After months of uncertainty, the U.S. and China on Monday announced a major trade agreement, temporarily easing tensions between the world’s two largest economies. Under the 90-day deal, U.S. tariffs on Chinese goods will drop from 145% to 30%, and China will reduce tariffs on U.S. goods from 125% to 10%.

Though it is a short-term deal, this shift marks the first major de-escalation since the tariff hikes earlier this year.

Markets responded immediately, reminding us why staying invested is the best strategy:

• The Dow Jones Industrial Average rose 1,044 points (2.5%).

• The S&P 500 gained 2.9%.

• The Nasdaq Composite jumped 4%.

These gains come after a sharp correction earlier in the year. From mid-February through April 8:

• The Dow declined 16.1%.

• The S&P 500 fell by 18%.

• The Nasdaq Composite dropped nearly 24%.

Since bottoming on April 8, we’ve seen a powerful rally:

• The Dow has recovered more than 12.5%.

• The S&P 500 has climbed by more than 17%.

• The Nasdaq Composite is up over 22%.

While volatility is uncomfortable, history shows that the market has a way of working through disruptions. Investors who remained steady through the selloff have been rewarded with a sharp rebound.

That said, let’s be clear: This is a point in time. Markets move daily, and no one knows where they’ll go tomorrow. This rebound may continue, it may pause, or it may even reverse. Nobody rings a bell at the top or bottom.

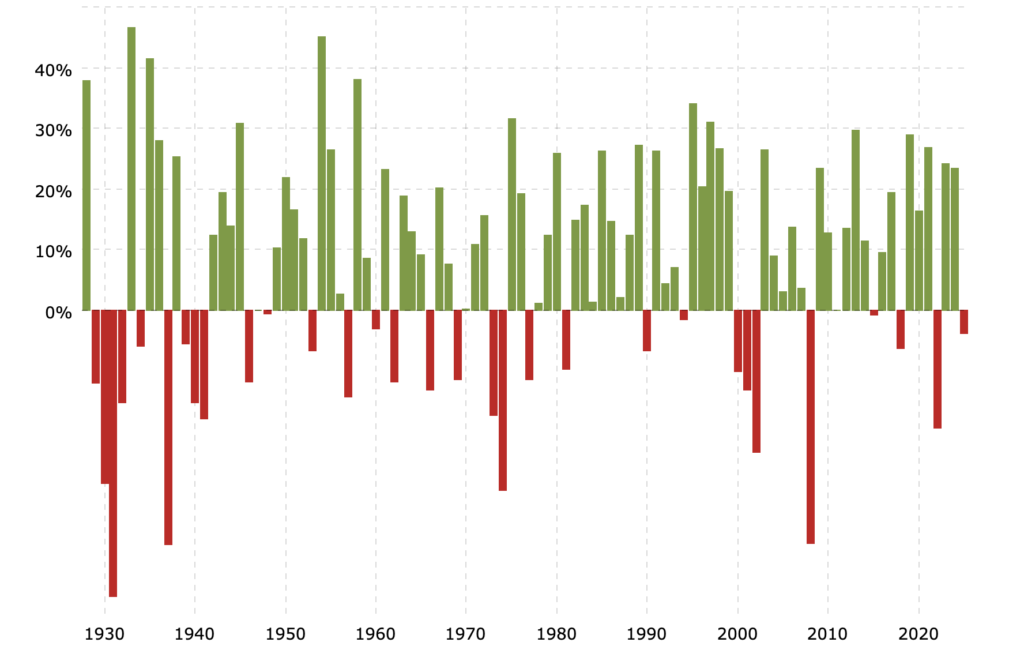

What we do know is this: Since 1926, the S&P 500 has ended the year in positive territory approximately 74% of the time. That means markets have been up nearly three out of every four years. That’s not theory — that’s nearly a century of fact, and long-term data remains our North Star.

S&P 500 Historical Annual Returns

While we remain optimistic about the rebound, we’re not assuming smooth sailing ahead. We’re not fortune tellers — we’re stewards. We didn’t panic when the market sold off. We stayed disciplined. And now, we’ll continue to be vigilant.

Our focus is on the long-term compounding of capital, not reacting to every headline or tick. We will monitor the landscape closely, manage portfolios actively, and make thoughtful, incremental adjustments where necessary.

We are not in the business of timing markets. We are in the business of helping you navigate them — with patience, clarity, and conviction.

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Source: Macrotrends