In this week’s update, we want to share with you our thoughts on the broader market and what we see on the horizon as we approach 2021.

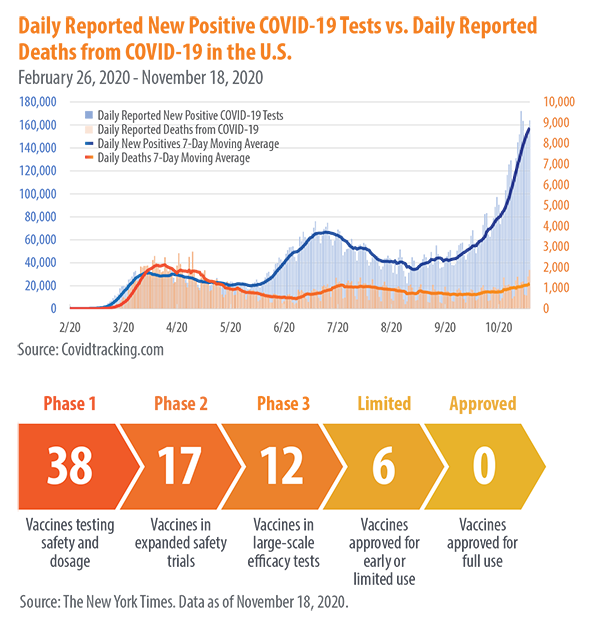

1. Vaccine: Three drug companies have signaled that their vaccines show greater than 90% efficacy, which is extremely strong; a typical flu vaccine is roughly 40% to 50% effective in a given year. Around the world, 12 vaccines are in phase III trials, and as vaccines begin to roll out soon, delivery and distribution will become the focal point. The markets have responded in anticipation of a “return to normal” in 2021 as speculators sell the work-from-home stocks, looking for value in beat-up sectors such as energy and financials.

We think that this is premature, as interest rates are likely to remain low for several years and energy companies must work through their excess supply while demand remains well below normal levels. Also, the virus is spreading rapidly throughout the country, and several cities and states are imposing a modified version of a lockdown to prevent their hospitals from becoming overrun.

2. Staying the course: Just as they did four years ago, the pollsters on TV misread the election. The lesson: Not only is politics unpredictable, but our certainties about investing might be wrong as well. We tend to overestimate the prevalence of negative information, which can lead to bad decisions. As we write in our weekly updates, it’s important to stay the course, follow the financial plan and to avoid trying to time the market based on what we think are certain outcomes. A recent Wall Street Journal article sums it well: “The trick is to embrace uncertainty without fooling yourself into thinking that impetuous decisions can give you control over it.”1

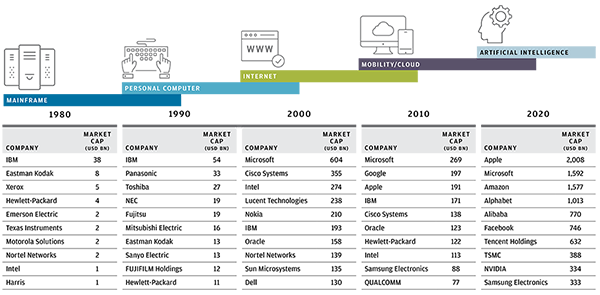

3. Technology (and talk of a bubble): Led by the so-called FAANG stocks – Facebook, Amazon, Apple, Netflix and Google — the technology sector has performed very well in 2020 compared to the overall market. Several factors have helped technology stocks outperform this year:

* Ease of buying and selling through new trading apps that allow fractional share ownership.

* Cheap money through low interest rates.

* Speculation of stay-at-home companies like Zoom — and how they will permanently change how business will be performed.

If you equally weight all the stocks in the S&P 500 instead of looking at it from a market-weighted perspective, the overall market is roughly 10% above its long-term average. Or, as the Wall Street Journal put it: “A Stock Market Bubble? It’s More Like a Fire.”

4. The evolution of industry: Over the last four decades, waves of innovation have transformed the power of technology, creating a new batch of winners across sectors and industries. As technology evolves, the sector lines continue to blur. For example, companies are now classified as FinTech, a combination of a financial and technology company. Healthcare companies’ use of artificial intelligence enables more efficient drug discovery. As we look ahead, we think that the disruptive power of technology will continue to spur shifts within industries and pave the way for new market leadership.

So, what can we continue to learn from all this?

Accurately predicting the next market move and timing the market is extremely difficult and can adversely affect the long-term performance of your portfolio. Riding out future market volatility in addition to having a diversified portfolio means staying the course and not trying to time the market. It all starts with a solid financial plan for the long run that understands the level of risk that is acceptable for each client. With regards to investments, we believe in diversification and having different asset classes that allow you to stay invested. The best option is to stick with a broadly diversified portfolio that can help you to achieve your own specific financial goals – regardless of market volatility. The economy, and therefore, the market, is bigger than the direction the political winds are blowing. Ultimately, it’s the long-term fundamentals that matter.

_____

All investments involve risk, including loss of principal. Past performance does not guarantee future results. There is no assurance that the investment process will consistently lead to successful investing. Asset allocation and diversification do not eliminate the risk of experiencing investment losses. Mutual funds are subject to market, exchange rate, political, credit, interest rate and prepayment risks, which vary depending on the type of mutual fund. Information provided is provided solely for informational purposes and therefore are not an offer to buy or sell a security, and are not warranted to be correct, complete or accurate by Kestra IS or Kestra AS.

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

S&P 500 Index is an unmanaged group of securities considered to be representative of the stock market in general. You cannot directly invest in the index.The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. Kestra IS and Kestra AS are not affiliated with CD Wealth Management.

Click here for additional investor disclosures.