Last week, President Biden announced the framework for the “Build Back Better” spending bill and outlined the plan to pay for it. The proposed bill stands at roughly $1.75 trillion, far less than the original $3 trillion. The social spending package focuses heavily on climate change, green energy provisions, childcare programs, expanded Medicare benefits and health care coverages, and universal kindergarten.

The chart below summarizes how the spending package would be funded: a new 15% minimum tax for corporations, a tax on corporate stock buybacks, investing in the IRS to boost enforcement, and a new surtax of 5% on individual income greater than $10 million with an additional 3% on income greater than $25 million.

+++

Proposals left in

Surtax on wealthy individuals: A 5% surtax would apply to individuals with income over $10 million. An additional 3% surtax would apply to income over $25 million.

Left in, but revised

Corporate tax rate: The House bill proposed a new top corporate tax rate of 26.5%. That was replaced in the compromise bill with a 15% minimum tax to ensure that no corporations can use loopholes and incentives in the tax code to pay a lower rate.

Taken out

Individual income tax rates: The House bill proposed increasing the top rate from 37% to 39.6% for individuals over $400,000 in income, but the proposal was dropped from the compromise bill.

Capital gains: The House bill proposed a new top rate on capital gains and dividends of 25% for individuals with more than $400,000 in income (vs. the current 0%, 15%, and 20%, depending on income), but the proposal was dropped from the compromise bill.

Estate tax: The House bill would have dropped the amount of inherited assets exempt from the estate tax from the current level of $11.7 million to about $6 million, but the proposal was dropped from the compromise bill.

Roth IRA conversions: The House bill would have prohibited Roth IRA conversions for both traditional IRAs and employer-sponsored plans for taxpayers with incomes above $400,000, but the proposal was dropped from the compromise bill.

Roth conversion limits: The House bill would have prohibited Roth IRA conversions for wealthier taxpayers beginning in 2032. That provision was dropped from the compromise bill.

Cap on aggregate retirement account balances: The House bill proposed that individuals with more than $10 million in tax-advantaged retirement accounts would be required to take required minimum distributions (RMDs), regardless of their age. That proposal was dropped from the compromise bill.

Billionaires’ tax on unrealized gains: An idea was floated in the Senate to levy an annual tax on unrealized gains for individuals with $1 billion or more in assets. But the plan did not attract enough support and was scrapped.

Taken out (for now)

State and Local Tax (SALT) Deduction: A group of lawmakers has been pushing to increase the $10,000 cap on the deduction for state and local taxes, which was imposed in 2017. While the provision was not included in the compromise bill, these lawmakers have said that they will continue to push for an increase in the cap. Democratic leaders have not yet ruled that out.

+++

For investors, the big news is that almost all the proposed tax increases that would have affected income, capital gains and estate taxes were dropped. Both the House and the Senate still must pass the revised bill, so more changes could be coming. We will continue to watch this very closely, and we will keep you apprised of major developments. If the bill passes, most individuals will not see any tax increases.

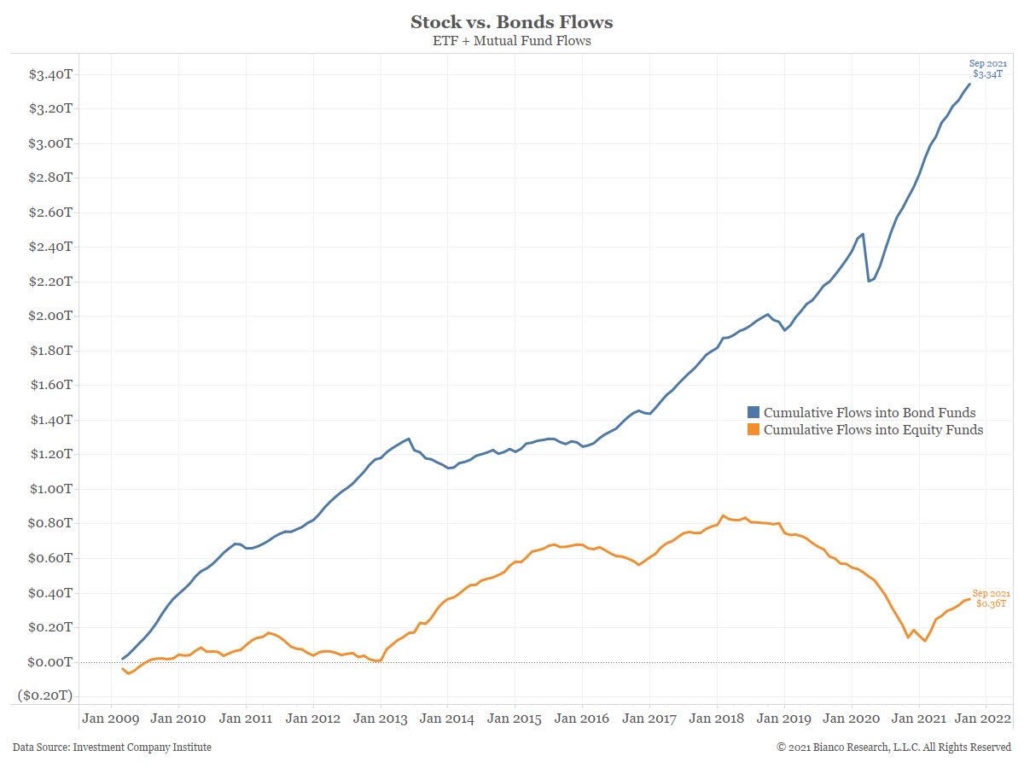

The new tax plan appears to pose less of a risk to equities than the plan that previously had been proposed. Even with all the talk of potential equity valuations, hyperinflation and Fed tapering, money has continued to flow into bond funds in comparison to equity funds, as the chart below shows. Over the last 12 years, bond funds have seen inflows of $3.34T, compared to equity inflows of only $.36T. If the fund flows were to reverse and equity inflows caught up with bond fund inflows, the equity markets could sustain the current rally.

So, what can we learn from all this? We continue to believe that it is better to plan than to predict. Building a plan to achieve one’s financial goals across a range of outcomes is the best practice, rather than being solely focused on what may happen if taxes increase.

Changes to your plan make sense only if they are in line with your goals; a well-built plan should provide guardrails and forestall emotional reactions when markets do not go the way we hope.

From a portfolio perspective, we continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been. Making market decisions based on what might happen may be detrimental to long-term performance. The key is to stay invested and stick with the financial plan. Markets go up and down over time, and downturns present opportunities to purchase stocks at a lower value. More and more noise is creeping into the markets today – worries about inflation, higher energy prices, slower growth, possible stagflation, etc.

The amount of liquidity in the markets remains at record levels. While questions do exist today about the state of the economy, many positives remain about our global economy. As we say each week, it is important to stay the course, focusing on the long-term goal and not on one specific data point or indicator.

It all starts with a solid financial plan for the long run that understands the level of risk that is acceptable for each client. Regarding investments, we believe in diversification and having different asset classes that allow you to stay invested. The best option is to stick with a broadly diversified portfolio that can help you to achieve your own specific financial goals — regardless of market volatility. Long-term fundamentals are what matter.

Sources: Investment Company Institute, Schwab

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. Kestra IS and Kestra AS are not affiliated with CD Wealth Management. Investor Disclosures: https://bit.ly/KF-Disclosures