One of the most important factors to consider with an investment is its liquidity — how quickly your money or investment can be converted to cash or how quickly your asset be sold without affecting its price too much. The ease with which this is possible is determined by the liquidity of the underlying asset, whether stocks, bonds, commodities or real assets.

Liquid assets may not always be the sexiest investments, but they will be available when they’re needed.

In the stock market, a stock, index fund or mutual fund must be able to be bought or sold quickly and with minimal impact to the stock’s price. Shares of large-cap companies traded on major stock exchanges tend to be highly liquid. Smaller companies are typically listed on smaller exchanges, and their shares can be less liquid, unless they are packaged into an index fund or mutual fund.

Investing in liquid securities is typically less risky than investing in illiquid ones. Therefore, illiquid assets tend to require a higher risk premium as compensation.

Large investors (such as pension funds or endowments like Harvard or Yale) tend to invest in illiquid assets with the hope of higher returns and increased diversification. This is what is called the illiquidity premium.

Historically, more illiquid private investments have been more accessible to the super-wealthy. The selling point for many of these investments is lower correlation to the stock market, lower market volatility on monthly statements and (investors hope) higher returns.

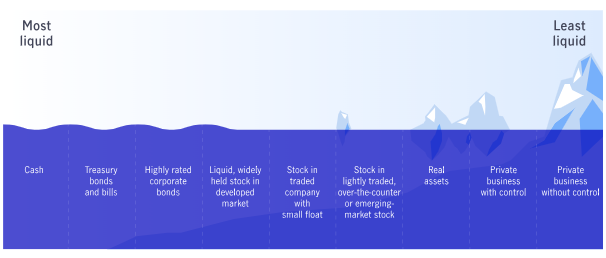

Examples of these private or alternative investments include private equity, hedge funds, venture capital, real estate, commodities and cryptocurrencies. The chart below illustrates the spectrum of liquidity well. It is important to keep in mind that as you move from more liquid to less liquid, the risk level also increases.

Where Assets Generally Sit on the Liquidity Spectrum

When times are tough or when markets are going through a rough patch, we find that liquidity is most important to our clients. The sexy alternative investments are typically the least liquid during that time, but pundits talk about the merits of being illiquid, as the “value of the fund” doesn’t fluctuate as much — there is not as much statement risk. That is because the investment’s illiquidity causes the true value of the holding to be unknown if the market were in a downtrend and it had to be sold early.

At CD Wealth, our philosophy is to focus on the liquid markets: money markets, fixed income (municipal bonds, corporate bonds, Treasuries, CDs), individual equities, mutual funds and index funds.

We are not investing our clients’ monies in alternative investments, whether liquid or illiquid. To use a golf analogy, we play in the fairway. We want to ensure that if a client needs their money, whatever is in the portfolio can be sold. That doesn’t necessarily mean that there would not be a loss, but it would mean that the holding is liquid, and you would have access to your monies.

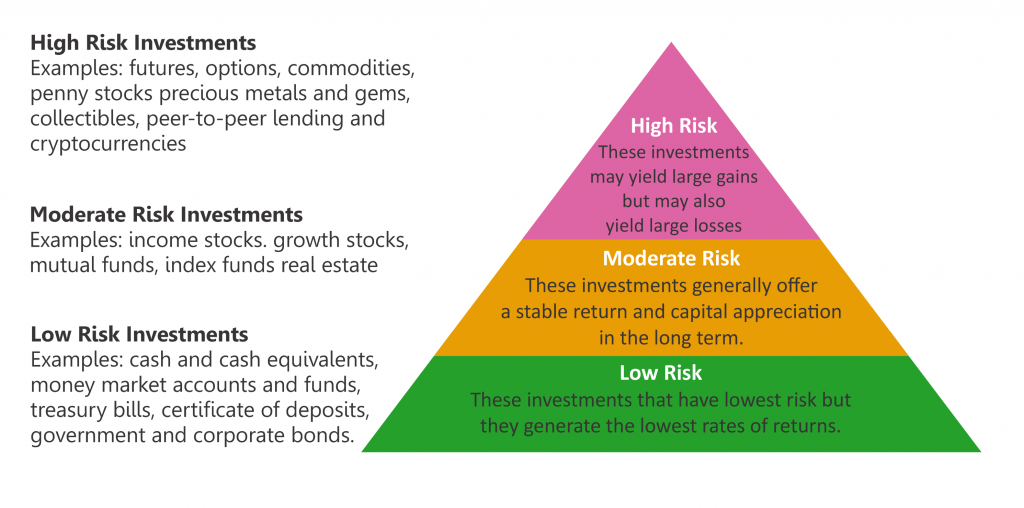

Think of this as a pyramid. The highest level of the pyramid has the most risk; often this includes holdings that are not liquid. If you had to sell, you may take a large loss, but there is also the opportunity for large gains. It is possible to make good money investing only in liquid securities. Those who have owned stocks like the Magnificent Seven will tell you that they have had great returns over the last 15 months while remaining liquid.

The lowest level of the pyramid is the safest and most liquid. These are cash and cash alternatives, along with fixed-income holdings. You can have liquid investments in each of the three rungs of the pyramid, but it is difficult to own illiquid investments in each of the three rungs. One of the largest risks is the inability to access your monies when you need them.

Having a mix of liquid assets can help you achieve your financial goals while also providing a safety net in times of uncertainty when money may be needed most. Understanding the pros and cons of each type of asset – liquid or illiquid – helps you make informed decisions about what is right for each person and family based on their financial needs.

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Sources: John Hancock, Investopedia

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS. Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.

Fidelity Investments and Fidelity Institutional® (together “Fidelity”) is an independent company, unaffiliated with Kestra Financial or CD Wealth Management. Fidelity is a service provider to both. There is no form of legal partnership, agency affiliation, or similar relationship between your financial advisor and Fidelity, nor is such a relationship created or implied by the information herein. Fidelity has not been involved with the preparation of the content supplied by CD Wealth Management and does not guarantee, or assume any responsibility for, its content. Fidelity Investments is a registered service mark of FMR LLC. Fidelity Institutional provides clearing, custody, or other brokerage services through National Financial Services LLC or Fidelity Brokerage Services LLC, Members NYSE, SIPC.