Many of our clients have been concerned lately about where they can find income in today’s environment of low interest rates. They ask us questions like:

• If rates remain low for several years, what changes will we need to make with our fixed-income holdings?

• Will fixed-income holdings continue to help my portfolio be diversified — and will bonds add return?

The bond market has been relatively quiet with Treasury yields trading near historic lows. Some worry that if markets become volatile and stocks face a large decline again, bond yields don’t have much room to fall, and therefore, they won’t provide as much protection as they have in the past. In March, both stocks and bonds fell simultaneously for several days before the Federal Reserve stepped in to calm the markets. We view this as an anomaly and not a financial crisis, since the entire economy was shut down due to the pandemic.

To be clear: We firmly believe that fixed income plays a critical role in portfolio diversification.

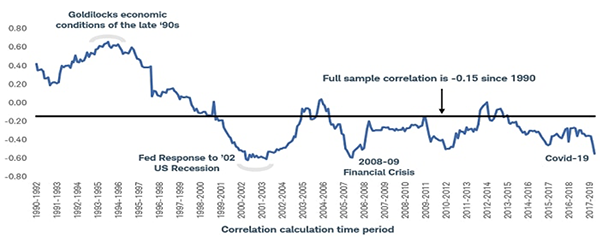

The right mix of assets depends on an individual’s capacity and tolerance for risk and reward. The traditional portfolio of 60% stocks and 40% bonds was designed as a starting point, understanding that stocks and bonds move differently over time, and the correlation between the two asset classes is not constant. The chart below shows the correlation over time between stocks and Treasury bonds, illustrating that bonds can provide diversification from stocks during market downturns.

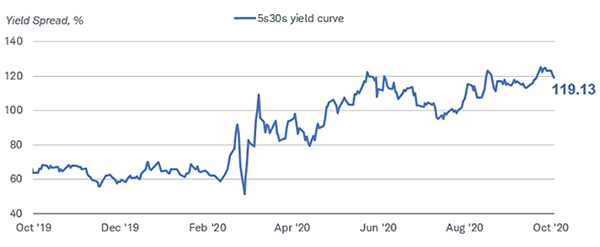

Looking beyond diversification, with yields currently low and expected to remain low for several years, the high returns seen so far this year in the bond market are not likely to be repeated over the next few years. Our expectation is that if the economy continues to improve, inflation will gradually move higher. Another round of stimulus could provide an additional boost to growth. This could lead to falling bond prices as intermediate and longer-term bond yields would rise, or steepen, as seen below.

We continue to recommend that investors maintain a broad diversification among stocks and bonds, and we expect returns for both stocks and bonds to be lower for the next 10 years compared to the last 10 years, as we are starting at a higher valuation point. Investors will need to maintain a broad exposure to global asset classes to help manage risk and provide a broader set of investment opportunities. Depending on each individual risk tolerance, the level of fixed income and equity exposure may vary. We believe that if you are a conservative investor, fixed income will continue to be a critical component of the portfolio and will offer opportunities for return.

So, what can we learn from all this?

We don’t believe that the diversification benefits from owning fixed income have changed. We believe that bonds still play an important role for diversification from stocks and provide income to boost portfolio returns. We will continue to look for opportunities in the fixed-income sector to provide diversification, income and total return. Riding out future market volatility in addition to having a diversified portfolio means staying the course and not trying to time the market.

It all starts with a solid financial plan for the long run that understands the level of risk that is acceptable for each client. With regards to investments, we believe in diversification and in having different asset classes that allow you to stay invested. The best option is to stick with a broadly diversified portfolio that can help you achieve your own specific financial goals – regardless of market volatility. The economy, and therefore, the market, is bigger than the direction the political winds are blowing. Ultimately, it’s the long-term fundamentals that matter.

_____

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

S&P 500 Index is an unmanaged group of securities considered to be representative of the stock market in general. You cannot directly invest in the index.The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. Kestra IS and Kestra AS are not affiliated with CD Wealth Management.

Click here for additional investor disclosures.