It has been almost three weeks since the wake-up call from the failure of Silicon Valley Bank, the 16th-largest bank in the U.S. Two days later, Signature Bank also failed. With the fear of contagion spreading, European banks also came under pressure, forcing regulators to step in and shore up financial institutions. Recently, Swiss giant UBS agreed to acquire rival Credit Suisse to help restore confidence in the global banking system.

For more than a year, investors have been wondering what would allow the Federal Reserve to alter its path of aggressive rate hikes to slow down the economy and inflation. Thanks to the banking crisis, it appears we have the answer. The interest-rate outlook for the balance of 2023 and beyond appears to be dramatically changed.

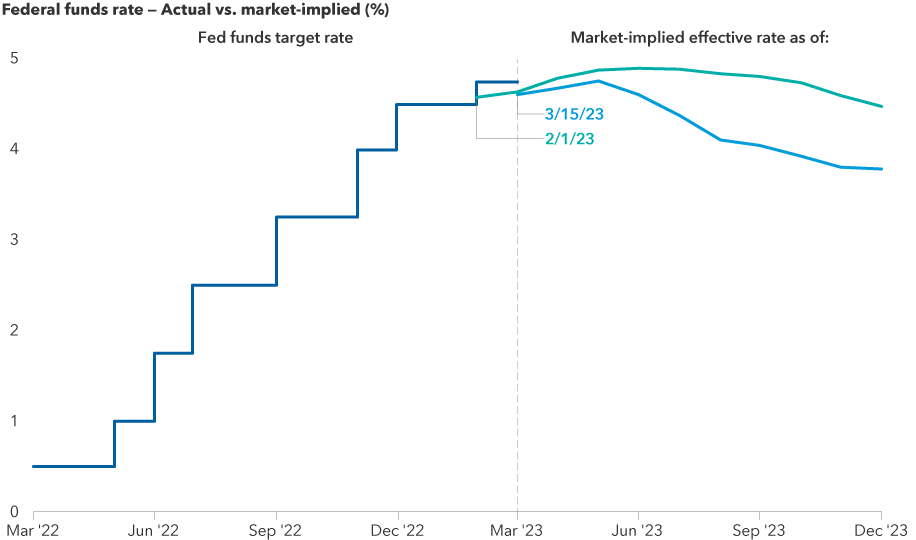

These events have led to an economic environment in which the Fed is tempering its hawkish tone and may even start cutting rates before the end of the year. (A hawk in the financial world is associated with aggressive monetary policy that favors higher interest rates to curb inflation.) While the Fed did raise the Fed funds rate by another 25 basis points last week, the central bank omitted language referring to the need for “ongoing” rate increases. The blue line in the chart below illustrates the sentiment shift from economists, reflecting a new potential path for the Fed. The latest Summary of Economic Projections suggests that Fed governors expect only one more rate hike this year.

SVB Collapse Has Drastically Altered Interest Rate Expectations

Since SVB’s failure, we have seen short-term Treasury yields plummet. The yield on the 2-year Treasury fell almost a full percentage point (100 basis points) over a three-day period, marking the largest decline since the Black Monday crash of 1987. The rapid decline in bond yields over the past three weeks means investors expect the Fed to cut rates as expectations for economic growth and inflation fall.

Another potential explanation for the falling yields is that more economists are predicting the possibility of a recession than before SVB’s troubles emerged. We have seen a dispersion between CD rates and Treasury yields since the SVB collapse; CD rates have remained elevated due to potential banking issues, while Treasury rates have remained depressed. Investors fled smaller regional banks and put excess cash into Treasury bonds, backed by the full faith and credit of the U.S. government, forcing rates lower.

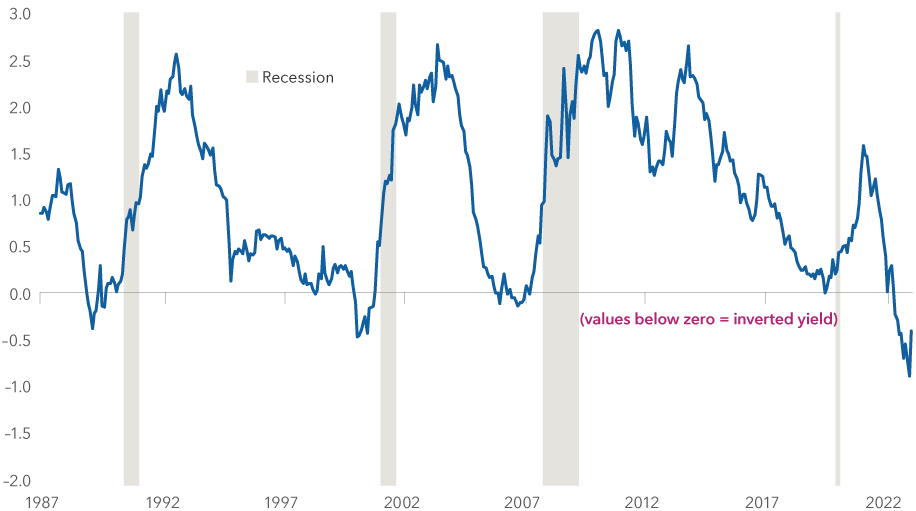

One of the strongest recessionary indicators remains the inverted yield curve. This is when the short-term U.S. Treasury bond yields are higher than the longer dated bonds. The yield curve first inverted in July and remains inverted today. The spread between the 10- and 2-year Treasury has decreased significantly since the SVB collapse, another sign that the bond market is forecasting a recession. In the four previous recent recessions, the yield spread between the 2- and 10-year bond reversed to a normal yield curve, and then the recession started.

Inverted Yield Curve Warns of Recession Risk

Difference between 10- and 2-year U.S. Treasury yields (%)

The Fed has a small window in which to avoid a recession. It still is targeting 2% inflation, but the costs associated with allowing inflation to remain high have become more severe since the SVB collapse. The current economic environment may be transitioning from an “asset crunch” to a “credit crunch,” which will inherently slow down economic growth and bring down inflation. We will continue to monitor the ongoing banking environment and keep you informed. As with any crisis, this one also presents potential investment opportunities, especially for those investors with long-term horizons.

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Sources: Capital Group, Schwab

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS. Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.

Fidelity Investments and Fidelity Institutional® (together “Fidelity”) is an independent company, unaffiliated with Kestra Financial or CD Wealth Management. Fidelity is a service provider to both. There is no form of legal partnership, agency affiliation, or similar relationship between your financial advisor and Fidelity, nor is such a relationship created or implied by the information herein. Fidelity has not been involved with the preparation of the content supplied by CD Wealth Management and does not guarantee, or assume any responsibility for, its content. Fidelity Investments is a registered service mark of FMR LLC. Fidelity Institutional provides clearing, custody, or other brokerage services through National Financial Services LLC or Fidelity Brokerage Services LLC, Members NYSE, SIPC.