Markets are good at reminding investors that stock prices don’t always go up. U.S. stocks continued their sharp drop on Monday after Friday’s inflation report, which showed that consumer prices rose at their fastest pace in 41 years. Although economists were already seeing signs of peak inflation with home, used car and lumber prices decreasing, the war in Ukraine’s effect on oil and gas prices led to a much stronger increase in the month-over-month consumer price index (CPI). As the markets braced for the Federal Reserve’s announcement on interest rate hikes, stocks in the S&P 500 again entered bear market territory, closing more than 20% below their all-time highs (which were set earlier this year). As we’ve written recently, bear markets, last an average of 15 months, while the average bull market lasts about six years. The chart below is a great reminder that on average, stocks have performed well three, six and 12 months after falling into a bear market.

Down markets provide investors with opportunities that may help with returns, reduce risk and provide tax advantages over time. What should you consider in a down market like the one we have today?

First, and foremost, do not panic

Panic is not an investing strategy. Selling and going into cash when the market is down can do irreparable harm to your long-term financial outlook. There is a reason you have a financial plan, and now more than ever is the time to stick with it.

Rebalancing portfolios

Investment portfolio construction, when done properly, is made up of various securities and asset classes that each perform differently. You may have often heard the term “asset allocation,” which references how a portfolio is constructed of stocks, bonds, cash, etc. Within each of these categories, there are different investment exposures. For stocks, the exposures might be small-cap, mid-cap, large-cap and international, while bond exposure may have investment-grade bonds, high-yield bonds, floating-rate bonds, treasuries, etc. By combining each of the different asset classes together, the overall risk of the portfolio may be reduced.

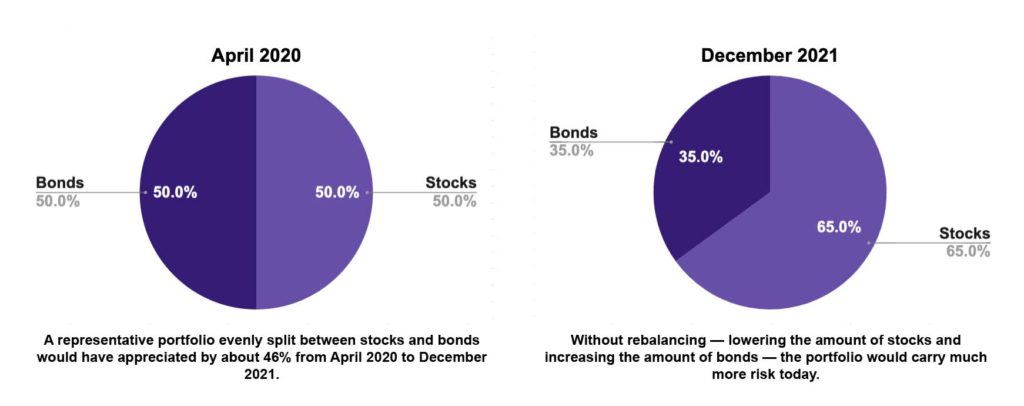

Over time, the portfolio may need to be rebalanced. Think of it like taking your car in for a tune-up after hitting a big pothole or speed bump. After large market moves, either up or down, a portfolio may benefit from tweaks or adjustments. The graph below displays how a portfolio needs a tune-up. Following the pandemic, a portfolio that had a 50-50 stock/bond allocation has grown to 65% stocks and 35% bonds a year and a half later, due to the run up in the market. Rebalancing helps investors ensure that they’re taking an acceptable level of portfolio risk and adhering to their set financial plan. It also helps with the adage of “buy low and sell high.”

Without Rebalancing, Large Market Moves Can Add Risk to a Portfolio

Tax-Loss Harvesting

When markets are rising and stocks or funds are sold for a profit, taxable gains occur. While taxable gains are not necessarily fun, they are a necessary part of investing. Selling holdings when the values are down may generate losses, which can be used to offset capital gains and potentially lower your future tax bill. Investment losses may also be used to reduce taxes on ordinary income. For further details, please see our past client letter on tax-loss harvesting.

Dollar-Cost Averaging*

Who doesn’t like shopping when their favorite items are 20% off or even more? With Monday’s losses, the S&P 500 is down nearly 22% from its high in January. The NASDAQ and Russell 2000 are down almost 30% from their recent highs. Investing in stocks when prices are down can be a powerful way to generate wealth over time. We recognize that it may be hard to invest more cash into the market when it is falling, but that is where dollar-cost averaging comes into play. For those in a 401K plan, this is exactly what you are doing – every two weeks you are investing money into the portfolio, whether the market is up or down.

There are very few free lunches in the investment world. As the saying goes, if it is too good to be true, then more than likely it is. However, asset allocation, diversification and periodic rebalancing are as close as it gets to a free lunch for investors. We are fully aware that down markets can be painful. At the same time, they can create opportunities for those who have excess cash. The chart below is a great reminder that historically, bull markets last much longer than bear markets, and the total return of a bull market far outweighs the negative return during a bear market.

So, what can we learn from all this? Sticking with the financial plan during times like these can be a real challenge – but that is why you have the plan. If we use our heads and don’t act on emotion, we can expect a more successful investing future — and maybe even get a free lunch along the way, thanks to rebalancing, tax-loss harvesting and dollar-cost averaging.

During these challenging times, it is important to keep the following in mind:

• Ignore the noise and sensationalist headlines.

• Remember that selling into a panic is not an investment strategy.

• Market declines are a part of economic cycles.

• Don’t try to time the market. Instead invest regularly, even when the market is falling.

It is likely that this recent market drop may be a mere blip in the long-term investment plan. We do not try to time the market. What really matters is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been. It is important to focus on the long-term goal, not on one specific data point or indicator. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Sticking with the financial plan during times like these can be a real challenge – but that is why you have the plan.

At the end of the day, investors will be well-served to remove emotion from their investment decisions and remember that over time, markets tend to rise. During volatile markets, it is it is important to remember that the fear of losing money is stronger than the joy of making money. Investor emotions can have a big impact on retirement outcomes. Market corrections are normal; nothing goes up in a straight line. Making market decisions based on what might happen may be detrimental to long-term performance. The key is to stay invested and stick with the financial plan. Markets go up and down over time, and downturns present opportunities to purchase stocks at a lower value.

It all starts with a solid financial plan for the long run that understands the level of risk that is acceptable for each client. Regarding investments, we believe in diversification and having different asset classes that allow you to stay invested. The best option is to stick with a broadly diversified portfolio that can help you to achieve your own specific financial goals — regardless of market volatility. Long-term fundamentals are what matter.

Sources: Kestra Investment Management, LPL, Schwab

*Dollar cost averaging does not assure a profit and does not protect against a loss in declining markets. This strategy involves continuous investing; you should consider your financial ability to continue purchases no matter how prices fluctuate.

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS. Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.