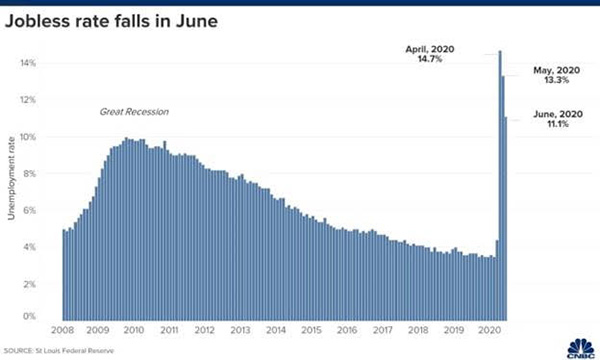

Yesterday’s unemployment numbers were significantly above expectations, and the current unemployment rate is now at 11.1%, a decrease from the previous number of 13.3%. A large contributor to the decline of the jobless rate was a plunge in those on temporary layoff as the economy continues to reopen and companies who have received PPP loans bringing back furloughed employees.

The market reacted positively to yesterday’s news with U.S. stocks trading higher, even as we continue to see rising numbers of new coronavirus cases.

WHAT’S DRIVING THE MARKETS?

The overall rebound in the stock market has been driven by the aggressive fiscal and monetary stimulus packages, progress in Coronavirus treatments and containment, as well as optimism for a quick economic recovery. The U.S. added 4.8 million jobs in June compared with expectations of 3.7 million and the unemployment rate fell for the second straight month. Stocks rallied after testimony to Congress by Federal Reserve Chairman Jerome Powell and U.S. Treasury Secretary Steve Mnuchin, who committed to anchor the U.S. economy through the public health disaster.

WHAT ARE WE LOOKING FOR?

We are looking for continued decrease in unemployment rates in addition to monitoring the second wave of COVID-19 cases. Currently, COVID-19 cases are on the rise in most states and the government is unable to restrain public behavior such as ensuring mask compliance.

We expect the road ahead will be filled with uncertainty and volatility; however, Powell’s promise this past Tuesday to continue doing whatever it takes to support the U.S. economy until it gets back to where it was before the pandemic has been a relief to investors and the U.S. markets.

Despite everything that the world is facing with the global pandemic, upcoming election in November and social protests, this quarter has started in a positive direction. The lowest number of companies on record have provided forward looking guidance for upcoming earnings. Technology and healthcare stocks have continued to provide a strong beacon of light for this market and we do not anticipate a sector rotation at this point in time.

_____

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. Kestra IS and Kestra AS are not affiliated with CD Wealth Management.