At CD Wealth Management, we believe the stock market remains the best place to invest money, both today and for the long term. Stocks represent ownership in the most innovative, productive and forward-looking companies across every industry and region — and the market is the world’s greatest engine for growth and wealth creation.

As the global economy expands and technology connects more people, investing is no longer just for the wealthy. As the Internet has opened access to information and fostered transparency, markets have become more democratic and resilient. With billions now taking part and a steady flow of capital, innovation, efficiency and long-term growth can thrive.

We believe that trend will only deepen over the next several decades. Innovation compounds — it doesn’t go backwards. We will not return to a world without smartphones or instant access to information. Advances in artificial intelligence, biotechnology, clean energy and global connectivity will continue to reshape how we live, how businesses grow and how people invest.

The stock market captures that progress in one place. It reflects human ingenuity, enterprise and adaptability, the very forces that have driven wealth creation for more than a century.

Yes, the market moves up and down in the short term — and it can be volatile, as we have seen repeatedly, especially in the last five years. But over time, it has rewarded investors who stay disciplined and participate in the growth of the global economy. The market remains liquid, transparent, and resilient.

We are never going to claim to know what will happen tomorrow. What we do know, however, is that history has consistently rewarded patience, discipline and time in the market. Our process is built on those principles, not on predictions.

That is why we remain committed to staying invested through every cycle, whether we are at an all-time high or a major low.

+++

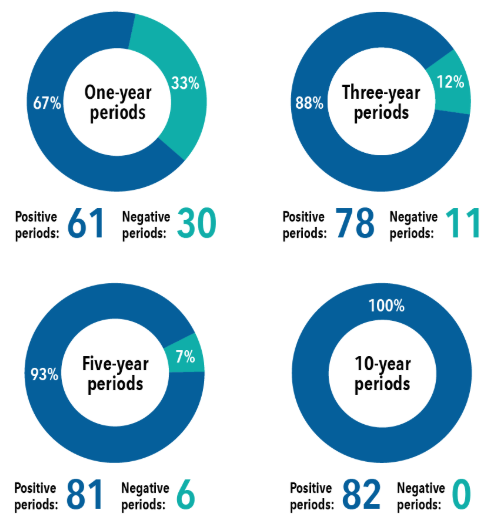

History has shown the longer the period, the greater the chance of a positive outcome.

+++

After such a strong run in the markets, it’s natural for investors to wonder: What matters most right now?

It is easy to feel confident when markets are rising, but confidence can fade quickly when volatility returns. Even if markets were to drop 30% next week, however, we would maintain the same steady long-term view that the stock market is the best place to generate wealth and value.

The market goes up and down, but over time it has always rewarded those who stay invested. The chart below shows two hypothetical investments in the S&P 500 over a 20-year period. Each investor contributed $10,000 per year, but one investor picked the best day to invest each year, and the other investor picked the worst day each year. Even with the worst market timing each year, the average annual return would have been 10.54%, compared to the best return of 12.25%.

The takeaway: Even selecting the worst day to invest, if you continue investing, you would have come out ahead.

Timing Isn’t Critical to Long-Term Success

This is why we believe the stock market is the place to be. We are not basing this opinion on speculation, but rather we are participating in the ongoing story of growth, innovation and progress.

We are not trying to outguess the market. We are following evidence that shows that long-term investors who stay the course come out ahead. Our strength is in discipline and consistency, not in forecasting. That is why we keep investing, why we add during periods of opportunity, and why we trust the strategy that has worked over decades, not days.

We are not here to shy away from where we are in the market at any given moment. We are here to follow our process, remain long-term focused and trust the history that has rewarded investors for generations.

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Sources: Capital Group, S&P 500