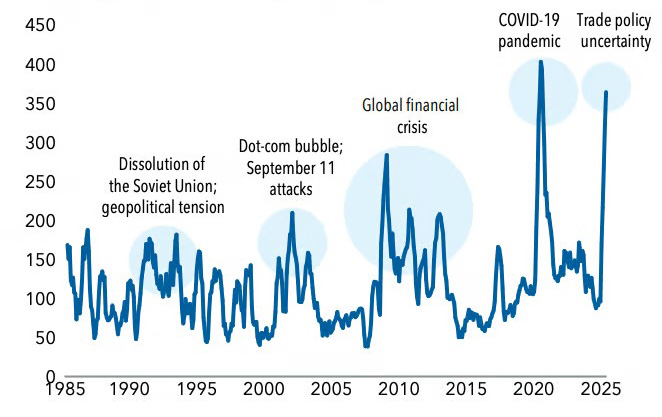

Volatility and uncertainty surrounding tariffs, geopolitical risks and interest rates marked the first half of 2025. While the market has rebounded from April lows, uncertainty remains at the forefront of investors’ minds for the second half of the year.

It’s been difficult for investors to discern the outcome of events such as tariff-induced trade wars and active military conflicts. This lack of clarity has impacted the decisions of investors and businesses. Ultimately, this led to the stock market correction we saw in the spring, as well as higher yields on U.S. Treasury Bonds and a decline in the value of the U.S. dollar. Nevertheless, it is imperative to remember how we started the year: with high valuations and positive outlooks priced into the market after the election.

Policy Uncertainty Has Weighed on Markets

Bloomberg U.S. Economic Policy Uncertainty Index

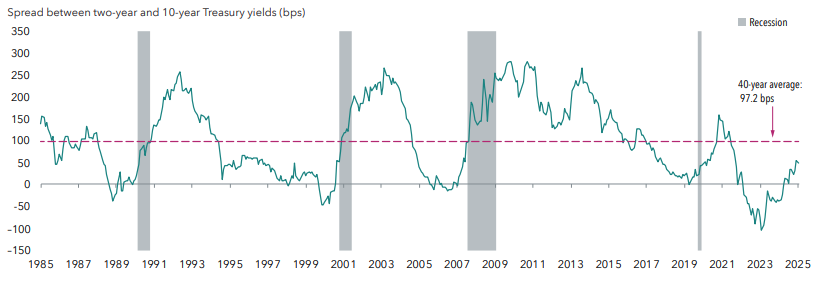

As stocks entered correction mode in April, yields on Treasury Bonds rose rapidly, ultimately pushing President Trump to pause the tariff war. Yields on the 10-year Treasury were as high as 4.5%, while 30-year Treasury bonds rose above 5% for the first time in several years.

We anticipate that the Fed will cut rates one or two times in the second half of the year. When interest rates decrease, bond prices inversely increase. An increase in bond prices will be beneficial for longer maturities by providing a boost to fixed-income returns.

On the other hand, intermediate term bonds with maturities between two and 10 years can also provide yield and diversification with decreased sensitivity to changes in interest rates, making the portfolio well positioned for rate cuts from the Fed.

U.S. Treasury Yield Curve Has Begun to Normalize

Inflation will continue to dominate the headlines for the remainder of the year, and people will continue to question how tariffs will impact inflation. This uncertainty and the desire to observe tariffs’ impact are the driving forces behind the Fed’s deliberate decision to wait on rate cuts.

The effects of the tariffs had not yet shown up in the economy by April or May. While we did begin to see some tariff impacts in the June inflationary data, disinflationary forces such as decreased rental prices, airfare and lodging countered tariffs’ effects.

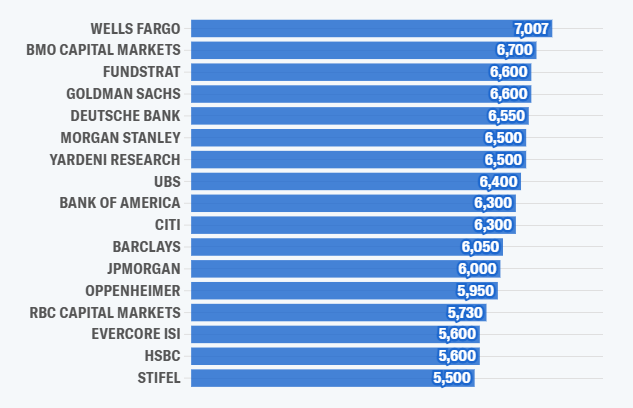

As the chart below shows, Wall Street strategists have yet to arrive at a consensus for the ending index value for the S&P 500. For reference, the S&P 500’s value was 6,306 on July 22. On the top end, Wells Fargo predicts the S&P will rise 11% before year’s end. Conversely, Stifel anticipates the S&P will drop almost 13% from current levels. The average projection of Wall Street firms demonstrates the S&P finishing the year around 6,200 – a small dip from where we are now.

Year-End 2025 Forecasts for the S&P 500

The U.S. economy faces a myriad of challenges in the second half of the year: tariff-induced inflation, the Federal Reserve’s monetary policy and instability in different areas of the world. With stocks rebounding from April lows, the bar is high for the market for the remainder of the year, with investor sentiment and positive earnings growth supporting the current market.

Every market cycle is different, making investing amid uncertainty a challenge. However, it also highlights the importance of being invested in a diversified portfolio. Equities have historically been the highest-returning asset class over the long run, and we do not see anything altering that precedent. We will continue to closely monitor the markets and make changes, as necessary.

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Sources: Bloomberg, Capital Group, CNBC, Fidelity, Schwab, Yahoo