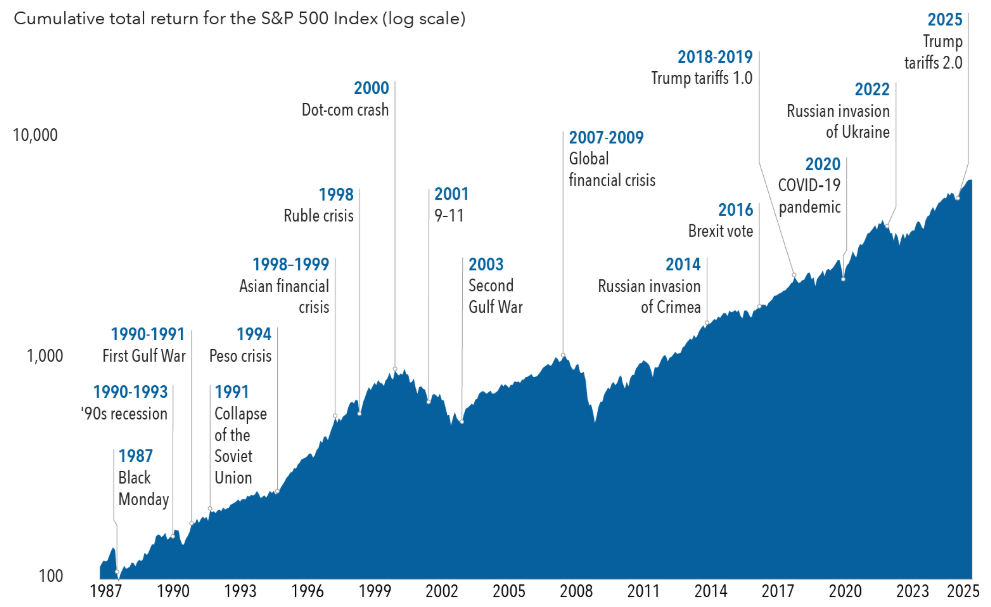

Earlier this month, markets reached another milestone as the Dow closed above 50,000 for the first time. Congratulations to those who stuck with the investment plan through thick and thin. Volatility sometimes brings challenges for investors, but with the knowledge that stocks tend to rise over the long run, buying when times are scary is a great way to build wealth.

Since 2020 alone, we have seen a global pandemic, a 25% market decline in 2022, and another 20% drop last year with Liberation Day and the Trump tariffs. There have always been reasons to wait and not invest, but history shows that investors who look beyond short-term uncertainty typically are rewarded.

How the Market Has Climbed Past Crises

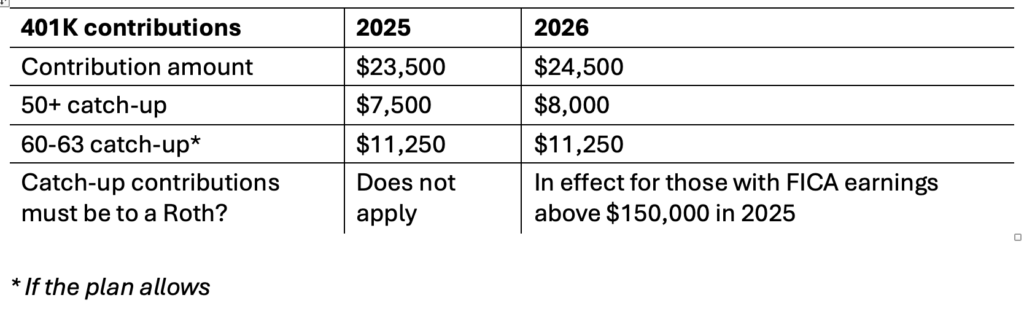

Key Retirement Rule Changes in 2026

There are some important changes this year for those who make catch-up contributions to their retirement plans. A provision of the Secure 2.0 Act emphasizes contributions to Roth accounts that can have a meaningful impact on retirement planning.

If you are 50 or older and have taxable earnings over $150,000 for the prior year (i.e., 2025 for 2026 contributions), any catch-up contribution to your 401K, 403b and 457b plans will have to be made to a Roth 401K with after-tax dollars. If you make less than $150,000, you will not be affected by the rule change; you can continue making catch-up contributions to your traditional 401K or Roth 401K.

Roth Refresher

Roth contributions are made with after-tax dollars.

How do Roth contributions impact your taxes and paycheck?

• You don’t get a tax deduction up front, which may result in a higher income tax bill.

• Qualified withdrawals in retirement will be tax-free.

• Your net paycheck is reduced because your payroll deduction is taken after income taxes are withheld.

Roth contributions can potentially be beneficial for investors who:

• Haven’t been able to make Roth IRA contributions because of income limitations.

• Want to minimize taxable income during retirement years.

• Seek more tax-free withdrawals in retirement with no required minimum distributions.

• Want to have more estate-planning options in the future to transfer money to heirs without tax obligations.

For 2026, the standard catch-up limit is $8,000, though individuals aged 60-63 may be eligible for a “super catch-up” of $11,250. That means you lose out on the upfront tax deduction, but you can potentially benefit from the Roth tax advantages, including tax-free earnings and withdrawals if you meet the five-year aging rule for the plan.

If your plan does not offer a Roth 401K option, you won’t be able to make catch-up contributions, though other options may be available, such as contributing your catch-up amount to a Roth IRA if you are under the income limit or making a Roth conversion.

401K Contribution and Catch-Up Amounts

5 Strategies to Consider

1. Max out your regular contributions. Regardless of age, the maximum contribution for this year is $24,500, which is a $1,000 increase over 2025. Contributions are separate from the matching funds. This year’s aggregate employee and employer contribution limit is $72,000.

2. Consider making partial contributions to a Roth IRA. If you are looking for Roth options, you may be able to contribute to a Roth IRA, depending on income levels. Contributions for prior tax years can be made up until the April 15 deadline of the current tax year. Both you and your spouse can make independent contributions. Roth IRA and Roth 401K contributions must each meet the separate five-year aging rule to avoid taxes and penalties.

3. Think about contributing to a traditional IRA. Whether or not you are covered by a workplace 401K, you can still make non-deductible contributions to a traditional IRA up to the annual limit of $7,500 for 2026. Individuals who are 50 and older can make catch-up contributions of $1,100 for 2026. This won’t lower your tax bill, but the funds can grow tax-deferred until you withdraw them in retirement. You also can convert them later into a Roth IRA using a backdoor conversion.

4. Convert your traditional IRA to a Roth IRA. In a backdoor Roth IRA conversion, you make non-deductible contributions first to a traditional IRA and then convert those funds into a Roth IRA. This is different from standard Roth conversion, which transfers tax-deductible contributions in a traditional IRA to a Roth IRA. A backdoor Roth conversion has more complex tax considerations, especially if the IRA has some tax-deferred funds. Converted balances to a Roth must also meet the separate five-year aging rule to avoid penalties on withdrawals. It is crucial to consult with your tax professional to understand the tax implications in advance.

5. Consider a health savings account (HSA). You may be able to contribute to an HSA account if you are enrolled in an eligible health savings plan. This can help you pay for qualified medical expense with pretax income while also allowing you to invest the money to help support retirement if you don’t need the funds now. The money you contribute to an HSA account isn’t subject to federal income taxes. Earnings accumulate tax-free, and withdrawals are not subject to federal taxes if used for qualified medical expenses. If you are eligible to contribute, the limits are $4,400 for an individual and $8,750 for family coverage.

Key Takeaways

• Starting in 2026, high earners making catch-up contributions to a 401K will have to make these contributions to a Roth 401K.

• Consider fully funding your 401K to take advantage of the employer match (if available).

• In addition to your 401K, you may be able to contribute to other tax-advantaged accounts, such as HSAs.

• Nondeductible contributions to an IRA and backdoor Roth IRA conversions may also be good considerations.

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy heading. We are anticipating and moving to those areas of strength in the economy and in the stock market.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the proven disciplines of diversification, periodic rebalancing, and forward-looking strategies, while avoiding reliance on stale retrospective data.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Sources: Capital Group, Fidelity, Carson Wealth