This is a big week for the stock market: Earnings season is under way with many of the large-cap names reporting this week, the Federal Reserve raised interest rates another 75 basis points (.75%), and second-quarter GDP estimates are set to be released. Many economists predict that this will be the second consecutive quarter of negative GDP growth, signaling to many that we are in a recession.

However, the National Bureau of Economic Research defines a recession as a significant decline in economic activity that is spread across the economy and lasts more than a few months. The bureau does not define it as two consecutive quarters of negative GDP growth. Nonetheless, the stock market — which is a leading indicator — has been signaling for most of this year that the economy is slowing and a recession is possible.

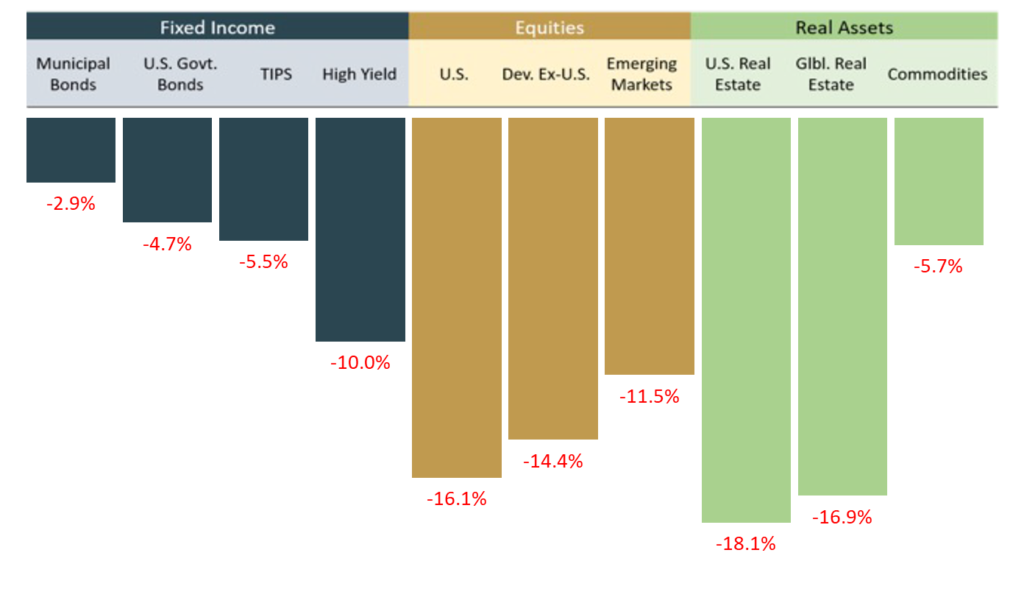

The chart below is a stark reminder of how the market performed the first half of 2022. There are many reasons for the broad-based declines in all asset classes – the ongoing war in Ukraine, China’s zero-COVID policy, fears of economic slowdown and — lest we forget — inflation. Stock markets look forward, pricing in what investors think will happen, not what is happening right now. As such, current stock and bond prices already reflect the significant economic slowdown, if not a full recession. Bear markets do end, and when they do, a bull market will ensue.

Q2 2022 Index Returns

Knowing that bear markets will end and that they do not last as long as bull markets, we are in the process of reallocating and rebalancing our client portfolios to account for where we think the market is heading, not where it has been. We are making the following changes:

1. Earlier this year, we took additional profits in technology and healthcare and transitioned into broader value-based equities as well as mid-cap stocks for further diversification. From a long-term perspective, we believe strongly in both the technology and healthcare sectors and maintain broad exposure to both. Typically, in the late business cycle and entering a recession, we see growth moderating, credit tightening up, earnings coming under pressure and inventories growing as sales fall. With earnings season under way, we already have seen many Wall Street analysts and companies reduce earnings forecasts based on the strong dollar and the weakening economy. This must happen for the market to reach a bottom.

2. As we have written in the past, one of the positives of a down market is the ability to tax-loss harvest. Tax-loss harvesting does not always have to occur at year end. As a reminder, under current tax law, it’s possible to offset current capital gains with capital losses you’ve incurred during the year or carried over from a prior tax return. Capital gains are the profits you realize when you sell an investment for more than paid for it, while capital losses are the losses you realize when you sell an investment for less than you paid for it.

Short-term capital gains are taxed as ordinary income rates, whereas long-term capital gains are taxed at a lower capital gains rate. Being able to reduce the tax on both short- and long-term capital gains by harvesting losses can help offset the gains one incurs from taking profits. Harvesting the loss has no effect on the portfolio value, since one can use the proceeds from the sale to buy a similar investment. This allows the investor to maintain similar asset allocation and reduce federal income taxes. We want to take advantage now of several holdings trading at a loss and swap out those holdings to capture the loss while maintaining similar asset class exposure. We swapped out our small- and mid-cap funds, as well as the international fund, to harvest the current losses.

3. From a fixed-income perspective, we shortened the duration of the portfolio late last year as we anticipated higher interest rates in 2022. This has played out as we envisioned. While the fixed-income markets have not been spared the downdraft of the overall markets, we feel that most of the interest-rate change is accounted for in the bond market. Therefore, we are increasing the overall maturity of the portfolio to capture the higher yields that the market offers. At the same time, we are substituting a tax-free municipal bond position instead of a taxable bond fund, as municipal bonds offer great value in this market.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading.

We are not guessing or market timing. We are anticipating and moving to areas of strength in the economy and in the stock market. We strategically have new cash on the sidelines and buy in for clients on down days or dips in the market – as one does with a 401K.

In the short term, the sentiment and the outlook for the global economy remain negative. Economists are debating whether the United States is in a recession, and if so, what this means. Regardless, we continually speak with our clients about staying the course and not listening to the noise. Even if we entera recession, every recession ultimately ends and expansion ensues, with an accompanying bull market.

We will continue to drive home the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

It all starts with a solid financial plan for the long run that understands the level of risk that is acceptable for each client. Regarding investments, we believe in diversification and in having different asset classes that allow you to stay invested. The best option is to stick with a broadly diversified portfolio that can help you to achieve your specific financial goals — regardless of market volatility. Long-term fundamentals are what matter.

Source: Kestra Investment Management

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS. Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.