Although some recounts and legal action remain before the results of the election become official, news networks have projected that Joe Biden will be the nation’s 46th president — and markets have rallied over the past week, buoyed by additional clarity and less policy uncertainty.

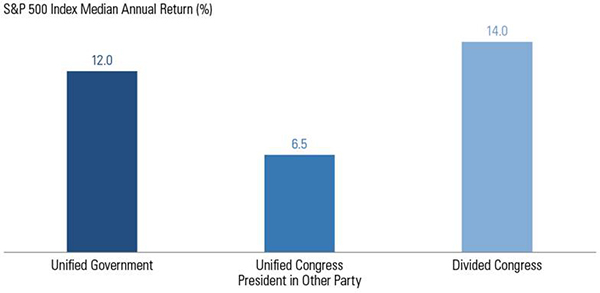

The S&P 500 rose 7.3% for the week last week. The strength continued this week with news from Pfizer on its vaccine efficacy and the hope that the world can return to “normal” in 2021. The predicted “blue wave” that some investors feared would unify the government and lead to significant policy shifts has evaporated — although legislative control remains up for grabs with a pair of Senate runoffs in Georgia coming in January. The chart below shows that since 1945, the S&P 500 has averaged a 14% annualized return with a divided Congress and a 12% return with a unified government.

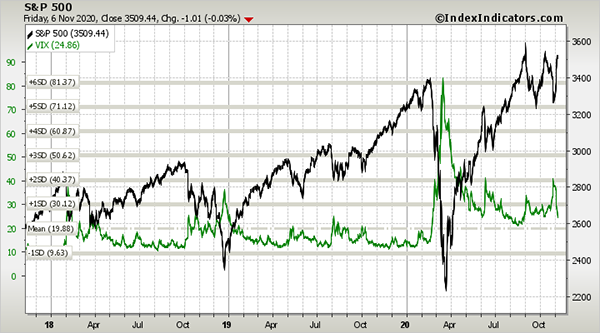

We received many calls leading up to the election from investors who were concerned about the possibility of higher volatility and a major market selloff after the election. As is often the case, however, the opposite occurred: We have seen volatility drop to levels last seen in August, and even before that, pre-pandemic levels. The chart below illustrates that volatility and market returns often move counter to each other. When volatility goes down, the stock market sees higher returns, and when volatility increases, stock market returns decrease.

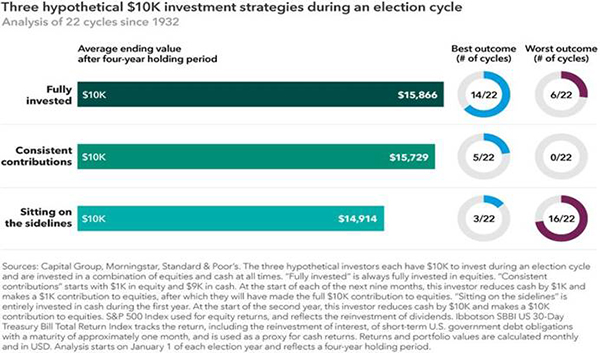

As we have discussed before, trying to time the market and make large bets seldom works out favorably. Market timing is rarely a winning strategy; staying invested is the key to long-term success. Historically, the best financial approach in election years is to stay invested, and we saw this play out again last week. Sticking with a long-term financial plan that is based on individual objectives while avoiding market timing around politics is usually the best course of action.

So, what can we learn from all this?

Accurately predicting the next market move and timing the market is extremely difficult and can adversely affect the long-term performance of your portfolio. Riding out future market volatility in addition to having a diversified portfolio is sound strategy. It all starts with a solid financial plan for the long run that is based on your acceptable level of risk. The best option is to stick with a broadly diversified portfolio that can help you to achieve your own goals, regardless of market volatility. The economy, and therefore, the market, is bigger than the direction the political winds are blowing. Ultimately, it’s the long-term fundamentals that matter.

Data sources: GSAM, Index Indicators, Capital Group

_____

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

S&P 500 Index is an unmanaged group of securities considered to be representative of the stock market in general. You cannot directly invest in the index.The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. Kestra IS and Kestra AS are not affiliated with CD Wealth Management.

Click here for additional investor disclosures.