In a surprise move last week, one of the three credit rating agencies downgraded the credit rating of U.S. Government debt by one notch, from AAA to AA+. Fitch’s explanation for the move was that the downgrade “reflects the expected fiscal deterioration over the next three years, a high and growing general government debt burden, and the erosion of governance relative to AA and AAA rated peers over the last two decades that has manifested in repeated debt-limit standoffs and last-minute resolutions.”

The change echoes a similar move by Standard & Poor’s (S&P) in August of 2011, when it downgraded the U.S. debt from AAA to AA+. The timing of last week’s downgrade is unusual given a lack of near-term concerns with the debt ceiling and the continued strength surrounding the U.S. economy. When the S&P downgraded U.S. debt in 2011, the economy was softening, inflation was declining, and yields were falling in other global markets. This time around, central banks are hiking rates in most markets.

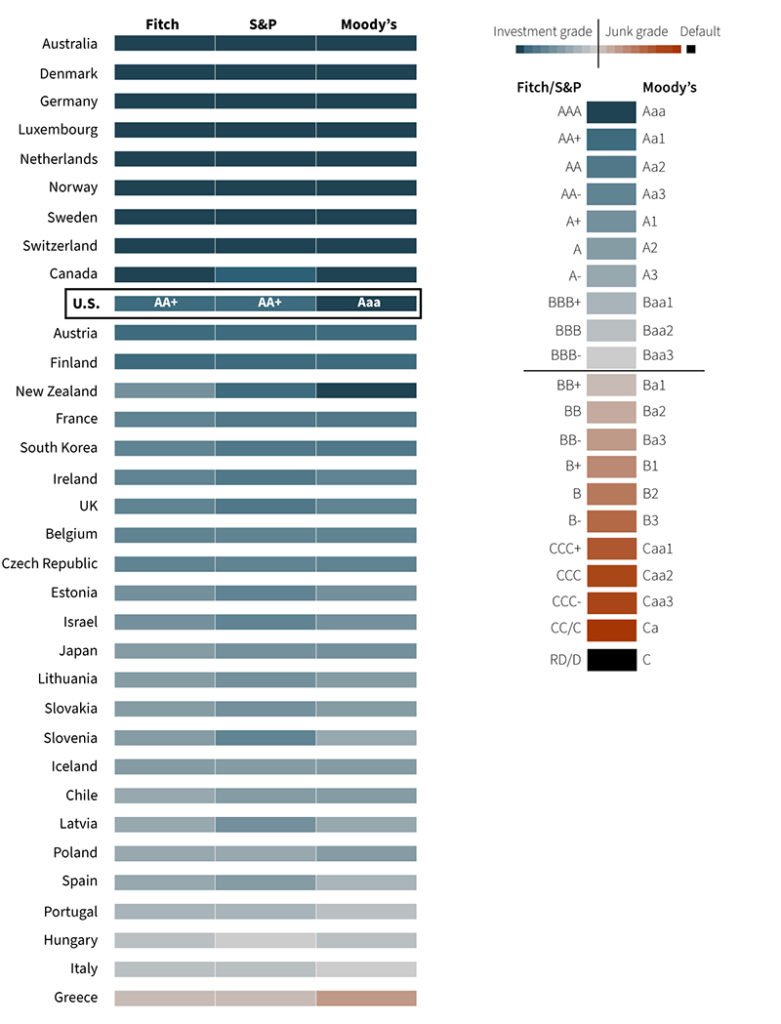

Moody’s remains the last of the three major credit rating agencies to maintain a top rating for the U.S. After the downgrade by Fitch, the U.S. ranks lower than Australia, Canada and some European countries, as seen in the chart below. If Moody’s were to downgrade the U.S. debt, that could exacerbate fiscal concerns — but even then, while volatility may increase, economists are skeptical that it would have a material impact on the U.S. bond market.

The U.S. debt is still viewed as a safe haven for many reasons: The U.S. has the ability to service the debt (even at higher interest rates), the economy is growing at a solid pace, and foreign capital inflows remain strong. There is no worry that the U.S. will default on its debt.

OECD Countries’ Credit Ratings

After a downgrade, the U.S. now ranks lower than Australia, Canada and some European nations like Germany in terms of creditworthiness under Fitch metrics. These nations were also rated triple A by S&P, a notch above the U.S.’s AA+.

We do not have long-term concerns about the downgrade. Here are a few key points to keep in mind:

• Fitch is considered the third-ranked rating agency of the three and has less influence on the market than S&P or Moody’s.

• The downgrade is not a growth forecast but a commentary on the state of the current (apparent) instability of our government from a political standpoint.

• This is not about the ability of the U.S. to service its debt. Fitch had warned during the debt-ceiling standoff earlier this year that it was considering a downgrade because a country refusing to pay its debts in a timely manner was not entitled to a AAA rating.

• We don’t expect the downgrade to affect many investments because few require AAA ratings. After the S&P downgrade in 2011, many institutions changed their investment mandates to state government bonds instead of a specific credit rating.

• The debt limit has been lifted for two years, inflation is slowing, and economic growth remains strong.

• Washington has passed multiple bipartisan deals with a split Congress. Gridlock can be a fiscal positive as the markets tend to perform best when the party that controls the White House and Congress are not the same.

We continue to believe U.S. Treasuries are considered to be the safest asset in the world. The Fitch downgrade is highlighting long-term political issues that are preventing the government from coming to agreements in a timely manner. There still is no substitute for U.S. Treasuries in the global financial markets, and the U.S. market remains the largest, most liquid and safest in the world.

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Sources: Lord Abbett, Moody’s, Reuters, Schwab

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS. Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.

Fidelity Investments and Fidelity Institutional® (together “Fidelity”) is an independent company, unaffiliated with Kestra Financial or CD Wealth Management. Fidelity is a service provider to both. There is no form of legal partnership, agency affiliation, or similar relationship between your financial advisor and Fidelity, nor is such a relationship created or implied by the information herein. Fidelity has not been involved with the preparation of the content supplied by CD Wealth Management and does not guarantee, or assume any responsibility for, its content. Fidelity Investments is a registered service mark of FMR LLC. Fidelity Institutional provides clearing, custody, or other brokerage services through National Financial Services LLC or Fidelity Brokerage Services LLC, Members NYSE, SIPC.