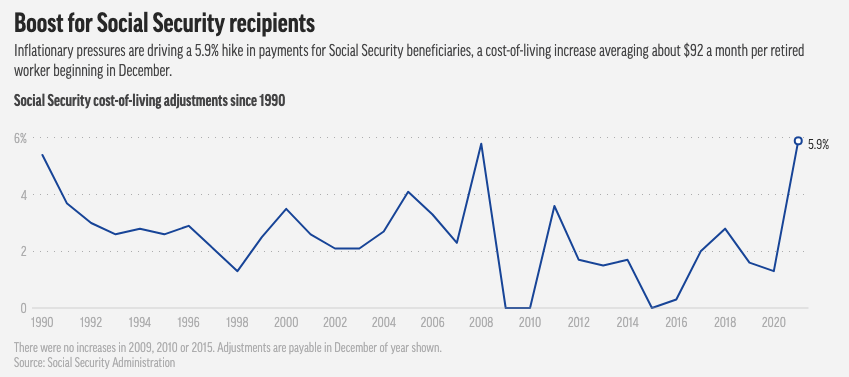

Millions of retirees received great news this last week: Social Security and Supplemental Security Income will get a 5.9% boost in benefits for 2022. This is the largest cost-of-living adjustment in almost 40 years. For the past 10 years, the annual average inflation adjustment has been 1.65%.

Roughly 50% of all seniors live in households where Social Security provides at least half of their income, and 25% rely on their monthly payments for all their income. With the increase for 2022, the average Social Security payment for a retired worker will be $1,657 per month, and a typical couple’s benefit would rise by $154 to $2,753 per month. The large increase will help retirees keep up with the rising costs of food, gas and other goods and services, as the current CPI — measuring the year-over-year change in consumer prices — is up 5.4%.

How does Social Security work — and how do I access my statement?

Social Security is financed by payroll taxes that are collected from workers and their employers. Both employees and employers pay 6.2% on wages, up to a maximum amount, which is adjusted yearly for inflation. (In 2022, the maximum amount will be $147,000.) The payroll taxes are paid into the Social Security system so that at retirement age, any time after age 62, workers who are entitled to benefits can decide if they want to begin taking Social Security or delay taking benefits up until age 70. For every year you delay taking benefits between age 62 and 70, the estimated monthly payment grows by about 8%. As part of the financial planning process, we discuss taking Social Security at age 67 versus age 70 because while each situation is different, the break-even scenario is age 81. This means that if you live past age 81, you would be better off financially if you wait until age 70 to begin taking Social Security benefits.

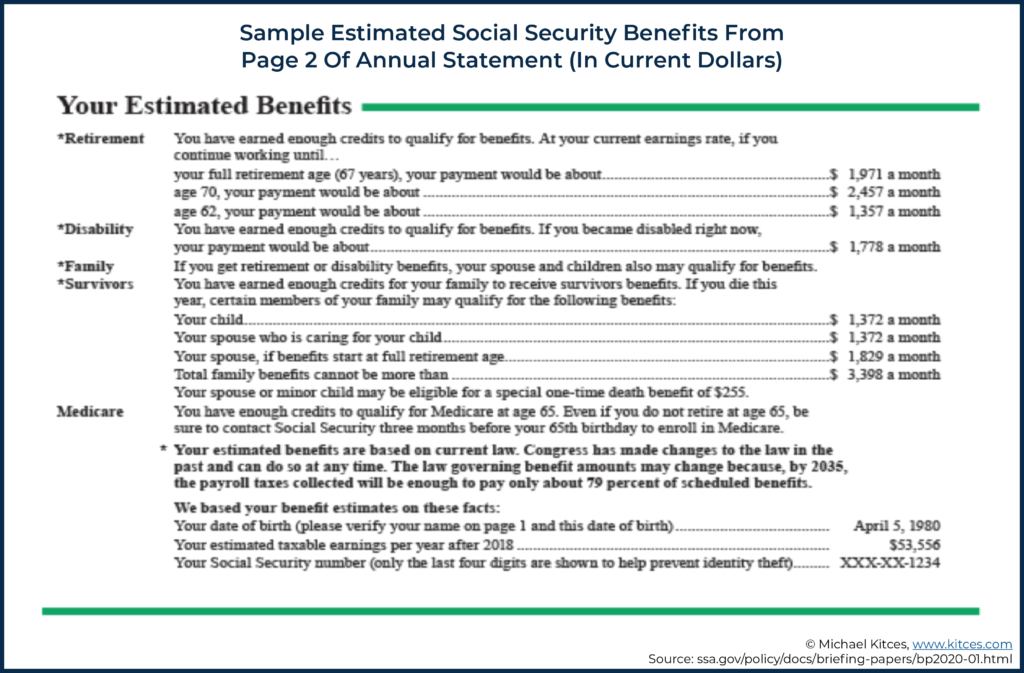

In 2011, the Social Security Administration stopped mailing annual statements to people’s homes. To access your statement, go to www.ssa.gov and create an account if you have not already done so. Page 2 of the statement (shown below) includes a summary of the estimated retirement, disability, family survivors and Medicare benefits based on the average earnings over a person’s entire work history. These benefits are not adjusted for inflation and are reported in current dollars, not future dollars. In other words, there are no inflation adjustments being applied to the benefit amounts, even though they may not be claimed for many years. The main area to study is the retirement section, where you can view the payment amounts if you take benefits at age 62, 66 or 67 (depending on your date of birth) and at age 70.

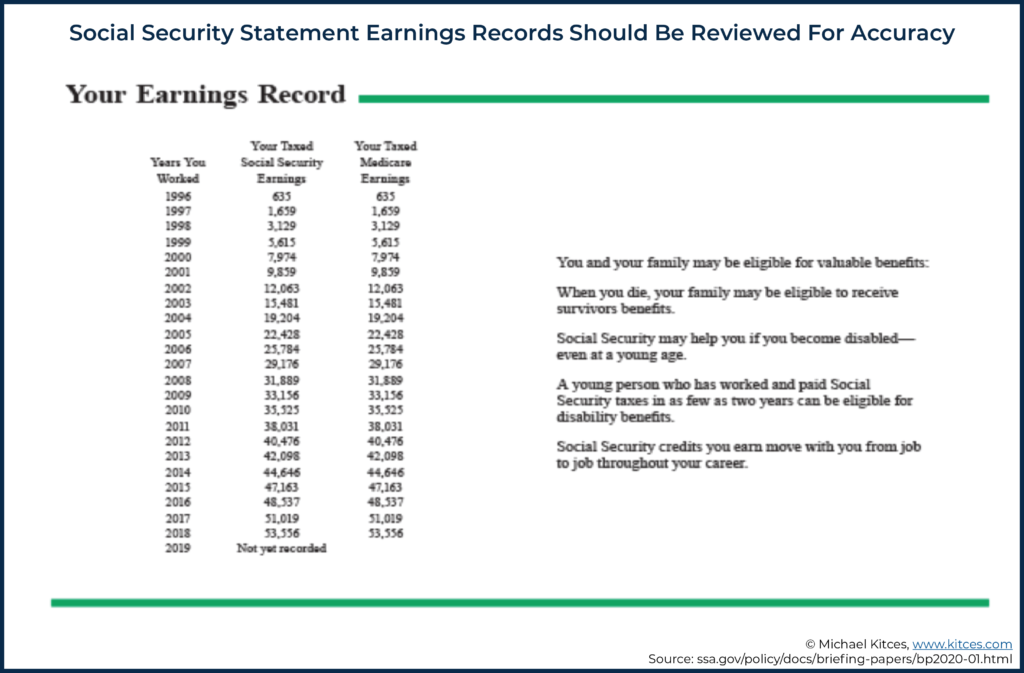

It is important to review the earnings record on Page 3 of the Social Security statement (shown below). Your benefits are based on the 35 calendar years in which your income was the highest. If you have fewer than 35 years of earnings, each year with no earnings will be entered as zero. Years with zero income can be replaced with higher-income years in the future. We recommend reviewing this page to make sure the annual income reported is accurate. In the event of an error or omission, you should gather evidence (W-2s, pay stubs or tax returns) and contact the Social Security Administration to have it corrected.

Social Security benefits that you receive at retirement are not tax-free. A married couple with a combined income of more than $32,000 may have to pay income tax on up to 50% of their benefits. Higher-income earners may have to pay tax on up to 85% of their benefits. Depending on where you live, you also may have to pay state income taxes on your benefits.

Married people can take what is called a spousal benefit, worth up to 50% of the other spouse’s Social Security benefit. If one spouse is a high wage earner and the other has not worked or has a very low Social Security benefit, taking half of the higher earner’s benefit may result in higher monthly income at retirement.

So, what can we learn from all this? Social Security benefits are an important part of most retirement plans. Even in situations where individuals are fortunate enough to avoid relying on benefits, you still should ensure you receive the correct amount. Reviewing your benefits is a critical step of the financial planning process.

From a portfolio perspective, we continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been. Making market decisions based on what might happen may be detrimental to long-term performance. The key is to stay invested and stick with the financial plan. Markets go up and down over time, and downturns present opportunities to purchase stocks at a lower value.

More and more noise is creeping into the markets today – worries about inflation, higher energy prices, slower growth, possible stagflation, etc. The amount of liquidity in the markets remains at record levels. There still exists a chance that we will see additional stimulus into the economy through an infrastructure package and possibly even a social spending package. While questions do exist about the state of the economy, there remain many positives about our global economy and reasons to be optimistic. As we say each week, it is important to stay the course and focus on the long-term goal, not on one specific data point or one indicator.

It all starts with a solid financial plan for the long run that understands the level of risk that is acceptable for each client. Regarding investments, we believe in diversification and having different asset classes that allow you to stay invested. The best option is to stick with a broadly diversified portfolio that can help you achieve your own specific financial goals, regardless of market volatility. Long-term fundamentals are what matter.

Sources: Associated Press, CNBC, Kitces

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. Kestra IS and Kestra AS are not affiliated with CD Wealth Management. Investor Disclosures: https://bit.ly/KF-Disclosures