Last week was a good reminder that stocks cannot go up all the time. The previous five weeks saw signs of investor exuberance after both Apple and Tesla announced stock splits and market volatility continued to drop at the same time.

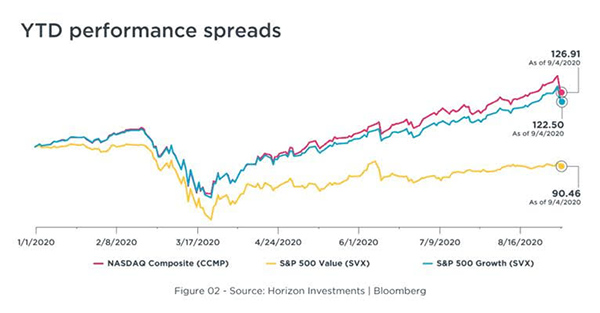

The same stocks that led the NASDAQ and S&P 500 higher were the same ones that fell the most last week. As seen in the chart below, Large Cap Growth stocks and the NASDAQ, since the market bottom in March, have significantly outpaced value stocks, and the selloff last week is an effort to reduce the spreads between growth and value stocks.

The reasons for the market pullback were the usual reasons: slowing recovery, tech stock bubble and an upcoming election. We do not think that the selloff last week is the beginning of a correction.

When stock valuations get stretched, as they recently have in the technology sector, they tend to snap back, much like a rubber band. If markets move too far in one direction, either oversold or overbought, they typically need to “reset” before moving higher, what many call profit taking. However, much of the volatility last week is being blamed on offshore funds option trading that led to large amounts of technology stock options being purchased. If this is the case, we expect this to be nothing more than a short-term move down in the markets.

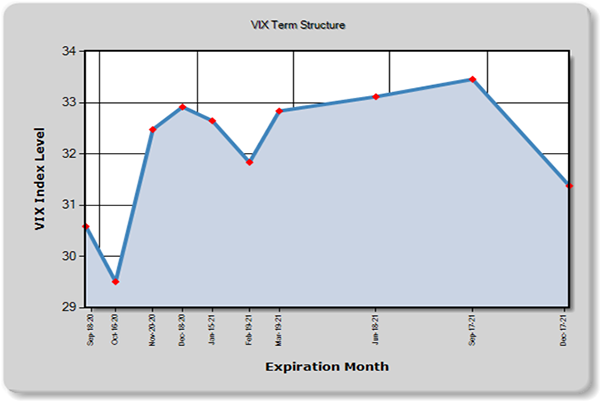

The VIX Index, which is a measure of forward volatility for the next 30 days, is flashing higher volatility than normal. The election is a big reason that the forward curve of the VIX index is steep as seen below. After we know who the next president will be, volatility is expected to level off.

While the market sold off last week, we saw interest rates rise and gold prices fall. This is not typical behavior of a market correction. Employment data continues to improve as the unemployment rate fell to 8.4 percent, well below expectations, and down from the high of 22 percent back in April.

The improvement in the labor market has been an unexpected source of strength for the economy. The expectation is that the pace of the rebound will begin to moderate, however, the pace of recovery remains ahead of forecast.

What to watch next

Now that Labor Day is behind us, the focus for the markets turns to stimulus talks and the election. Last week, Congress passed a resolution on the budget to avoid a government shutdown. It also may mean that stimulus talks may be stalled for the rest of the year. The markets will be watching the political scene closely and will dominate the news well beyond Nov. 3.

So, what can we learn from all this? Staying the course during periods of market volatility is critical for the long-term success of your financial plan. We will continue to closely track the markets, the sector rotation and continue to tweak the portfolios as necessary.

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS. Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.