At CD Wealth Management, we view education as a fundamental part of our client relationships. Transparency matters to us; helping you understand the why behind our strategies is as important as the strategies themselves. Through our newsletters and articles, we share insights that provide clarity and context so you can feel informed, confident, and engaged in the planning process.

The following pieces resonated with our clients the most this year. If you found them insightful, please share them with family members or friends who might benefit from them as well.

+++

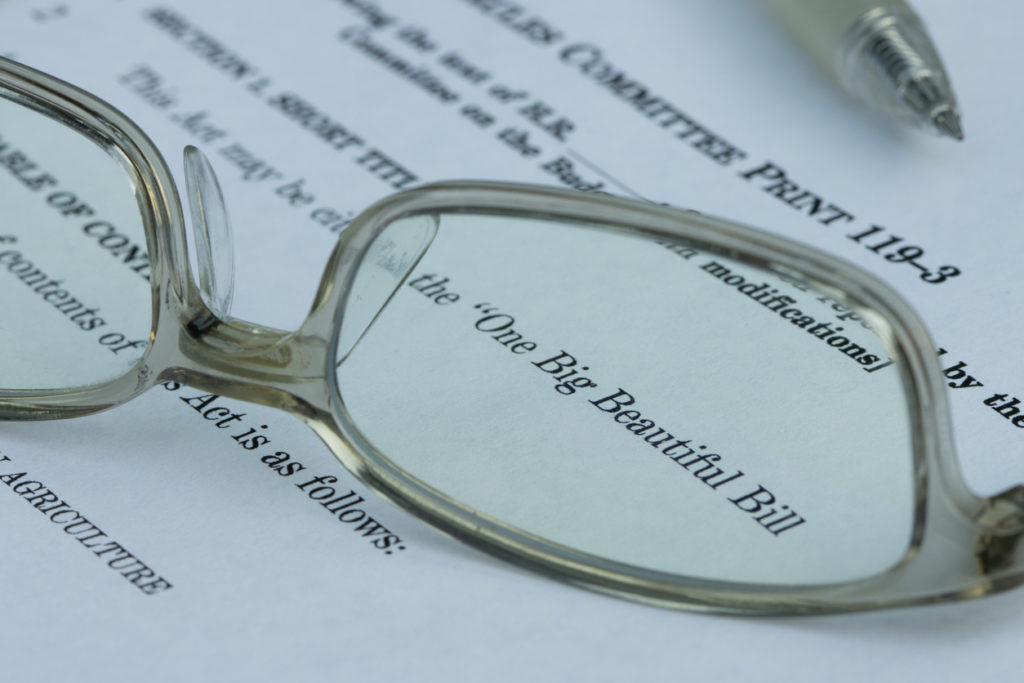

1. What to Expect Now That the ‘Big Beautiful Bill’ Has Become Law

July 10, 2025

Trump’s tax law locks in lower rates and higher exemptions for high earners and estates — and adds new savings incentives.

+++

2. Understanding the 10-Year Treasury and Its Impact on Your Investments

June 27, 2025

It influences all borrowing costs, from interest rates on bonds to mortgage rates and student loans.

+++

3. Here’s What History Tells Us About the Impact of the Government Shutdown

Oct. 2, 2025

Government shutdowns are typically more of a political standoff than an economic crisis.

+++

4. Your Guide to Paying for College: Save More, Stress Less

June 12, 2025

A savings strategy that includes a tax-advantaged 529 plan can help you prepare for the challenge of paying for college.

+++

5. What Caused Mid-May’s Market Selloff — and What Happens Next?

May 22, 2025

The sudden decline was driven largely by the bond market, not by any shift in the economy or corporate fundamentals.

+++

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy heading. We are anticipating and moving to those areas of strength in the economy and in the stock market.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the proven disciplines of diversification, periodic rebalancing, and forward-looking strategies, while avoiding reliance on stale retrospective data.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.