As we approach the fourth quarter of 2020 and the upcoming presidential election, many investors are asking about volatility and how to potentially hedge the portfolio against future volatility.

In previous messages, we have discussed the volatility index, VIX, which is a measure of forward-looking volatility for the next 30 days. The VIX is known as the fear gauge, as it reflects the market’s short-term outlook for stock price volatility as derived from option prices on the S&P 500. The challenge with the VIX index is that investors can’t access the VIX index; you can’t purchase it.

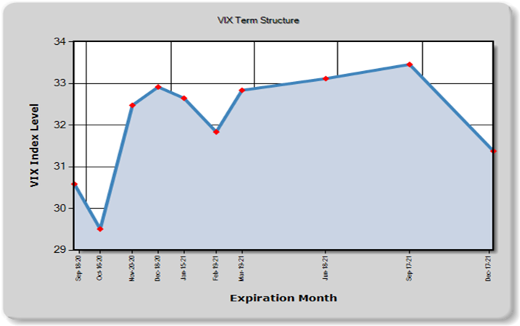

In a chart that we recently shared on volatility, higher volatility looks like it will last into next year, regardless of the election outcome or the arrival of a vaccine against COVID-19.

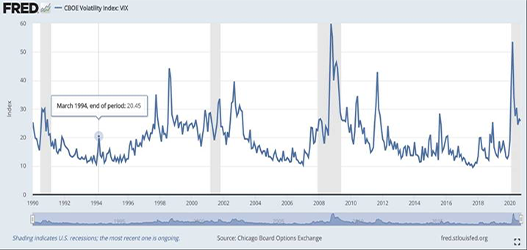

The VIX can remain elevated long after the depths of a crisis. For example, for most of 2009, the index hovered in the mid-20s range. A reading below 20 in the VIX suggests investors perceive market risk to be low, while a reading above 30 indicates more nervousness in the market. The VIX has been trading between 25 and 30 for most of September 2020.

The chart above clearly highlights the large moves to the upside in the VIX index– 1998 Long Term Capital Management blow up, 2000 tech bubble, 2008-2009 financial crisis, 2011 downgrade of US debt, and most recently the COVID-19 pandemic. So the question still remains, how does one protect themselves from increased volatility in their portfolio? If we could, the easy answer would be to buy the VIX index as a hedge in the portfolio to guard against increased market volatility leading to the stock market going down.

However, as we previously stated, investors can’t purchase the VIX index. Some investors purchase complicated index funds that attempt to replicate the volatility index through futures-based pricing or invest in hedge funds or other alternative investments, while others trade options – all in the “hope” of mitigating risk or volatility. All the above, however, have significant risk and investment challenges and none are the panacea for increased market volatility.

We believe that the key is to stay the course and not try to time the market. It all starts with a solid financial plan for the long run that understands the level of risk that is acceptable for each client. With regards to investments, we believe in diversification and having different asset classes that allow you to stay invested. The best option is to stick with a broadly diversified portfolio that can help you to achieve your own specific financial goals – regardless of market volatility. The economy, and therefore, the market, is bigger than the direction the political winds are blowing. Ultimately, it’s the long-term fundamentals that matter.

We want our clients to continue to focus on the following as we will continue staying the course of their financial plans and being proactive to make specific strategic moves in the portfolios that have proven necessary during these times:

Revisit Your Investment & Financial Planning Objectives: For nearly all investors, longer-term objectives are made possible when taking an appropriate level of risk.

Continue to Maintain a Longer-Term Mindset: Avoid letting recent market volatility convince you to abandon your prudently designed, long-term investment plan. Short-term reactive decisions could significantly impair portfolio returns.

Excess Cash Reserves: Continue to contribute according to your periodic investment plans as investing a portion of your excess cash reserves.

_____

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. Kestra IS and Kestra AS are not affiliated with CD Wealth Management.