The Coronavirus Aid, Relief, and Economic Security Act (“CARES Act”) was signed into law by President Trump on Friday, March 27, 2020. Phase Three of the stimulus is estimated at more than $2.2 Trillion. Given the speed with which the U.S. economy is slowing down, the government is acting quickly to limit the economic damage wrought by the coronavirus and is indicating further actions may be needed.

Fiscal and monetary responses have been unprecedented. The Fed, for the first time, is buying corporate bonds. Other central banks have moved into buying equities. While the odds are stacked against the Federal Reserve stretching from corporate debt from buying stocks, the historical response has been to say, “never say never”. We expect as the news regarding jobless claims increases, monetary policy should respond accordingly.

Employers and workers will be adjusting to a new normal once this health crisis has passed. There has often been concern regarding how the internet would handle increased traffic all at once and how it would react to those changes. The good news is that US networks are handling internet traffic spikes without any major hiccups thus far while many people are having to work from home. Video streaming is up 38% and video chat has been up 212%1.

Putting current market volatility into historical perspective will help you stay the course during turbulent times. While the market continues to be volatile, sticking to your investment strategy may be a challenge, but remains extremely important. Market cycles offer both obstacles and opportunities.

Remember, markets go up and down. Since the turn of the millennium, the market’s negative response to health crises has been relatively short-lived.

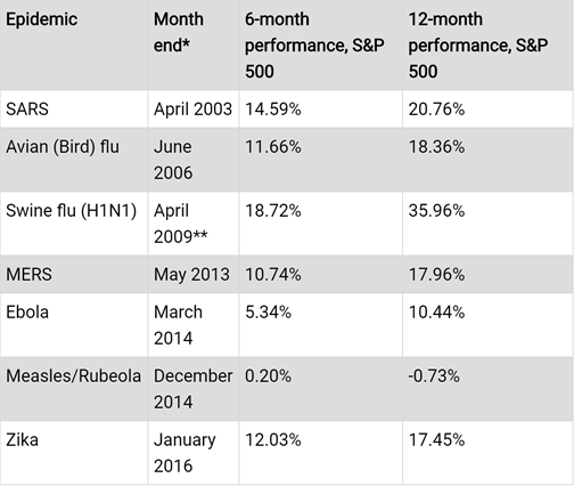

As this table shows, approximately six months after early reports of a major outbreak, the S&P 500 bounced back by an average of 10.47%. After 12 months, it rebounded by an average of 17.17%. Although there are no guarantees the current situation will follow a similar pattern, it may be reassuring to know that over even longer periods of time, stocks typically regain their upward trajectory, helping long-term investors who hold steady to recoup their temporary losses, catch their breath, and go on to pursue their goals.

HISTORICAL RESPONSE TO HEALTH CRISES

(6 AND 12 MONTHS POST MAJOR OUTBREAK)

*End of month during which early incidents of outbreak were reported.

**H1N1 occurred during the financial crisis, when, as during other periods, many different factors influenced stock market performance.

The volatility in the market is largely driven by ever-increasing fears about the potential effects of the coronavirus (COVID-19) and its ultimate impact on the global economy. The unpredictability, strength, and suddenness of the historic tumble was and has been unsettling for all of us.

What should you do?

First, keep in mind that market downturns sometimes offer the chance to pick up potentially solid stocks at value prices, which could position a portfolio well for future growth. Again, there are no guarantees that stocks will perform to anyone’s expectations, and decisions could result in losses including a possible loss in principal, but it may be helpful to remember that some investors use downturns as opportunities to buy stocks that were previously overvalued relative to their perceived earnings potential.

Moreover, if you typically invest set amounts into your portfolio at regular intervals, a strategy known as dollar-cost averaging (DCA), which is commonly used in workplace retirement plans and college investment plans — take heart knowing you are utilizing a method of investing that helps you behave like the value investors noted above. Through DCA, your investment dollars purchase fewer shares when prices are high, and more shares when prices drop. Essentially, in a down market, you automatically “buy low”, one of the most fundamental investment tenets. Over extended periods of volatility, DCA can result in a lower average cost for your holdings than the investment’s average price over the same time period.

We are closely monitoring the still-unfolding situation. We do not currently find compelling reasons that would justify overriding our asset allocation methodology despite the current elevated uncertainty from the Coronavirus. CD Wealth Management continues to believe that our clients should remain patient and adhere to their well-constructed, diversified investment portfolio anchored to their long-term goals and time horizon.

1 Barrons.com, April 5, 2020

____________________________________

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. Kestra IS and Kestra AS are not affiliated with CD Wealth Management.