We are now less than 100 days from the upcoming presidential election, and many investors are thinking about the pros and cons of which president may win the White House. You may feel strongly about one party or the other when it comes to your politics, but when it comes to your portfolio, it doesn’t matter which party wins the White House according to historical returns.

Fundamentals like corporate earnings, interest rates and economic growth are the main concerns for the stock market. Jeremy Siegel, author of the book Stocks for the Long Run, says that Wall Street’s obsession with politics is mostly misplaced:

“Bull markets and bear markets come and go, and it’s more to do with business cycles than presidents.”

Stock returns are influenced by multiple factors including business cycles, corporate profits, globalization and unpredictable events, like 9/11 or COVID-19.

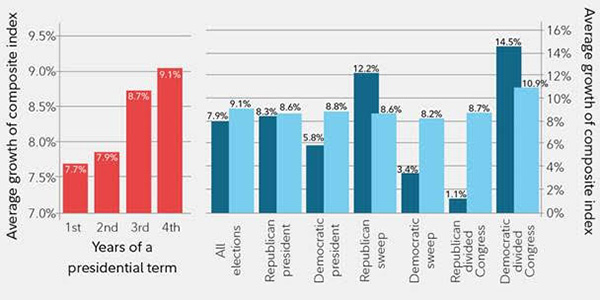

The chart below is a breakdown of the “Presidential Cycle” during the first two years of a presidency compared to the end of the four-year term. The “Presidential Cycle” shows a consistent pattern in which the first two years of a presidential term have tended to produce below-average returns while the last two years have been above average.

The reason for this, more than likely, is that during the first two years, the president’s new agenda takes time to work its way through the economy while the last two years, the party in power is focused more on getting re-elected and see increase fiscal and monetary stimulus. What’s interesting to note in the chart below is that whatever differences there are in the outcomes over the first two years all but disappear by the time the four-year cycle takes place.

As shown by the light blue bars below, over four years there is little difference in stock market return between Republican and Democratic presidents.

If we look at numbers alone, the short answer is that Democratic presidents have had better returns since 1929 than their Republican counterparts. More reliable is the market’s influence on election outcomes. When the S&P 500 has risen the 3 months before an election, the incumbent party generally has gone on to win the White House; when it has fallen, the incumbent has generally lost.

What can we learn from all this? The best option is to stick with a broadly diversified portfolio that can help you to achieve your own specific financial goals – regardless of who prevails in November. The economy, and therefore the market, is bigger than the direction the political winds are blowing. Ultimately, it’s the long term fundamentals that matter.

Now more than ever, it is important to maintain an investment strategy based on your own goals, time horizon and risk tolerance. All investing involves risk and there are no guarantees that any investment strategy, especially which biotech or pharmaceutical stock wins the COVID-19 vaccine race, will be successful.

_____

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. Kestra IS and Kestra AS are not affiliated with CD Wealth Management.