The S&P 500 fell for the second week in a row, but the losses were minor. Technology stocks were hit the hardest last week, while energy stocks surged. Credit card debt broke the $1 trillion mark for the first time; some economists think this is a sign that the consumer is tapped out and simply buying on credit.

It is important to remember that net worth has risen over the past few decades from $44 trillion in 2000 to $150 trillion today. Since 2000, credit card debt has gained 106%, but net worth has gone up almost 250%! Credit card debt accounts for 21% of disposable income, which is lower than the average of 26% over the past 20 years.

Inflation remains top of mind for most people over the last 18+ months. While the news continues to tell us that inflation is coming down, most people aren’t feeling the decrease in prices in their pocketbook: Food prices are still higher than where they were a few years ago and overall, it feels to most like it just costs more to live today than it did a few years ago.

Consumer Price Index (CPI), which tracks a basket of goods and services purchased by households, continues to be watched closely for signs that inflation is dropping.

In July, inflation was up 3.2% year over year, well below the June 2022 level of 9%. Energy, food and vehicle prices lead the charge on the way down. Over the past year, energy prices have been down 12%, food inflation eased to 4.9%, and used car prices fell by 6%. Energy prices have helped reduce headline inflation. Over the last three months, headline inflation has been running at a 1.9% annual rate. Cars and shelter make up 50% of the core inflation basket. (Shelter does not include home prices, only a measure of rents.)

Inflation is moving in the right direction – lower – but remains more persistent than expected over the first half of the year. Core goods dropped from 12% to .8% over the past year, while core service inflation has slowed only to 6.1% in July, down from a peak of 7.3% in February. When you take out food and energy, overall inflation has seen less progress, especially in services. The Fed target level of 2% remains the goal, but we may not see that until sometime next year.

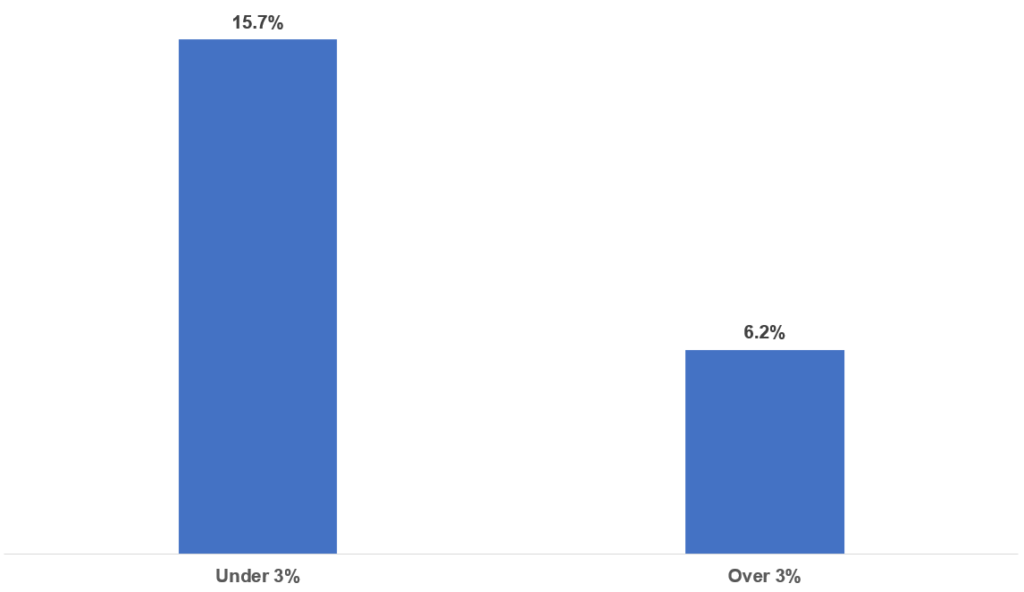

Inflation vs. the Stock Market: 1928-2022

The stock market has experienced above-average returns when inflation was below average and has seen below-average returns when inflation was above average. Since 1928, inflation has been below 3% about 55% of the time; the average return in those occasions has been 15.7%.

The market has experienced positive returns while inflation is over 3%, but nowhere near the average annual return of lower inflation. Higher inflation doesn’t guarantee lower stock market returns, but it makes sense that the markets aren’t happy with an increase in economic volatility.

The U.S. economy has expanded in the first half of the year, as measured by GDP. Consumer spending — which is 65% of GDP — remains resilient, partially as seen through the increase in credit card debt and increased net worth. Labor markets remain very tight, with unemployment at 3.5%. The Fed’s choices over the next few months will be critical for the markets to successfully navigate either a “soft landing” recession or no recession at all.

Although inflation continues to move in the right direction, the economy remains strong, which may continue to keep prices higher than the Fed would like. As of now, economists think that the Fed will not raise rates in September, and many are forecasting the end of the interest-rate cycle. If that is the case, that should be a positive for the market as we head into the latter part of the year.

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Sources: A Wealth of Common Sense, Carson Wealth, JP Morgan

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS. Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.

Fidelity Investments and Fidelity Institutional® (together “Fidelity”) is an independent company, unaffiliated with Kestra Financial or CD Wealth Management. Fidelity is a service provider to both. There is no form of legal partnership, agency affiliation, or similar relationship between your financial advisor and Fidelity, nor is such a relationship created or implied by the information herein. Fidelity has not been involved with the preparation of the content supplied by CD Wealth Management and does not guarantee, or assume any responsibility for, its content. Fidelity Investments is a registered service mark of FMR LLC. Fidelity Institutional provides clearing, custody, or other brokerage services through National Financial Services LLC or Fidelity Brokerage Services LLC, Members NYSE, SIPC.