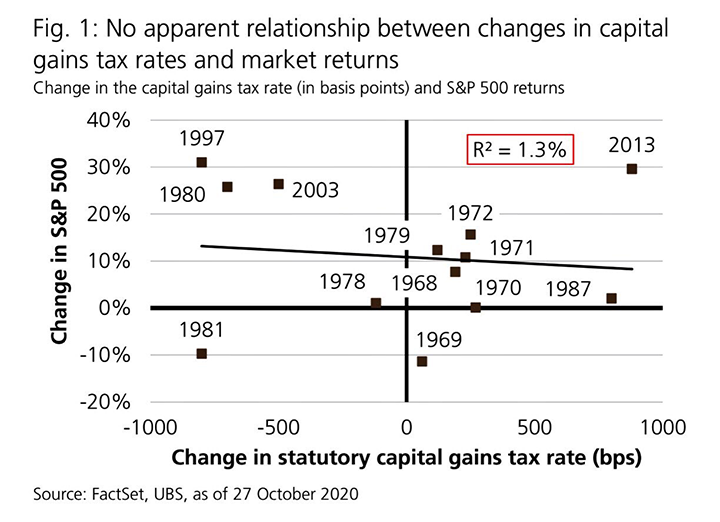

Last week, rumors began to swirl about the Biden administration’s proposal for increasing tax rates for the richest Americans from 37% to 39.6% and raising the capital gains tax on people earning more than $1 million from 20% to 39.6%. There is still a long way to go before we see any tax hikes, and as is often the case, the initial market reaction is to sell upon hearing the news. Markets have produced better-than-average returns during past tax increases, as other economic factors are happening that may influence subsequent market behavior. Going back to 1968, there is only a minimal correlation between changes in the capital gains tax rate and market returns, as seen in the chart below.

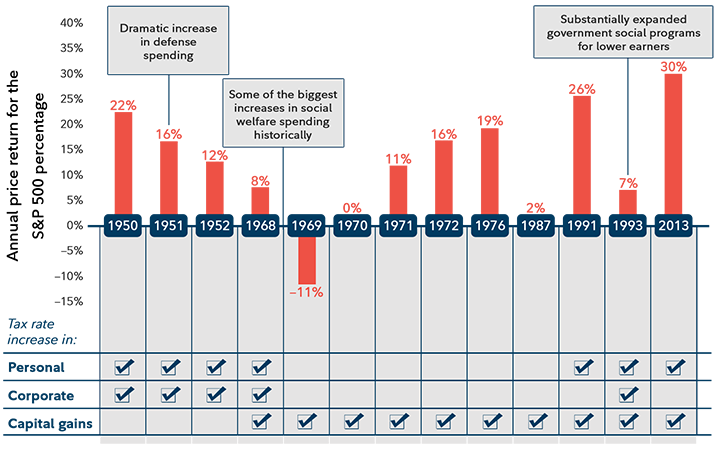

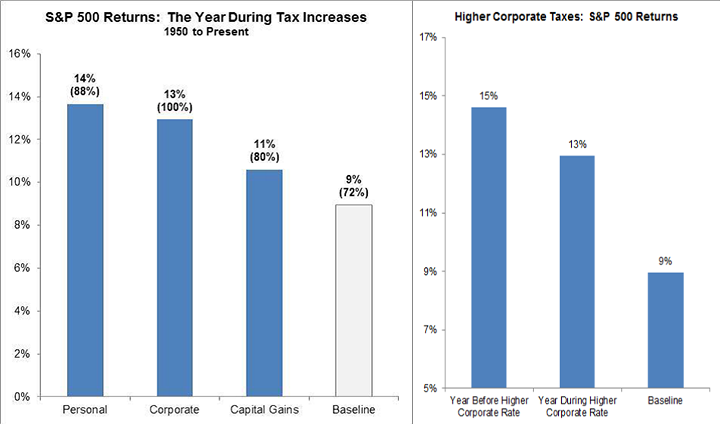

The next chart further illustrates the point that the market selling last week on the news of potential higher tax rates may be overblown. Since 1950, only one instance of negative market returns in the S&P 500 occurred when taxes were increased. Taxes break down into three buckets: corporate, personal and capital gains. Big tax increases are rare, and only once since 1970 have all three been increased at the same time. (That happened in 1993.) Democrats have slim margins in both houses of Congress, and it is still to be determined how much of the higher tax rate agenda will make it into law. It will take time for Congress to negotiate a major package, and it’s possible that if rates are increased, it may not happen until 2022.

In years with tax increases, the average S&P 500 return since 1950 has been 9%. However, changes to the tax code do not happen in a vacuum; normally, there are other actions in Congress and the economy. As we are seeing today, significant stimulus spending by the government and action from the Federal Reserve following the pandemic shutdowns also may contribute to higher-than-average returns, even when taxes are being raised.

So, what can we learn from all this? Making market decisions based on conjecture of what might happen may be detrimental to long-term performance. The S&P 500 historically has performed well in years of tax increases. The key is to stay invested and stick with the financial plan. Markets go up and down over time, and downturns present opportunities to purchase stocks at a lower value.

Given the difficulty of timing the market, the most realistic strategy for a majority of investors is to invest and stay invested over time. Procrastination, or not investing, is worse than bad timing. We continue to view more risk being out of the market than in the market. Riding out future market volatility, in addition to having a diversified portfolio, means staying the course. From an investment perspective, we use trends to help with the strategic and tactical asset allocation and where we see the portfolio heading over the next 5-7 years with short-term adjustments along the way.

It all starts with a solid financial plan for the long run that understands the level of risk that is acceptable for each client. With regards to investments, we believe in diversification and having different asset classes that allow you to stay invested. The best option is to stick with a broadly diversified portfolio that can help you to achieve your own specific financial goals — regardless of market volatility. Long-term fundamentals are what matter.

Sources: Factset, UBS, Fidelity

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. Kestra IS and Kestra AS are not affiliated with CD Wealth Management. Investor Disclosures: https://bit.ly/KF-Disclosures