Preliminary sales numbers have been posted for Thanksgiving and Black Friday, and they paint an interesting picture. Black Friday hit a new record with consumers spending an estimated $9 billion, an increase of 21.6% over last year’s $7.4 billion. On Thanksgiving Day, retail sales totaled $5.1 billion, an increase of 21.5% over last year.

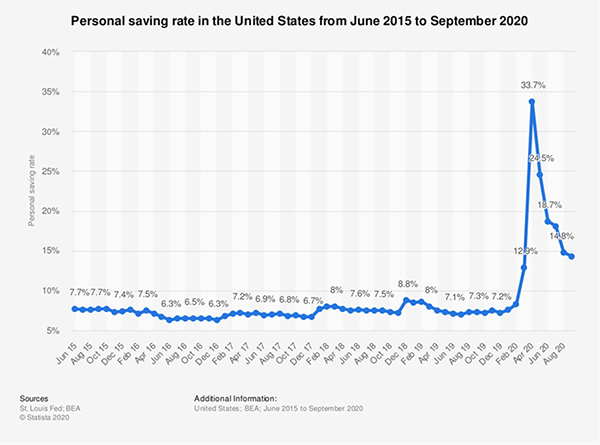

Meanwhile, foot traffic at stores fell by 52.1% compared with last year, a reflection of consumers’ move toward online shopping as the pandemic continues to spread. And consumers have more money to spend as well; consumer saving remains elevated compared to pre-pandemic levels. The stock market is reflecting optimism in companies that heavily favor the online retail environment, even in a post-pandemic reality.

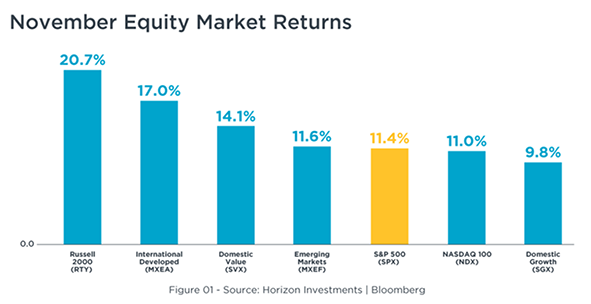

The stock market continued to move higher in November, setting records along the way. The chart below reflects November equity market returns for stock indexes through Nov. 27. The Dow Jones Index breached 30,000 for the first time, and the NASDAQ surged past 12,000. Investors are in a bullish mood while the economy continues to deal with the second wave of the coronavirus, possible lockdowns, increased unemployment claims and a lack of stimulus from Congress for those who remain out of work. While economic numbers and sometimes grim headlines tell the story of the past, the stock market’s focus on is on the future. The markets aren’t ignoring the news of the day, they simply are looking beyond it.

Optimism in stocks continues to move the market higher, shrugging off negative economic data. The reason for the optimism is severalfold:

• Expected vaccine rollouts from Pfizer and Moderna later this year and in early 2021

• Political winds calming with the change in administration

• Potential split party between the White House and the Senate

• Continued talk of stimulus package before the end of the year

• Federal Reserve’s pledge to keep rates near zero for years to come

This does not mean that stocks are without risks. It will be some time before industries such as hospitality, service and energy return to their pre-COVID levels of employment and positive outlook. Stock prices are high based on optimism for the future, which is reflecting breakthroughs in vaccine development. However, the backdrop remains positive for asset prices, and we will continue to buy the market dips.

So, what can we learn from all this?

Trying to time the market is extremely difficult. As we near the end of 2020, we view more risk being out of the market than in the market. Riding out future market volatility in addition to having a diversified portfolio means staying the course.

It all starts with a solid financial plan for the long run that understands the level of risk that is acceptable for each client. With regards to investments, we believe in diversification and having different asset classes that allow you to stay invested. The best option is to stick with a broadly diversified portfolio that can help you to achieve your own specific financial goals – regardless of market volatility. Long-term fundamentals are what matter.

Data Sources: Horizon, St. Louis Federal Reserve, CNBC

_____

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

S&P 500 Index is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a popular indicator of the stock market based on the average closing prices of 30 active U.S. stocks representative of the overall economy. NASDAQ Composite Index measures all NASDAQ domestic and international based common type stocks listed on The NASDAQ Stock Market. The Russell 2000 Index (RTY) measures the performance of the small-cap segment of the U.S. equity universe. The MSCI EAFE Index (MXEA) is an equity index which captures large and mid cap representation across 21 Developed Markets countries around the world, excluding the US and Canada. The S&P 500® Value Index (SVX), represents the value companies, as determined by the index sponsor, of the S&P 500 Index. The Index measures the performance of large-capitalization value companies in the United States. The MSCI Emerging Markets Index (MXEF) captures large and mid cap representation across 26 Emerging Markets countries. The NASDAQ-100 Index (NDX) is made up of 103 equity securities issued by 100 of the largest non-financial companies listed on the Nasdaq stock market. It is a modified capitalization-weighted index. The S&P 500® Growth Index (SGX), represents the growth companies, as determined by the index sponsor, of the S&P 500 Index. The Index measures the performance of large-capitalization growth companies in the United States. It is not possible to invest directly in an index.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. Kestra IS and Kestra AS are not affiliated with CD Wealth Management.