As we are in this for the long haul, we know there will be peaks and valleys, and our plan is to continue to stay the course. From a portfolio perspective, we continue to actively monitor your portfolio. In late March, we made the following adjustments:

1. Increased large cap exposure, through additional exposure to technology and healthcare.

2. We funded the increase in large cap stocks by selling out of small and mid-cap stocks as well as real estate.

3. For fixed income, we sold emerging market debt and added to our U.S. bond portfolio through additional exposure to high quality corporate bonds.

From a planning perspective, we remain focused on tax loss harvesting, postponing Required Minimum Distributions for those clients who do not need the income from their IRAs, and repositioning the portfolio when appropriate.

Over the weekend, the Wall Street Journal relayed that markets are reacting not just to where the economy is, but also to the range of outcomes for where it could be going. Many factors are driving this recession with two prominent themes being the lockdowns and social distancing, which is in turn driven by the pandemic. The best minds in our country are working around the clock to help us get past this pandemic. The continued fiscal and monetary policy stimulus of epic proportions have pumped trillions of dollars into our economy. Medical experts continue to collaborate to provide a cure.

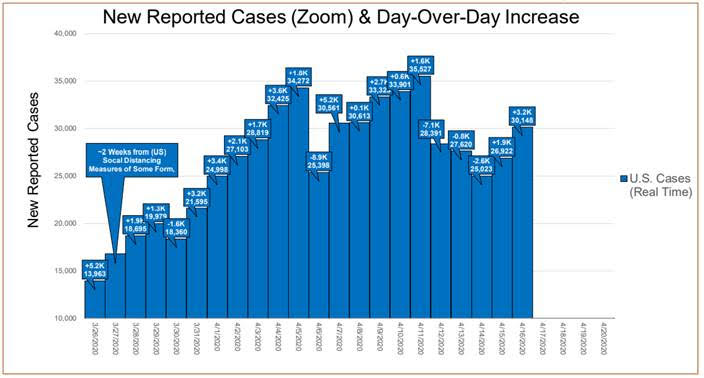

As of April 16th, the curve has flattened as the U.S. had fewer new reported cases than it did 12 days prior.

The continued movement in the markets, paired with all the economic headlines you see daily, can leave you searching for facts to try and make sense out of all the information we see and hear. It has been roughly 2 months since the S&P 500 hit an all-time high, and about one month since it hit a low we have not seen since 2017. This made March the most volatile month in U.S. history and the S&P 500’s 34% drop between February 19 and March 23 the fastest decline from a record bull market to a bear market. Thanks to a massive government stimuli package, combined with discussions of upcoming plans to ease some restrictions due to COVID-19, the markets have rallied the last few weeks. The S&P 500 is now just 15% below its pre-pandemic high and the Nasdaq 100 is positive (1.1%), as of Friday, April 17.

Furthermore, earnings season kicked off last week giving a glimpse into how the pandemic affected the financials of key corporations during the first quarter, with many companies even stating their expectations for the remainder of 2020. The markets showed optimism last week for two potential reasons:

1. Talk of steps to begin to reopen the economy.

2. Flattening of the curve of new COVID-19 cases (see above graph).

Volatility has continued this week, with the markets coming down Monday and Tuesday and then rallying back on Wednesday. This shows that uncertainty continues to drive this market. While our views are to stay the course, we will continue to monitor and make necessary updates to your portfolio.

Wall Street Journal – www.wsj.com

The source for any S&P 500 Index (Daily) Data, will be Yahoo Finance (^GSPC). It will be shown assuming historical dividends are reinvested and in U.S. Dollar terms.

____________________________

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. Kestra IS and Kestra AS are not affiliated with CD Wealth Management.