money left over in a 529 plan when the kids finish college and/or graduate school. With the flexibility of 529 plans, there is no time limit on when the funds must be withdrawn.

The most common options for leftover 529 money are:

• Save it for future educational needs, whether for that beneficiary or another potential beneficiary, such as future grandchildren.

• Transfer the 529 account to a new beneficiary.

• Make 529 withdrawals for non-education expenses and pay tax on the earnings portion of the withdrawal.

• Use up to $10,000 of the leftover 529 funds to pay down student loans.

You also could roll the leftover 529 funds into a Roth IRA. (This is a new option.) There are several things to consider before doing this:

1. The 529 plan must have been maintained for the designated beneficiary for at least 15 years.

2. The Roth IRA must be established in the name of the designated beneficiary.

3. The amount transferred from a 529 plan to a Roth IRA in the applicable year, together with all other IRA contributions, must not exceed the Roth IRA annual contribution limit.

4. The transfer amount must come from contributions made to the 529 plan at least five years prior to the transfer date, and the aggregate amounts transferred from 529 accounts to all Roth IRAs must not exceed $35,000 per beneficiary.

5. Further guidance from the IRS may change. It is always best to consult with your CPA regarding your specific circumstances.

Sending your loved ones to college should be an exciting time. Planning ahead can reduce the uncertainty around the affordability of college. For many, a child’s college education is one of the biggest long-term saving goals — and achieving that objective is a multi-step process. And if you’re fortunate enough after graduation, figuring out what to do with leftover monies is a good problem to have!

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Sources: Baird, Fidelity, T Rowe Price