We have all been there before. You’re at a social event or party where you hear of a great opportunity to invest in some “private” deal or alternative investment. Maybe it is someone starting a business or an inventor with the next great idea — or even a new technology that may change the world. Some people may think these opportunities are like being invited to join an exclusive club for the rich and famous. Others may be searching for different ways to invest money outside of the liquid, public markets.

Historically, these types of investments have been more accessible for the super-wealthy and made popular by Harvard or Yale endowments. They tend not to be correlated with the stock market and may offer the potential for high returns, but typically with much higher risk.

Opportunities such as these are called private investments or alternative investments — financial assets or investments outside the stock and bond market. Examples include private equity, hedge funds, venture capital, real estate, commodities and cryptocurrencies. Here’s a brief description of several alternative investments:

• Private equity funds are invested directly into companies rather than into publicly traded stocks or bonds. Private equity firms raise money from investors and institutions and invest those monies directly into non-traded companies. There are several different types of private equity investments, such as distressed funds, leveraged buyouts and “fund of funds,” for example.

• Hedge funds are investment structures that pool monies together to invest in many different asset classes, and they are typically unconcerned with market direction. In its simplest form, a hedge fund is known as Long-Short. They go “long” by buying one stock in an industry, such as Ford, and “short” by selling another stock in the same industry, such as GM. Therefore, they are what is called market neutral. Hedge funds, like private equity, take on many different types, such as macro, equity, value and distressed.

• Venture capital investment typically involves financing startup companies and businesses. This is similar to how private equity works, but venture capital invests more in startup and early-stage businesses, whereas private equity investments are usually in more developed companies. There are different forms of venture capital investments such as seed, early-stage and expansion investments.

• Real estate investments such as investment properties, office buildings, apartments or vacation homes also are considered alternative investments, as they are purchased outside of the publicly traded markets. There are many other types of alternative investments within real estate such as hard money loans, private notes, real estate partnerships and opportunity zone investments.

• Commodities are investments that typically are available to investors of all experience levels and easier to purchase than other alternatives, such as gold, silver, oil or natural gas.

• Cryptocurrency has become a more recent phenomenon among alternative investments. Investors are putting money into Bitcoin or Ethereum or in the network blockchain, which is a digital ledger to track cryptocurrency movement and ownership.

The pros and cons of alternative investments

PROS:

• They are not correlated to the stock market. This means that they add diversification to your portfolio while attempting to minimize risk. As we briefly outlined above, there are many different types of alternative investments, and the more investments one owns, the more one can potentially further reduce volatility in the portfolio.

• There is a potential for increased returns. As with any risky investment, there are no guarantees or guaranteed returns. Proponents of alternative investments maintain that higher returns can be achieved through these types of investments — but with the potential for higher returns comes higher risk.

CONS:

• They lack liquidity. Alternative investments tend to be private, i.e., not publicly traded, and therefore, they are less liquid. This means that they may be difficult to exit, and your monies could be tied up for many years, giving you no access to those funds. During the Great Recession, for example, many alternative investments stopped any redemptions of their funds, and clients who needed the money had no access to those monies.

• They have high investment minimums. For many people, higher minimums may make such investments unavailable. If an investment requires a high minimum to participate and that investment makes up a large percentage of your net worth, then it may not be prudent to have that much of your nest egg in one, potentially illiquid investment.

• They have higher fees. Most alternative investments carry higher investment fees than publicly traded funds do. At the same time, alternative investment fees are not always transparent, nor are they regulated by the SEC. Fees vary based on the type of investment, so it is important to understand the fee structure and how the fund manager gets paid.

• They lack regulation. Alternative investments are not regulated by the SEC and are not subject to reporting requirements. In addition, the underlying assets are often difficult to value, which can be deceptive for pricing and price transparency. Because of the lack of regulation and transparency, this can lead to risk of fraudulent investments. When you buy a stock, index fund, mutual fund or bond, you know that what you are buying is a real asset.

• They are complex. Alternative investments are often complex instruments and may require a high level of due diligence. If you are considering an alternative investment, it is imperative to do the research and understand all tax implications as well. For example, you may be a limited partner requiring a K-1, which in turn may delay filing your taxes. If you have several private investments, you may receive several K-1s, and this could lead to increased fees for filing taxes.

In recent years, alternative investments have grown in popularity. During down markets, alternative investments seem to become more popular as investors look to invest in something other than stocks.

Since alternative investments don’t have the same liquidity, transparency and valuation requirements of publicly traded stocks and bonds, investors may think that alternatives offer more security.

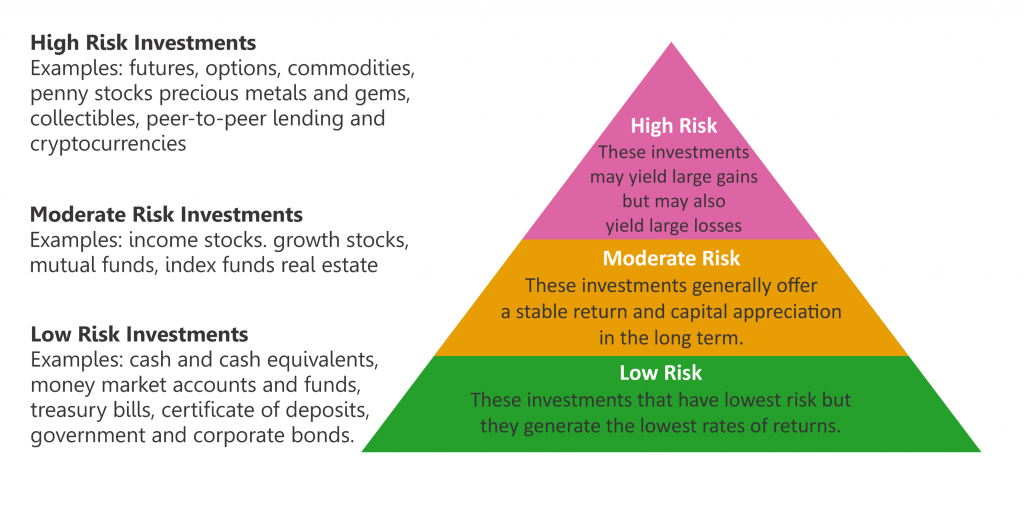

As seen in the pyramid below, alternative investments are higher on the risk scale, and therefore need to be well thought out and researched before investing capital. Please remember: If it sounds too good to be true, it normally is!

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Sources: Forbes, Investopedia

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS. Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.