Last week, we wrote about Social Security and retirement. This week, we are focusing on the opposite end of the lifecycle spectrum: planning for college. With the price of college continuing to rise, saving enough money to pay for four years of education can feel like an overwhelming task.

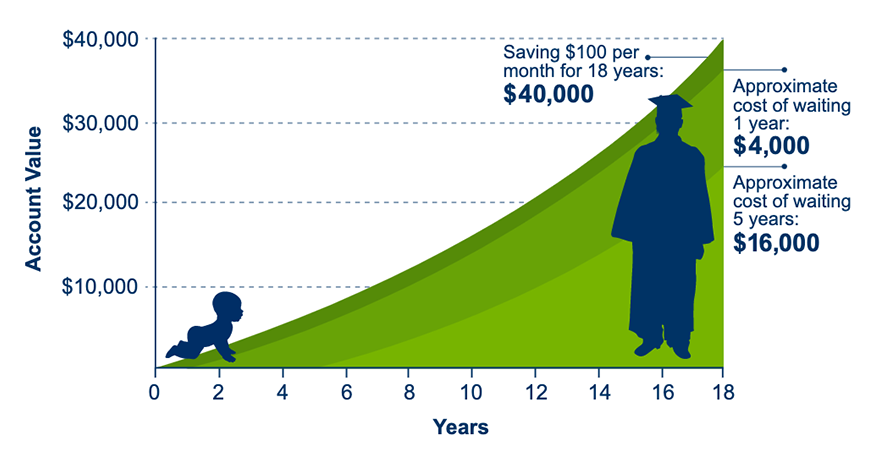

In 2019-2020, the average cost of a year at an in-state public university was roughly $22,000, while a year of private school was more than $50,000. By the time today’s newborns are set to enroll in college, four years at an in-state public university probably will cost more than $265,000. The longer you wait to start saving for college, the less time you allow for compound growth, and therefore, you will spend more of your own money, rather than letting your money work for you. It is never too early to begin saving for the educational objectives of your family, whether that means for your kids or your grandkids.

The most common and most popular way to save for college tuition is through a 529 plan, named after the section in the Internal Revenue Code that authorizes qualified tuition plans. A 529 account is an education investment account with rules and guidelines set by individual states. Each state negotiates the fees for management and mutual funds separately. If you live in a state that does not have an income tax (like Texas), you can choose to invest in any state’s 529 plan.

Each year, you can invest up to $15,000 per parent or $30,000 per couple into a 529 plan. Grandparents — or anyone else, such as a family member or friend — also can contribute the same amount to a 529 plan. A 529 account can be super funded with one-time contributions of $75,000 per person or $150,000 per couple; this uses up five years of annual gifting.

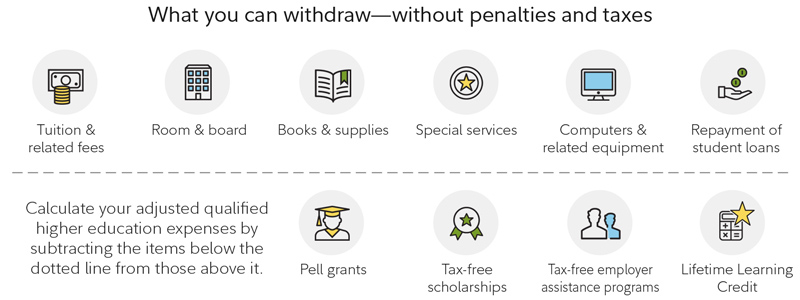

Earnings in 529 plans are not taxed under the federal tax code. Withdrawals for eligible expenses are tax-free, and many states allow 529 contributions to be deducted from state income taxes. If withdrawals are used for purposes other than qualified education expenses, the earnings can be subject to a 10% federal tax penalty and, if applicable, state income tax. The chart below highlights qualified expenses that can be taken from a 529 plan. As always, please consult your CPA for tax questions.

The Tax Cuts and Jobs Act of 2017 provided investors additional options for how they can spend their 529 dollars. You can now use up to $10,000 per year from 529 accounts to pay private tuition for children attending kindergarten through 12th grade.

Additionally, 529 plans offer several other great benefits, including:

Federal and state tax breaks

* As long as the money is used for qualified higher education expenses, no taxes are owed on 529 plan earnings.

* If you live in a state with a state income tax and you use that state’s plan, you avoid state taxes as well.

Age-based investment options

* 529 plans offer investments based on the age of the student and your family’s risk tolerance. Age-based plans automatically adjust the risk level from aggressive to conservative as the student gets closer to college.

No income-based restrictions

* No matter what your income level is, you can contribute to a 529 plan.

Flexibility of use

529 plans can be used for college, graduate school, trade schools and kindergarten through 12th grade. If there are leftover funds available, the money can remain in the 529 plan for another beneficiary (such as a sibling or grandchild), or a parent can use it for continuing education or for paying down student loan debt.

Ability to change investments

Federal tax law allows the account holder to change investments once a year or when there is a change of beneficiary.

Wealth transfer using a 529 plan

* Contributing to a 529 plan can also help grandparents or others reduce the size of their taxable estate while helping fund a grandchild’s education.

* Money held inside a 529 plan is outside of one’s estate.

+++

So, what can we learn from all this? A 529 plan allows you to save for a wide range of academic needs while also taking advantage of state and federal tax benefits. College savings plans are easy to set up, and anyone may contribute to them. The IRS allows individuals to fund five years of gifting at one time to frontload the plans and allow the investments more time to grow.

From a portfolio perspective, we continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been. Making market decisions based on what might happen may be detrimental to long-term performance. The key is to stay invested and stick with the financial plan. Markets go up and down over time, and downturns present opportunities to purchase stocks at a lower value.

More and more noise is creeping into the markets today – worries about inflation, higher energy prices, slower growth, possible stagflation, etc. The amount of liquidity in the markets remains at record levels. There still exists a chance that we see additional stimulus into the economy through an infrastructure package and possibly even a social spending package. While questions exist about the state of the economy, there remain many positives about our global economy and reasons to be optimistic. As we say each week, it is important to stay the course, focus on the long-term goal and not focus on one specific data point or one indicator.

It all starts with a solid financial plan for the long run that understands the level of risk that is acceptable for each client. Regarding investments, we believe in diversification and having different asset classes that allow you to stay invested. The best option is to stick with a broadly diversified portfolio that can help you to achieve your own specific financial goals — regardless of market volatility. Long-term fundamentals are what matter.

Sources: American Funds, Fidelity, College Board

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. Kestra IS and Kestra AS are not affiliated with CD Wealth Management. Investor Disclosures: https://bit.ly/KF-Disclosures