Just like the waves of the ocean, constant predictions about the stock market ebb and flow from the Wall Street talking heads. As we entered 2022, the average Wall Street market strategist predicted the S&P 500 would close the year at 4,500 (it’s currently at 3,999). Now, as the seas are choppier heading into 2023, three of the largest Wall Street firms predict that the S&P 500 will hit 3,000 — a 25% drop from current levels — at some point during the year.

At the end of the day, no one knows — not even the talking heads at the largest Wall Street firms. These are predictions from traders who are focused on the seasonal tides.

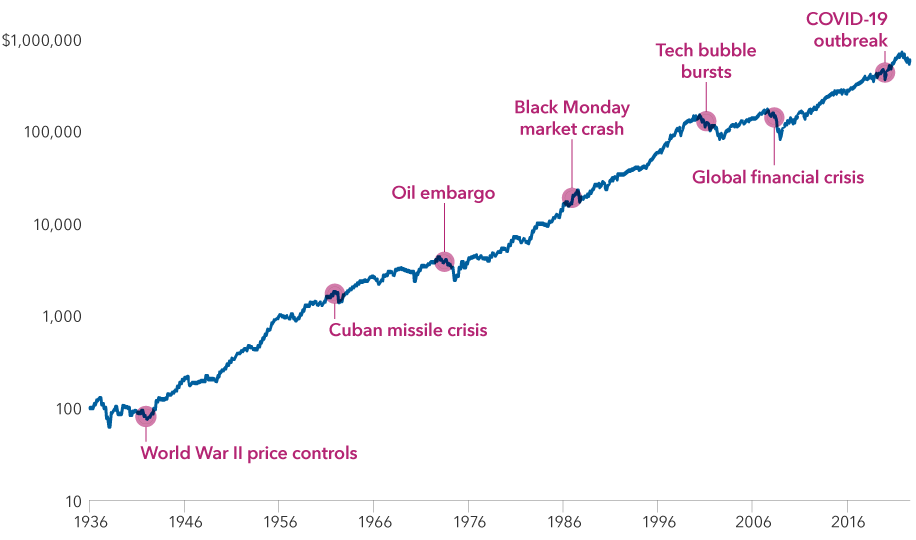

As you can see in the chart below, there have been many unsettling news events over the last 80 years. Looking through a long-term lens, you may be hard-pressed to find a bear market on the chart. This is why we focus on the long term: The trend rises with positive returns over long periods of time.

The stock market has overcome past bear markets and unsettling news.

Growth of a hypothetical $100 investment in the S&P 500 Index (with dividends reinvested)

Despite the uncertain outlook for 2023, there are many reasons for investors to be optimistic:

• Republicans gained control of the House in the midterm elections, and Wall Street has historically preferred political gridlock. The S&P 500 has generated an above-average annual return of 13.6% since 1950 during the years in which Congress is split. The last eight times the S&P 500 finished the midterm election in the red (negative returns), it finished the following year up at least 10.8%, with an average return of 24.6%.

• Money market short-term bonds and Treasuries are providing alternatives to the market and are likely to continue rising in the early months of 2023.

• Inflation, the biggest thorn in the market side for 2022, is showing signs of slowing with the Consumer Price Index CPI and the Producer Price Index both down more than 1% from their recent highs.

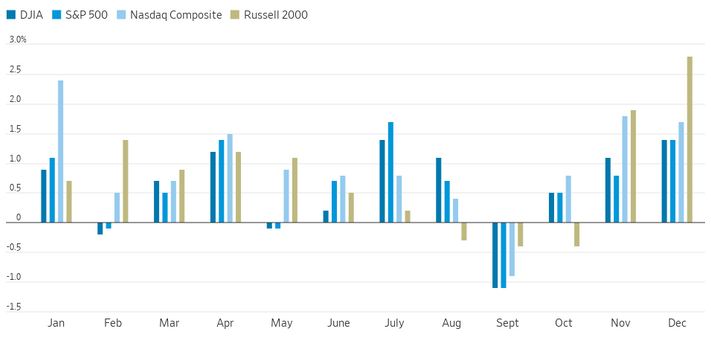

In the short term, December historically also has provided reasons to be optimistic. Following is a breakdown of how major indexes tend to perform in the last month of the year:

• The Dow Jones Industrial Average is up 71% of the time, the highest winning percentage of any month.

• The average December return for the Dow is 1.4%, second only to July.

• The S&P 500 is up 73% of the time, the highest winning percentage of any month.

• The average December return for the S&P 500 is 1.4%, the third-best month of the year.

• The NASDAQ is up 61% of the time with an average return of 1.7%, also the third-best month of the year.

• The Russell 2000 (Small Cap Stocks) is up 83% of the time, also the highest winning percentage of any month.

• The average December return for the Russell 2000 is 2.8%, the best average for any month.

Average Monthly Performance

The bottom line: Past outcomes are not predictive of future outcomes in the stock market. We hear this all the time, and they are certainly words to live by. Short-term waves and tide movements may help contextualize short-term moves in the market, but they should not serve as basis for long-term investment decisions.

Each economic and market cycle is different from previous ones. There are thoughtful, experienced, and respected economists who can give us all well-reasoned arguments why this bear market is different and why it is not a good time to invest in stocks. But we’d like to close with this comment from Dean Witter in May 1932, a few weeks before the end of the worst bear market in history: “Some people say they want to wait for a clearer view of the future. But when the future is again clear, the present bargains will have vanished. In fact, does anyone think that today’s prices will prevail once full confidence has been restored?”

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Sources: Dow Jones Market Data, Forbes, MarketWatch, Standard & Poor’s

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS. Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.