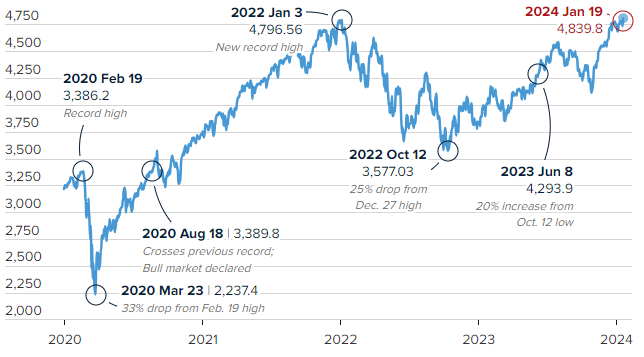

It took a little more than two years, but the S&P 500 closed at a new all-time high on Friday. The previous high, set in early January 2022, preceded a sharp drop in the market that was sparked by war in the Ukraine, supply-chain challenges from the pandemic and a spike in inflation not seen since the 1980s.

The bear market ended in October 2022, and since then, stocks have recovered from the 25% drop — despite many economists and Wall Street analysts predicting that a weakening economy, tapped-out consumers and higher rates would keep stocks from moving higher.

S&P 500 Hits Record 4,839.8 Close

Recent milestone closes since January 2020

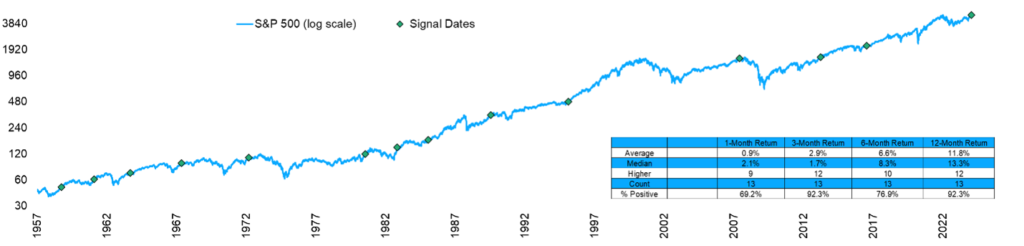

The S&P 500 has set more than 1,000 new highs since 1957 — meaning a record high was set on 7.1% of all trading days. In our opinion, stocks trading at all-time highs is perfectly normal and should not be viewed as a warning sign.

It is more unusual to go a year without a record high — like we did in 2023 — which has happened just 13 times. After setting a new high, returns were better than average 12 of those 13 times, with an average return of more than 11% in those 12 instances.

Don’t Fear New Highs

S&P 500 performance after a new all-time high and more than a year without making one

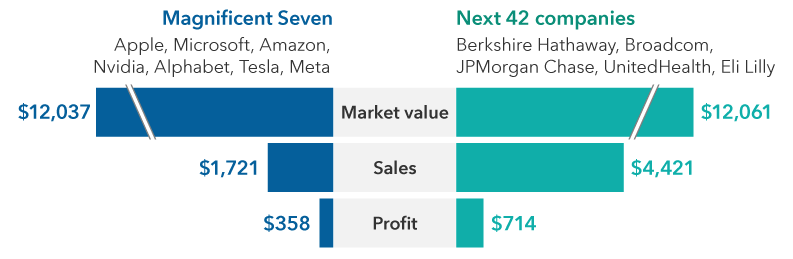

The Magnificent Seven stocks – Alphabet, Amazon, Google, Meta, Microsoft, Nvidia and Tesla – have been a big reason for the market rise over the last 12-plus months. At year end, those seven stocks had a market capitalization (value) of about $12 trillion. To get to the S&P’s next $12 trillion in market capitalization, you need to look at 42 companies to find similar value.

The S&P 500 Index has a forward P/E (price to earnings ratio) of less than 16 when you exclude the Magnificent Seven stocks. That is not expensive from a historical perspective. Earnings growth estimates for the Magnificent Seven remain strong, as analysts are expecting more than 20% for those seven stocks and more than 11% for the S&P 500 as a whole.

Long-term estimates for the Magnificent Seven remain high, but these stocks come with increased volatility. Risks to the group include elevated expectations as well as potential global weakness and heightened regulations in several of the companies. This is a good reminder to maintain diversification around the Magnificent Seven.

Can the Magnificent Seven Maintain Their Dominance?

Stocks of the S&P 500 (USD billions)

We believe a good source of diversification in 2024 will be the fixed-income market. Both stocks and bonds had a terrible year in 2022, and diversification was thrown out the window that year. For most of last year, bonds continued to struggle. It was not until the fourth quarter — when the Fed started hinting about the end of the rate-hiking cycle and potential rate cuts in 2024 — that bonds rebounded and ended the year in the positive.

We believe bonds are poised to return to their more traditional roles as a portfolio stabilizer and a source of diversification. We continue to see investors focus on short-term Treasuries, CDs and money market funds.

The current level of money market funds is more than $6 trillion, almost double the average from 2011 to 2017. We anticipate that as the Fed provides a clearer signal for interest-rate cuts, monies will flow out of shorter-duration bonds and money market and into longer-dated bonds.

As a reminder, when interest rates fall, bond prices increase, providing a boost to bond returns. This is the main reason that bonds should be a stabilizer in 2024, as it is widely expected that the Fed will begin to reduce interest rates at some point this year. There is no hard and fast rule that says that money from money market funds must flow into equities. Those funds may flow into stocks and bonds, helping both asset classes potentially have a strong 2024.

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Sources: Carson, CNBC, FactSet, Capital Group

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS. Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.

Fidelity Investments and Fidelity Institutional® (together “Fidelity”) is an independent company, unaffiliated with Kestra Financial or CD Wealth Management. Fidelity is a service provider to both. There is no form of legal partnership, agency affiliation, or similar relationship between your financial advisor and Fidelity, nor is such a relationship created or implied by the information herein. Fidelity has not been involved with the preparation of the content supplied by CD Wealth Management and does not guarantee, or assume any responsibility for, its content. Fidelity Investments is a registered service mark of FMR LLC. Fidelity Institutional provides clearing, custody, or other brokerage services through National Financial Services LLC or Fidelity Brokerage Services LLC, Members NYSE, SIPC.