The U.S. economy is experiencing suspended progress as shelter-in-place orders have powered down a large fraction of economic activity.

Below are three possible scenarios and their respective implications for the economy and markets. Early economic data for March shows a devastating dislocation in employment and a plunge in consumer confidence. As we have seen, the shelter-at-home orders across the U.S. in response to the COVID-19 pandemic have caused large portions of the economy to close.

2020 may well become known as the Great Reboot. Many aspects of this pandemic are being labeled unprecedented.

A looming challenge, that is new to our country, is how to safely and effectively reboot our economy after hitting “the pause button.” It is critical to note that the predominant variable among these three hypothetical scenarios is how the pandemic will evolve in 2020.

The economy partially re-opened this past Friday, and we are looking forward to seeing the results of how it progresses. For the purposes of this market insight, we are limiting the hypothetical reboot scenarios to 3; however, there are many other routes this economy can take, majority of which stems from how quickly the economy re-stimulates.

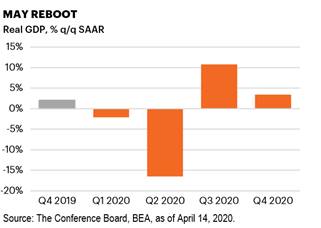

May reboot

This is a possible best-case scenario, which assumes that beginning in May, we can reopen the economy. This potential scenario implies the COVID-19 pandemic essentially caused a 6-week-long health crisis that largely resolves. While the -16.5% decline in Q2 would be the worst on record, it would leave 2020 GDP down -1.6%, which is more typical of a normal recession.

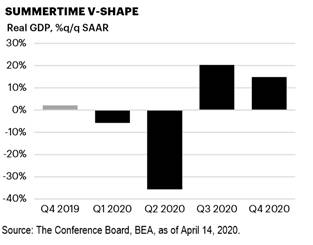

Summertime V-shape

This potential scenario assumes that cases peak at a higher level and peak later into the second quarter. This could mean a potential delayed reopening until June or even July. This longer broad-based lockdown could cause Q2 GDP to potentially decline -35.6%, almost twice as much as the first scenario. It could also mean a possible sharper rebound, but it leaves 2020 with a hypothetical contraction of -5.6%.

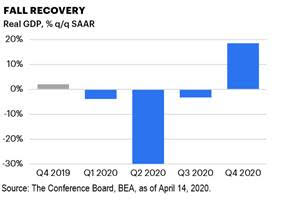

Fall recovery

This potential scenario reflects a more protracted arc to the pandemic. The possible decline in Q2 is significant here, at -29.9%. In this scenario, as the economy tries to restart mid-Q2, there are possible setbacks related to a resurgence of COVID-19 cases that causes the shelter-at-home orders to recur. This keeps growth in Q3 weak and, with a third consecutive quarter of contraction, delivers a -6.0% contraction in growth.

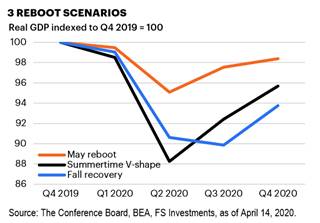

These hypothetical scenarios all include a decline in Q2, followed by some form of record quarterly gain, causing many to assign a V-shape to the economy. A shallower downturn is better, as is a faster recovery. In the past, in a typical recession, it can take more than a year after the recession ends for the economy to recapture the same pre-downturn level of output. As the country begins to re-open, many areas are still closed and limited. The remaining social-distancing requirements continue to impact particular sectors (concerts, sporting events, international travel and tourist attractions) of the economy.

3 reboot scenarios compared

The focus on the Great Reboot is sparking hope that our economy, once free of shelter-at-home orders, will nimbly and rapidly rebound. Much of this depends on how the pandemic evolves. Once businesses are allowed to reopen and consumers can shop more freely, a significant amount of activity could return. Many economists expect the economy to reboot in stages, sometimes successfully and sometimes with setbacks. The labor market could determine how much traction spending will get as the economy starts back up.

Nobody knows how long this virus will last, but it is universally agreed upon that it will not last forever. Over the last six weeks we have seen the Federal Reserve and the Treasury Department and our government’s willingness to put fiscal stimulus into the economy. It is not often that there is a 96-0 vote in the Senate as we saw on March 25, 2020. It appears that our government is going to continue to support stimulus to help combat this pandemic-led recession. Contrary to what the media portrays at times, there is a level of unity amongst our leaders.

We continue to pay close attention as this pandemic plays itself out. We will make tweaks to your portfolio if necessary and when needed. We want to remind you that our strategy is for you to stay the course as you have a solid financial plan behind your investments.

PLEASE NOTE: Our office continues to remain open during this time. Although some of us are working remotely, there will always be someone in our office to assist you. If there is something you need to drop off, or something you need for us to mail to you, please let us know! We understand these are extraordinary times, and we are here to continue to help you and your family!

_____________________

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. Kestra IS and Kestra AS are not affiliated with CD Wealth Management.