On Wednesday, the House of Representatives approved The Fiscal Responsibility Act, the deal President Biden and Speaker Kevin McCarthy reached over the holiday weekend to raise the debt ceiling. The measure now goes to the Senate, which could approve it before the weekend.

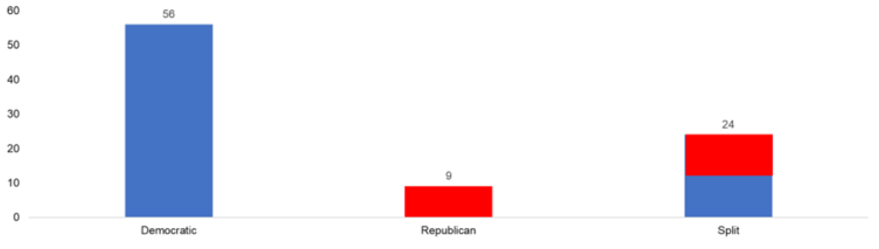

Treasury Secretary Janet Yellen has said federal funds could run out by June 5 unless Congress acts to raise the debt ceiling. As we have written before, this is not the first time this issue has been a matter of contention; in fact, a split Congress like the one we have now has agreed to increase the ceiling 24 times before.

Increases to the Debt Ceiling Under a Split Congress Are Normal

How many times the debt ceiling increased based on the makeup of Congress (1959-present)

What’s in the bill?

• Debt limit extension to 2025: The core of the deal is a suspension of the debt ceiling until Jan. 1, 2025, after the next presidential election. If it’s necessary at that time, the Treasury Department can again use extraordinary measures to pay the bills for months.

• Spending limits: The agreement includes spending caps for the next two years. In fiscal 2024, it would limit military spending to $886 billion and nonmilitary discretionary spending to $704 billion. In fiscal year 2025, those numbers would both increase by a moderate amount. Most importantly, there are no cuts to Social Security or Medicare.

• Student loans: The deal ends President Biden’s freeze on student loan repayments by the end of August and restricts his ability to reinstate such a moratorium. Borrowers will be required to resume paying their student loan bills 60 days after June 30.

• Other cuts: The bill would rescind about $28 billion in unspent COVID relief funds. It also would eliminate $1.4 billion in IRS funding.

What happens next?

The Democratic-controlled Senate will consider the bill and could vote on it before the weekend. If the bill fails, the U.S. would be in threat of immediate default with less than a week remaining until June 5. Even if the bill passes, it is possible that the U.S. debt rating will receives a downgrade, like we saw in 2011.

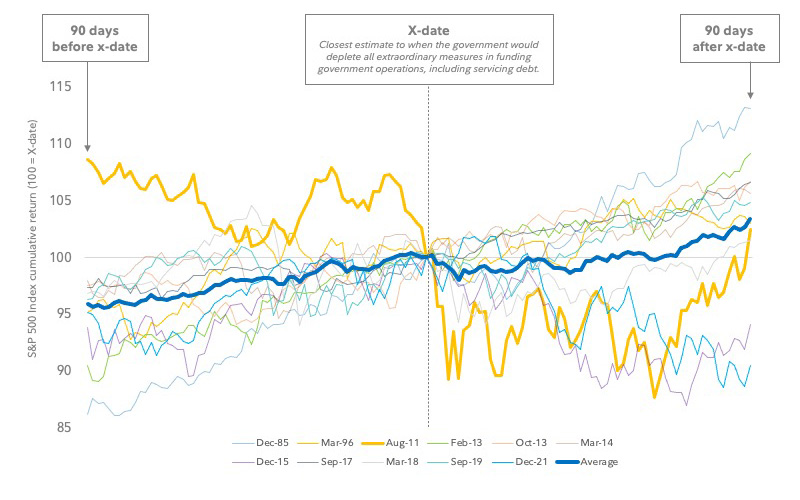

From a stock market perspective, the deal in its current form does not include enough spending cuts to tip the economy into a recession, nor does it add enough spending to increase inflation worries. The chart below shows where the S&P 500 was trading 90 days before and after the “X” date in the last 11 debt-ceiling crises. In all but two instances, the S&P was higher 90 days later. This reiterates our stance against trying to time the market, instead staying invested for the long-term.

On Average, Stocks Moved Higher After Past Debt Crises

In most cases, stocks gained both before and after a debt-ceiling crisis was resolved; 2011 was an unusually volatile example.

The markets and the economy are likely to avoid an enormous crisis. There are two plausible scenarios going forward – either the imminent passage of the bill, or a failure to pass the bill, leading to a market correction and then quick passage of the bill. Either way, the debt ceiling will get raised and default will be avoided.

That does not mean that the U.S. credit rating will avoid a downgrade. If that were to happen, the markets could see a repeat of 2011 — and as seen in the chart above, even after an agreement was reached, the market sold off almost 20% from its peak.

It is important to remember that it is hard to say exactly when everything will be resolved and that as part of the planning process, we plan for the unexpected. A default or downgrade could usher in a period of increased market volatility. If that were to play out, we will continue to discuss what we can control in times like these, which is our emotions, and not what happens in Washington. We will continue to follow the long-term investment plan.

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Sources: Bloomberg, Carson, Fidelity

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS. Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.

Fidelity Investments and Fidelity Institutional® (together “Fidelity”) is an independent company, unaffiliated with Kestra Financial or CD Wealth Management. Fidelity is a service provider to both. There is no form of legal partnership, agency affiliation, or similar relationship between your financial advisor and Fidelity, nor is such a relationship created or implied by the information herein. Fidelity has not been involved with the preparation of the content supplied by CD Wealth Management and does not guarantee, or assume any responsibility for, its content. Fidelity Investments is a registered service mark of FMR LLC. Fidelity Institutional provides clearing, custody, or other brokerage services through National Financial Services LLC or Fidelity Brokerage Services LLC, Members NYSE, SIPC.