Rising recession fears pushed U.S. stocks briefly into bear market territory last week, with the S&P 500’s decline from its all-time high reaching 20%. There is no official bear market designation on Wall Street, though some may count Friday’s intraday lows as confirmation of one. The Dow Jones is mired in an eight-week losing streak, the longest since 1923. Meanwhile, the S&P 500 has been down seven straight weeks, the worst run since 2001.

We recognize that these times may make investors uncomfortable. Jack Bogle, the founder of Vanguard, famously said, “Stay the course, don’t let these changes in the market, even the big ones [like the financial crisis] … change your mind — and never, never, never be in or out of the market. Always be in at a certain level.” When the market was experiencing wild fluctuations in 2016, the great Warren Buffet told investors, “Don’t watch the market closely. Try not to worry too much about it.”

Here are four ways to stay on track toward achieving your goals while avoiding the common pitfalls investors experience during turbulent times:

Remember that this, too, shall pass.

Declines have been common occurrences and, on average, have not lasted a long time. Investors who realize that declines are inevitable and temporary have avoided the imprudent behavior of selling out of the market during down times. The market has always recovered from declines (although past results don’t guarantee future results). The chart below puts into context the frequency and duration of previous declines.

Keep your focus on the future.

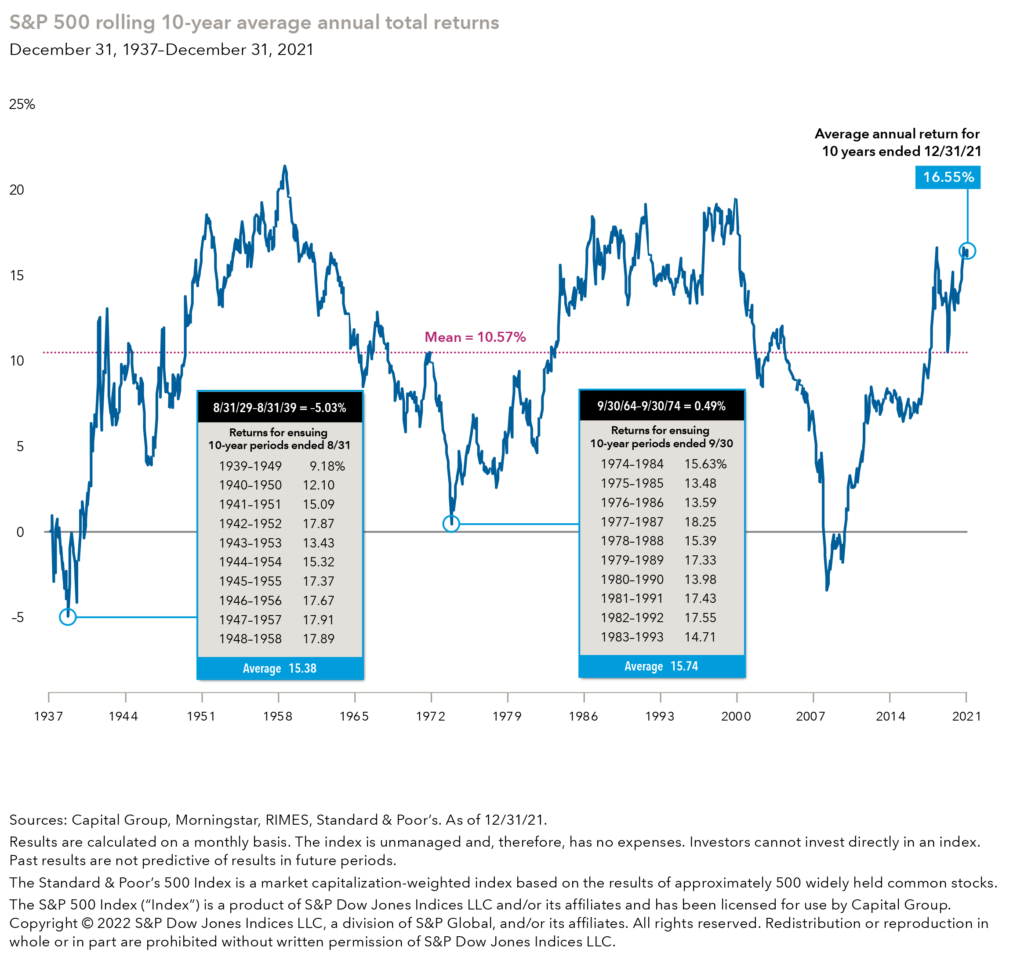

It is important to maintain proper perspective; don’t place too much emphasis on recent events or disregard long-term realities. Long-term investors have been rewarded: The chart below shows that going back to 1937, the 10-year average return of the S&P 500 is 10.57%. That doesn’t mean that there haven’t been periods of time with below-average returns, but staying invested through those times has paid off for the long-term investor.

Don’t try to time the market.

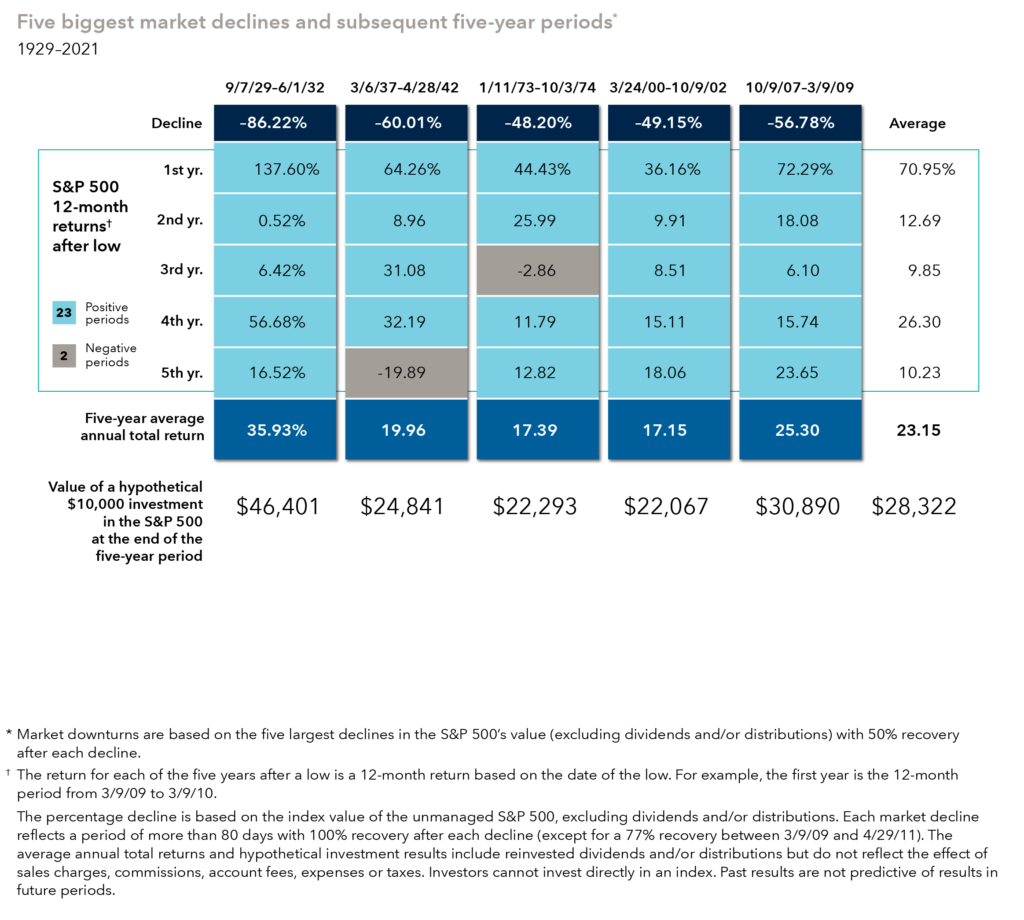

If you sell now and hope to get back into the market if it goes down further, you could miss out on gains when stocks recover. As we have written before, the pain humans feel from losses is greater than the joy they feel from an equal gain. Every S&P 500 downturn of 15% or more has been followed by a recovery. As shown on the chart below, the average return following the five biggest market declines since 1929 has been 70.95%. Over the longer term, the average value of an investment more than doubled over the five years after each market low.

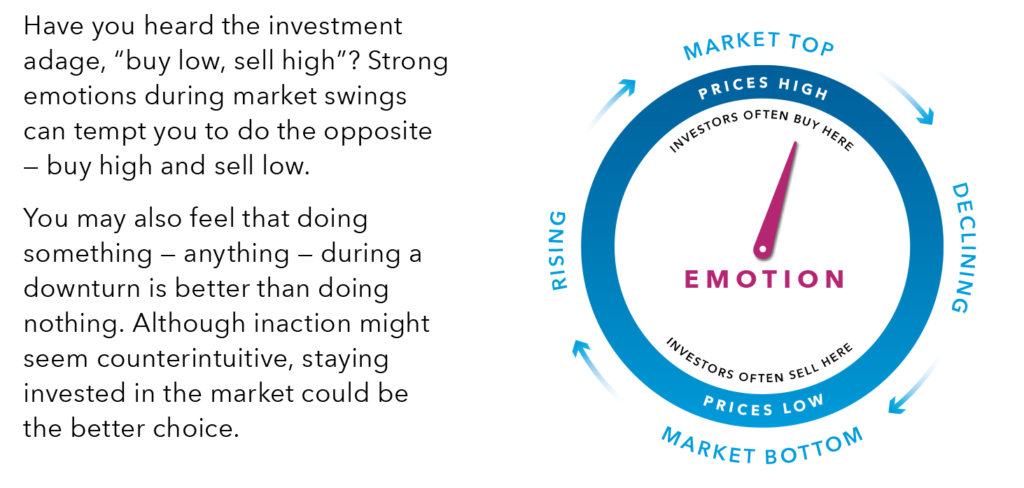

Don’t let emotions cloud your judgment.

As we often say, avoid the noise. Look past the headlines and stay focused on the longer-term goals. Don’t look at the market — or your account value — every day. During volatile times, look at the portfolio less often, knowing we are watching your portfolios very closely and continuing to make tweaks along the way. Investors tend to make poor decisions when they let their emotions take over.

So, what can we learn from all this? It is always difficult to see the value of your investments fall. During these challenging times, it is important to keep the following in mind:

• Ignore the noise of the sensational headlines.

• Selling into a panic is not an investment strategy.

• Market declines are a part of economic cycles.

• Don’t try to time the market, and do invest regularly, even when the market is falling.

It is likely that the current market drop may be a mere blip in the long-term investment plan. We are not going to try to time the market; what really matters is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns.

We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been. It is important to focus on the long-term goal, not on one specific data point or indicator. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

At the end of the day, investors will be well-served to remove emotion from their investment decisions, and remember that over a longer time horizon, markets tend to rise. Understanding that people fear losing money more than they enjoy making money is important during volatile markets. Investor emotions can have a big impact on retirement outcomes.

Market corrections are normal, as nothing goes up in a straight line. Making market decisions based on what might happen may be detrimental to long-term performance. The key is to stay invested and stick with the financial plan. Markets go up and down over time, and downturns present opportunities to purchase stocks at a lower value.

It all starts with a solid financial plan for the long run that understands the level of risk that is acceptable for each client. Regarding investments, we believe in diversification and having different asset classes that allow you to stay invested. The best option is to stick with a broadly diversified portfolio that can help you to achieve your own specific financial goals — regardless of market volatility. Long-term fundamentals are what matter.

Source: American Funds, CNBC

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS. Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.