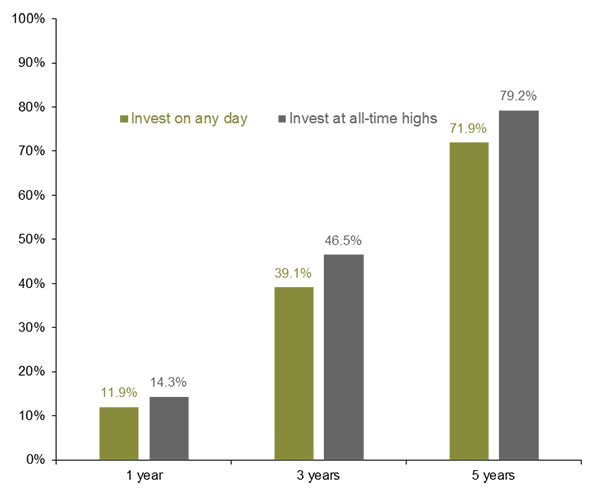

The S&P 500 has had an impressive rally since the lows of March 2020, and it already has had 27 new highs this year, outpacing the average number of all-time highs reached per year since 1988. That does not mean that the market will go up in a straight line, and it is reasonable to expect choppiness going forward because of several factors we have recently discussed: equity valuations, new COVID-19 strains and concerns over inflation.

As the market continues to hit new highs, it is likely that it also will experience a pullback. However, history suggests that now may be as good as any time to put cash to work in the market for the long run. As shown in the chart below, if you invested in the S&P 500 on any random day since the start of 1988, your one-year total return was 11.9% on average. If you invested only on days when the S&P 500 closed at all-time highs, your average one-year total return was 14.3%. The three- and five-year returns show similar results: Investing on all-time high days led to strong returns.

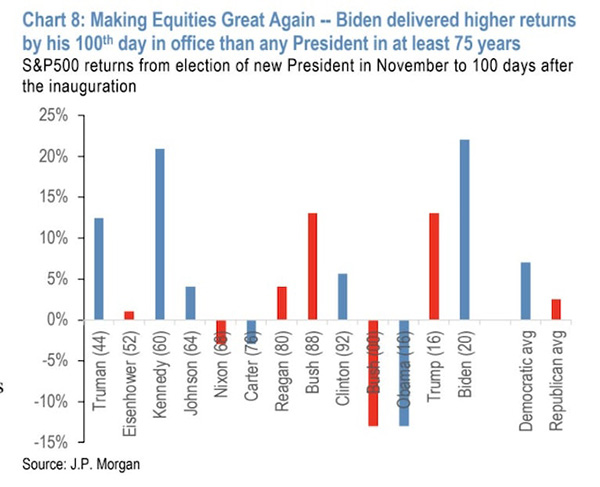

As we write about each week, we cannot time the market. The market fundamentals stay supportive for economic expansion, and monetary policy should remain accommodative for the next couple of years. President Biden’s first 100 days in office have seen the highest return of any president in more than 75 years, and the economy still is reopening, while almost 8 million Americans remain unemployed compared to pre-pandemic levels.

The balance in the Senate with a 50/50 split, along with a slim Democratic margin in the House, continues to provide a challenge for the White House to pass major tax legislation or policy changes. It’s possible that even if the administration changes the capital gains tax rate, some future Congress could change it back. There are several strategies investors can use to help reduce the impact from proposed tax law changes. We recommend taking a wait-and-see approach at this point, as it is unclear exactly what, if anything, the tax law would look like.

So, what can we learn from all this? Optimism in the stock market remains elevated. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, not making investment decisions based on where we have been. Making market decisions based on what might happen may be detrimental to long-term performance.

For those concerned about potential tax hikes, it is worth noting that the S&P 500 has performed well in years of previous increases. The key is to stay invested and stick with the financial plan. Markets go up and down over time, and downturns present opportunities to purchase stocks at a lower value.

Given the difficulty of timing the market, the most realistic strategy for a majority of investors is to invest and stay invested over time. Procrastination, or not investing, is worse than bad timing. We continue to view more risk being out of the market than in the market. Riding out future market volatility, in addition to having a diversified portfolio, means staying the course. From an investment perspective, we use these trends to help with the strategic and tactical asset allocation and where we see the portfolio heading over the next 5-7 years with short-term adjustments along the way.

It all starts with a solid financial plan for the long run that understands the level of risk that is acceptable for each client. With regards to investments, we believe in diversification and having different asset classes that allow you to stay invested. The best option is to stick with a broadly diversified portfolio that can help you to achieve your own specific financial goals — regardless of market volatility. Long-term fundamentals are what matter.

Sources: Factset, JP Morgan

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. Kestra IS and Kestra AS are not affiliated with CD Wealth Management. Investor Disclosures: https://bit.ly/KF-Disclosures